Bitcoin doesn’t care about your government’s funding problems. In fact, it loves them.

The leading cryptocurrency smashed through $119,000 for the first time since mid-August as the U.S. government shut down operations Wednesday. Other major tokens joined the party, with Ethereum, XRP, Solana, and Dogecoin climbing 4% to 7% in 24 hours.

But here’s the twist nobody saw coming. This isn’t just another crypto rally. The shutdown might trigger a chain reaction that sends Bitcoin even higher.

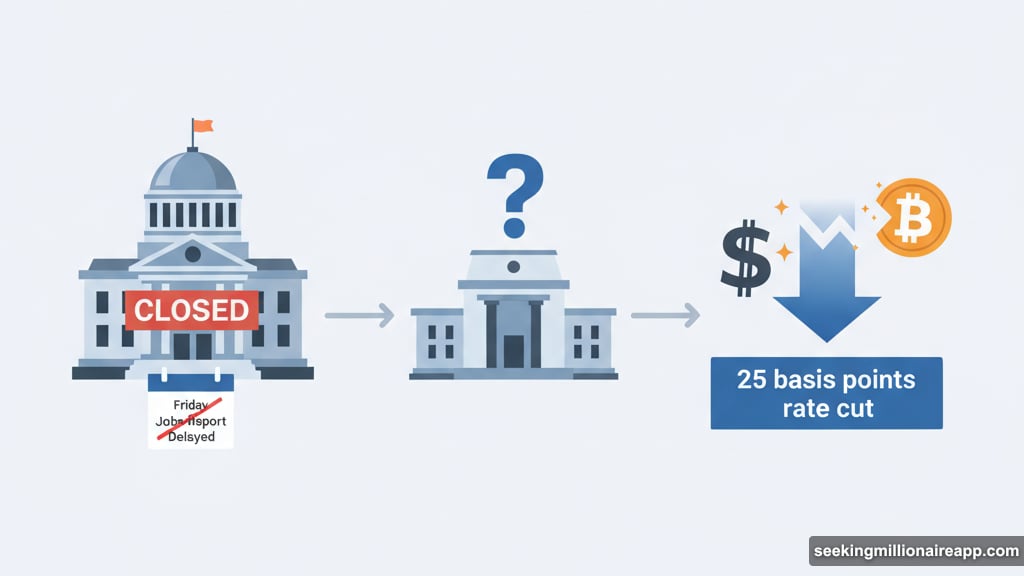

The Government Shutdown Created a Perfect Storm

Congress couldn’t agree on funding. So the government shut down. Standard political theater, right?

Not quite. This time, the timing matters more than usual.

The shutdown delays Friday’s nonfarm payrolls report. That’s the official monthly jobs data that markets obsess over. Plus, Wednesday’s private payrolls numbers already painted a grim picture of the labor market.

Missing that official data creates a curious problem for the Federal Reserve. They’re flying partially blind on the economy’s health. So what happens next? According to Matt Mena, Crypto Research Strategist at 21Shares, the Fed likely cuts rates by 25 basis points in October and keeps another cut on the table by December.

Those rate cuts matter. They push real yields lower and weaken the dollar. That combination historically supports Bitcoin prices.

Markets Love Uncertainty More Than Certainty

The shutdown injects pure uncertainty into financial markets. Economic reports vanish. Government operations freeze. Traditional market playbooks break down.

Bitcoin thrives in exactly these conditions. It’s the asset that profits when conventional markets stumble and regulators lose control.

The CoinDesk 20 Index jumped 5% to 4,217 points. That’s not just Bitcoin running solo. The entire crypto market is catching fire.

Moreover, this rally hints at something bigger brewing beneath the surface. When Bitcoin breaks through resistance levels during moments of macro chaos, explosive moves often follow.

The Liquidity Impulse Nobody’s Talking About

Here’s where things get interesting. The shutdown potentially triggers what analysts call a “positive liquidity impulse.”

Translation? More money flowing into financial markets. Lower borrowing costs. Easier access to funding. That environment encourages risk-taking, and Bitcoin ranks high on the risk spectrum.

The Fed already cut rates by 25 basis points last month. They signaled more easing ahead. Now add delayed economic data that might understate labor market weakness. The Fed’s hand gets forced toward additional cuts.

“That mix should pull real yields lower and soften the dollar into Q4, with a mild bear-steepening in the curve and gold staying bid. Net effect: a positive liquidity impulse that historically supports BTC,” Mena noted.

Gold’s performance confirms this thesis. Both Bitcoin and gold surged following the shutdown news. These aren’t random moves. They’re deliberate flights to alternative assets when traditional safe havens feel shaky.

Options Traders See This Coming

Derivatives markets tell a fascinating story. Deribit-listed Bitcoin options look cheap right now, especially near-term contracts.

Greg Magadini, Director of Derivatives at Amberdata, pointed to the steep contango in implied volatility. That’s trader-speak for “big moves are coming, but near-term options don’t reflect it yet.”

“After a long ‘dry spell’ for BTC volatility, the U.S. government shutdown could finally be the catalyst to make BTC move a lot,” Magadini said.

Smart traders are buying straddles. That’s when you purchase both call and put options at the same strike price. You profit from big moves in either direction. The strategy makes sense here because Bitcoin could either rally hard as a dollar hedge or crash if risk assets panic.

That options setup reveals the market’s expectations. Traders anticipate explosive volatility. They’re positioning for significant price swings. The only question is which direction hits first.

The Dollar Faces Real Pressure

The shutdown arrives while the dollar already shows weakness. Rate cuts pressure the currency. Delayed economic data adds uncertainty. Political dysfunction doesn’t help confidence.

Bitcoin often moves inverse to dollar strength. When the greenback weakens, crypto tends to rally. That pattern’s playing out right now in real-time.

Plus, international investors increasingly view Bitcoin as a hedge against currency instability. Not just emerging market currencies either. Even major developed market currencies face questions when governments shut down and central banks keep cutting rates.

The flight to alternatives isn’t theoretical anymore. It’s happening on exchange platforms globally.

Why This Rally Feels Different

Bitcoin’s broken through $119,000 before. But the context matters. This surge comes amid genuine macro uncertainty, not just crypto-specific hype.

Traditional markets don’t know how to price delayed economic data. They’re uncertain about Fed policy trajectories. They’re watching government dysfunction unfold in real-time. That combination creates the exact environment where Bitcoin shines.

Remember, Bitcoin was designed for moments like this. A decentralized currency that operates regardless of government shutdowns. A store of value that doesn’t require Congressional approval to function. An asset that thrives when faith in traditional systems wavers.

The rally past $119,000 isn’t just about price levels. It represents Bitcoin fulfilling its original promise as an alternative to government-controlled money.

What Comes Next Depends on Data

The nonfarm payrolls report will eventually release. Government operations will resume. Markets will get clarity on the economy’s actual state.

But here’s what won’t change. The Fed’s already committed to an easing cycle. Inflation remains sticky but manageable. Employment shows signs of softening. That backdrop supports risk assets regardless of short-term political drama.

Bitcoin’s technical position looks strong too. Breaking through $119,000 clears resistance that’s held since August. Next major resistance sits near the all-time high. If momentum continues, that level could fall within weeks.

Options positioning suggests traders expect volatility in both directions. But the net effect favors upside. Cheap near-term options combined with improving macro conditions create asymmetric opportunity.

The government shutdown might last days or weeks. Either way, it’s already delivered the catalyst Bitcoin needed. What happens next depends on whether buyers maintain pressure or take profits at resistance levels.

Smart money’s watching Fed guidance closely. If rate cut expectations strengthen further, Bitcoin’s rally likely continues. If economic data surprises to the upside and rate cut bets fade, crypto could give back recent gains quickly.

For now though, Bitcoin’s sending a clear message. When traditional systems falter, decentralized alternatives benefit. That thesis just got validated at $119,000.