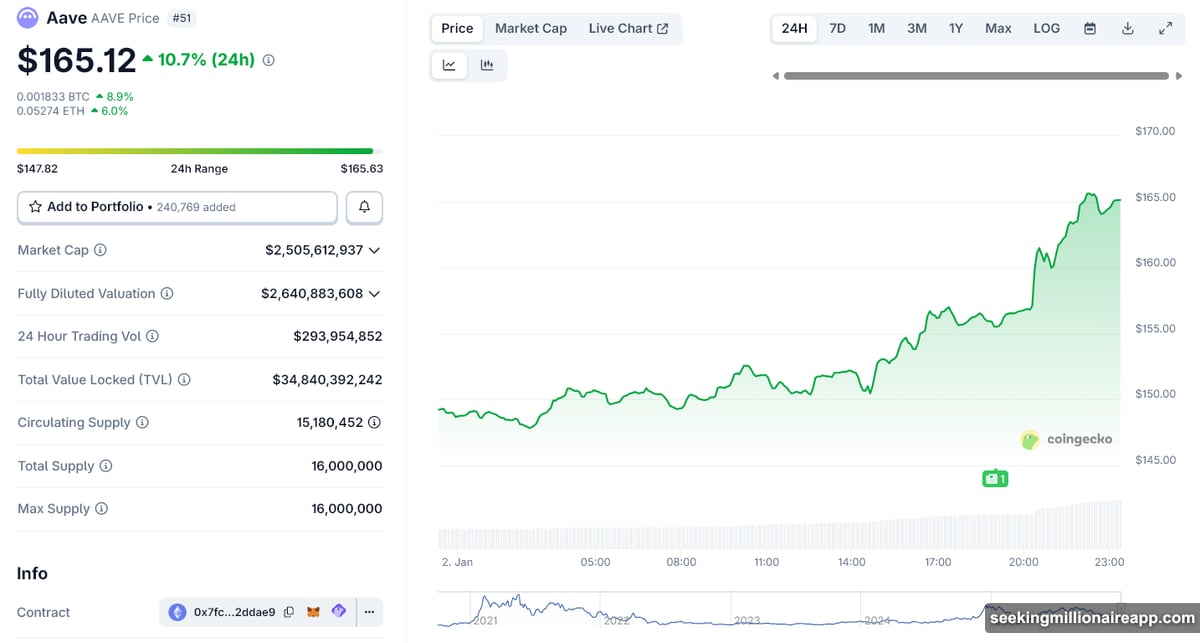

Aave Labs dropped a bombshell on January 2nd. The DeFi lending giant announced plans to share off-protocol revenue directly with AAVE token holders.

Markets reacted immediately. AAVE surged over 10% within hours as traders processed what this shift means for governance and value alignment.

But here’s the real story. This move ends weeks of bitter internal conflict about who controls Aave’s brand, revenue streams, and future direction. Plus, it sets up a governance vote that could reshape how one of DeFi’s largest protocols operates.

What Revenue Sharing Actually Means

Aave Labs founder Stani Kulechov outlined the core proposal. Off-protocol revenue would flow directly to token holders through a structured mechanism.

So what counts as off-protocol revenue? Think front-end interfaces, swap integrations on the official Aave app, and future consumer products built on Aave infrastructure. These revenue streams exist outside the core lending protocol but leverage Aave’s brand and user base.

Currently, Aave Labs captures this revenue without sharing it with DAO participants. That’s created tension. Token holders argue they should benefit from commercial activity tied to the protocol they govern.

The upcoming proposal will detail exactly how distribution works. Moreover, it promises safeguards preventing sudden changes that could harm token holders without DAO approval.

Brand Control Becomes the Real Battleground

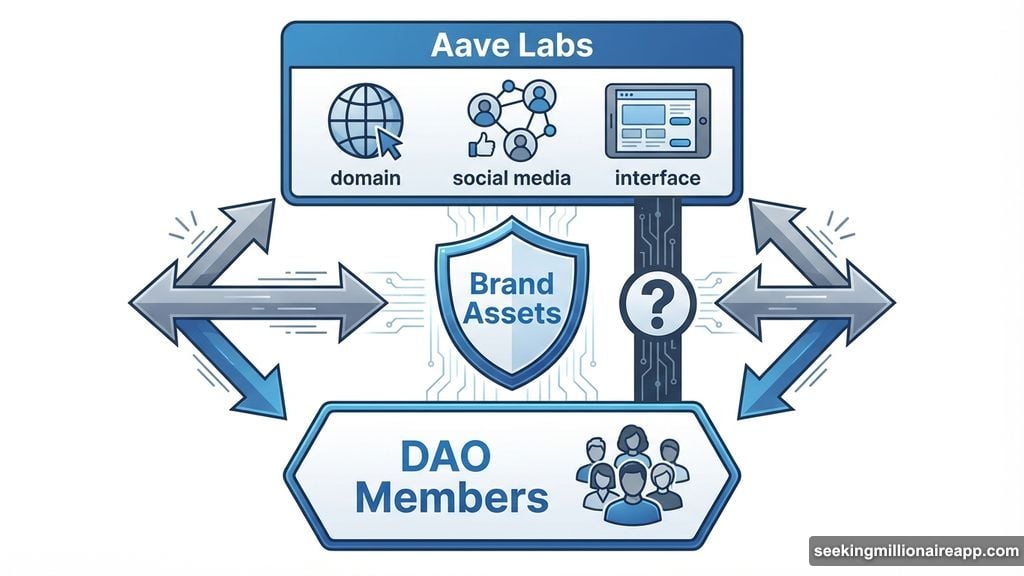

Revenue sharing matters. But brand control might matter more.

Aave Labs currently owns key assets like domains, social media accounts, and the primary user interface. These gateways generate value and shape public perception. Yet DAO members have minimal say over how they’re managed or monetized.

The new proposal addresses this directly. It will specify ownership structures for brand assets and establish clear rules about commercial use. Furthermore, it defines what decisions require DAO approval versus what Aave Labs can execute independently.

Industry observers note this issue extends beyond Aave. Many DeFi protocols struggle with similar tensions between founding teams and decentralized governance. However, Aave’s transparency about the problem stands out.

Internal Conflict Forced This Moment

This announcement didn’t come from nowhere. Recent weeks exposed deep disagreements within Aave’s ecosystem.

DAO delegates publicly accused Aave Labs of excessive control over revenue and communication channels. They pointed to AAVE’s sharp price decline as evidence that governance uncertainty was damaging token value.

In fact, some delegates threatened to fork the protocol if Aave Labs didn’t address their concerns. That’s how serious tensions had become.

Aave Labs responded with this proposal framework. But skeptical delegates aren’t celebrating yet. They emphasize that vague promises won’t cut it anymore. Instead, they demand precise, enforceable commitments covering ownership, revenue distribution, and accountability mechanisms.

One delegate wrote that the DAO needs “clear and verifiable rules, not corporate PR language.” That sentiment captures the mood among governance participants.

Real World Assets Drive the Long Game

Behind the immediate controversy sits Aave’s ambitious expansion plan. The protocol aims to move beyond crypto-only lending into real-world assets, institutional products, and consumer applications.

These initiatives require significant infrastructure investment. Aave V4 and expanded GHO stablecoin adoption form the foundation. But building consumer-friendly products costs money and demands centralized execution speed.

That’s where revenue sharing becomes strategic. If Aave Labs can demonstrate clear value alignment with token holders, it gains legitimacy to pursue aggressive growth initiatives. Without that alignment, every commercial decision becomes a governance battle.

Notably, Aave already ranks among the top 15 crypto platforms by revenue in 2025. The protocol generates substantial fees from lending activity. However, token holders want direct exposure to growth beyond base protocol fees.

The DAO Vote That Matters

Everything hinges on the upcoming governance proposal. If approved, Aave establishes a new model for balancing innovation with decentralization.

The proposal must address three critical components. First, revenue sharing mechanics with transparent calculations. Second, brand asset ownership with enforceable controls. Third, governance safeguards preventing unilateral changes by any party.

If the vote fails, internal conflict likely intensifies. Some delegates might pursue protocol forks. Others might exit their positions entirely. Either outcome would damage Aave’s competitive position and developer momentum.

Market participants are watching closely. AAVE’s 10% price jump suggests optimism about resolution. Yet experienced DeFi observers remain cautious. They’ve seen similar proposals collapse during implementation or get watered down through compromise.

Why This Sets a Precedent

Aave’s situation mirrors challenges across DeFi. Protocols launched with idealistic decentralization goals but discovered that building real products requires practical centralization.

The tension isn’t good versus evil. It’s about finding sustainable models where founding teams can execute quickly while token holders maintain meaningful control and value capture.

If Aave succeeds, other protocols will likely adopt similar frameworks. If it fails spectacularly, the DeFi industry might reconsider how much decentralization actually works for growth-stage projects.

Either way, January’s governance vote carries implications beyond AAVE price action.

Token holders deserve revenue exposure tied to protocol success. Founding teams need operational flexibility to compete. Governance structures must balance both needs without paralyzing decision-making.

Aave’s attempting that balance. Whether it works determines not just AAVE’s future but potentially the next evolution of DeFi governance itself.

The vote matters. The framework matters more. Watch how this plays out carefully.