Artificial intelligence just got its own wallet. Coinbase launched a system that lets AI models like Claude and Gemini handle cryptocurrency transactions independently – no human needed.

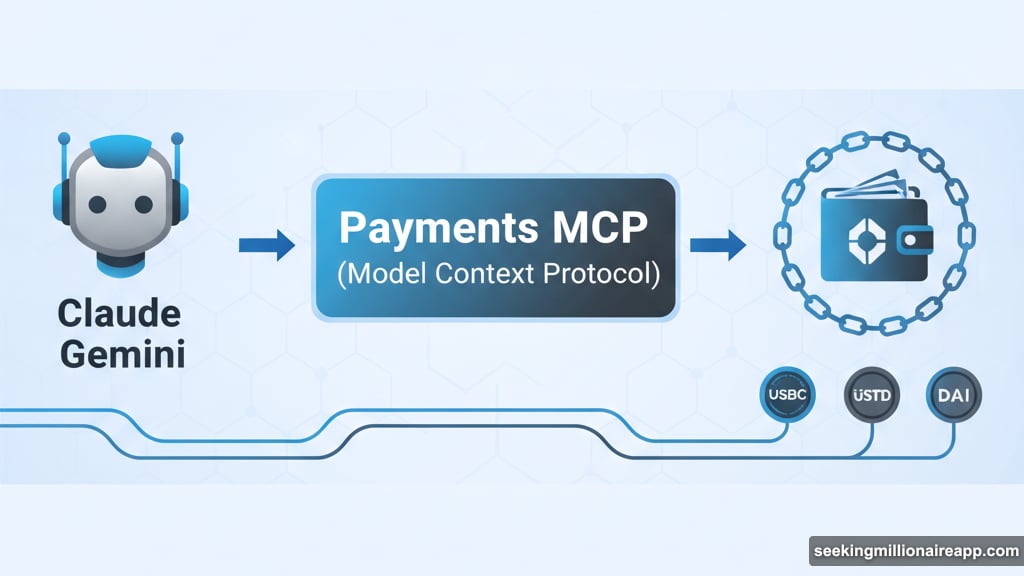

The exchange calls it Payments MCP. But don’t confuse this MCP with multi-party computation encryption. This one stands for Model Context Protocol, a framework connecting large language models to external services.

What does that mean practically? AI agents can now create wallets, move stablecoins, and access onchain financial tools using simple text commands. The same blockchain actions humans perform, except faster and automated.

The x402 Foundation Changes Payment Rules

Coinbase didn’t build this alone. They partnered with Cloudflare to establish the x402 Foundation, an organization focused on creating payment standards specifically for AI systems.

According to Coinbase Developer Platform leaders Dan Kim and Erik Reppel, the protocol bridges AI and blockchain in ways previously impossible. AI agents finally plug directly into the crypto economy through real infrastructure.

Stablecoins power the system. They move instantly across networks, integrate smoothly with APIs, and skip human intermediaries entirely. That makes them perfect for AI-driven transactions that need speed and reliability.

The system runs locally and customizes for different use cases. Plus, it requires minimal user input once deployed. AI can participate in decentralized finance independently – a significant shift from needing constant human oversight.

Why Stablecoins Beat Traditional Payment Rails

Traditional payment systems weren’t designed for AI. Banks require human verification, credit cards need personal accounts, and wire transfers take days.

Stablecoins solve these problems. They settle transactions in seconds, operate 24/7 without banking hours, and cost pennies regardless of transaction size. For AI systems processing hundreds or thousands of payments daily, those advantages compound rapidly.

Moreover, stablecoins integrate seamlessly with smart contracts. AI agents can trigger complex financial operations programmatically – lending, swapping assets, or funding projects – all without touching fiat currency or traditional banking infrastructure.

The x402 protocol builds on this foundation. It creates standardized methods for AI systems to interact with blockchain networks, ensuring different AI models can communicate and transact consistently across platforms.

Real Applications Beyond Hype

This isn’t theoretical. AI agents could autonomously pay for computing resources when training models. They might purchase data sets, compensate human contributors, or settle microtransactions for API calls.

Take content creation. An AI system could generate an article, automatically pay editors for revisions, compensate fact-checkers, and handle licensing fees – all through blockchain transactions requiring no human approval.

Customer service bots could process refunds instantly. Research AI might fund experiments or pay for lab equipment. The applications multiply once AI systems control their own economic activity.

However, questions remain. Who’s liable when AI makes bad financial decisions? How do you regulate autonomous systems that transact independently? These issues need answers before mass adoption.

The Technical Foundation Matters

Payments MCP connects to existing blockchain infrastructure rather than creating new systems. That’s smart. Building on proven networks like Base (Coinbase’s Layer 2) means inheriting security and decentralization benefits.

The Model Context Protocol itself provides the bridge. It allows large language models to access external tools and services while maintaining context about ongoing tasks. Financial operations become another capability AI can leverage alongside web searches or code execution.

Developers can customize the system for specific needs. Want AI to only transact within certain limits? Add those constraints. Need multi-signature approval for large transfers? Build that logic in. The flexibility supports various business requirements.

Coinbase promises minimal setup friction. That matters for adoption. If deploying AI payment systems requires weeks of engineering work, most companies won’t bother. Simple implementation accelerates experimentation and real-world testing.

Blockchain Finally Serves AI Needs

Blockchain advocates always claimed the technology would revolutionize finance. But most use cases felt forced or impractical for average users.

AI changes that equation. Autonomous systems need programmable money that operates without human gatekeepers. Blockchain provides exactly that infrastructure.

The timing aligns with AI capabilities maturing. Models now handle complex tasks reliably enough to manage financial operations. Combining that intelligence with blockchain’s automation creates genuinely novel applications.

Still, challenges exist. Blockchain transactions cost gas fees. AI systems making thousands of small payments might rack up substantial costs. Layer 2 solutions help, but they’re not free.

Security concerns also loom. If AI controls private keys, protecting those keys becomes critical. One compromised model could drain wallets faster than humans react. The industry needs robust security frameworks before billions flow through AI-managed accounts.

What This Means for Crypto Adoption

Institutional interest in crypto often hinges on practical business applications. AI payments might finally deliver that killer use case.

Companies already invest heavily in AI infrastructure. Adding payment capabilities that reduce friction and costs makes business sense. No need to convert crypto enthusiasts – just offer better tools for existing AI deployments.

The Robinhood integration allowing BNB purchases shows exchanges expanding access. Coinbase pushing AI integration represents another vector for mainstream adoption. Different paths, same destination: making crypto useful for people who don’t care about decentralization philosophy.

Prediction markets saw massive growth through Polymarket proving real-world utility. AI payments could trigger similar momentum if applications deliver measurable value.

Skeptics will question whether AI truly needs crypto rails. Can’t traditional APIs handle payments? Sure, but with more friction, higher costs, and geographic restrictions. Blockchain removes those barriers while adding transparency and programmability.

The Foundation Just Got Laid

Payments MCP represents infrastructure, not a finished product. Think early internet protocols rather than consumer applications.

Developers will build on this foundation. Expect AI agents that autonomously manage investment portfolios, negotiate contracts, or operate businesses with minimal human oversight. The tools now exist to experiment.

Whether these experiments succeed depends on solving trust and liability questions. Users need confidence that AI systems transact responsibly. Regulators need frameworks that balance innovation with consumer protection.

But the technology works today. AI can send crypto transactions independently using simple language commands. That capability didn’t exist months ago.

Coinbase bet big on this vision by partnering with Cloudflare and creating industry standards through x402. They’re not just building products – they’re establishing infrastructure other companies will use.

The crypto and AI industries converge here. Both technologies promise to reshape finance and business. Combining them might accelerate that transformation or create new complications. Time will reveal which outcome dominates.

Right now, the door just opened for AI to participate directly in the crypto economy. What walks through that door next could surprise everyone.