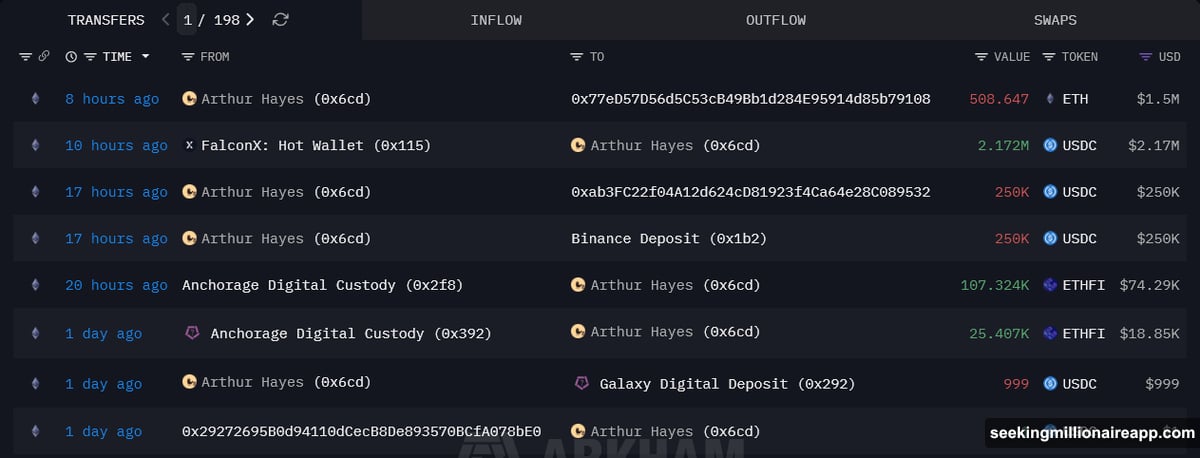

BitMEX founder Arthur Hayes transferred 508 ETH to Galaxy Digital this week. That’s roughly $1.5 million worth of Ethereum hitting an institutional desk.

The timing raises eyebrows. Just days earlier, Hayes delivered one of his most bullish Ethereum predictions ever, calling ETH the backbone of institutional Web3 adoption. So why move coins now?

Plus, this isn’t some random wallet. On-chain data confirms the transfer came from Hayes’ known address and landed at Galaxy Digital’s deposit address. That’s the kind of move that typically precedes a sale or OTC deal.

What Actually Happened

On-chain tracking shows Hayes sent 508.647 ETH to Galaxy Digital. At current prices near $3,000, that’s about $1.5 million in value.

However, Hayes still controls over 4,500 ETH in his wallets. So this represents portfolio rebalancing, not a full exit. The bulk of his Ethereum position remains intact.

Transfers to institutional desks don’t always mean immediate selling. But they usually indicate liquidity needs or planned execution. Galaxy Digital operates trading and custody services, making them a natural choice for large transactions.

The move comes as Ethereum trades just below the psychologically important $3,000 level. December brought volatile action, with ETF outflows and derivatives repositioning creating choppy conditions.

Hayes’ Bullish Case Still Stands

Here’s where it gets interesting. Days before this transfer, Hayes laid out his strongest institutional Ethereum thesis yet.

He argued that traditional finance finally accepted the limits of private blockchains. Big banks tried building their own ledgers for years. Most failed or scaled back dramatically.

“You can’t have a private blockchain. You must have a public blockchain for security and real usage,” Hayes explained. He believes Ethereum wins that race because of its security, network effects, and developer ecosystem.

Moreover, Hayes pointed to stablecoins as the catalyst making Ethereum legible to Wall Street. Banks need programmable money. Stablecoins provide that. And most stablecoins run on Ethereum.

“You’re going to see large banks start doing crypto and Web3 using a public blockchain. I think the public blockchain will be Ethereum.”

He acknowledged privacy concerns remain a sticking point. But he expects solutions at the application layer or through Layer-2 networks. The base Ethereum layer still anchors security.

“They might build an L2 that has some sort of privacy features… but the substrate, the security layer, is still Ethereum.”

The $20,000 Prediction Context

Hayes recently offered a long-term price target that caught attention. He suggested Ethereum could reach $20,000 by the next presidential election cycle.

At that price, 50 ETH would be worth $1 million. That’s a compelling narrative for long-term holders. But it’s also a multi-year timeframe, not a 2025 prediction.

“If ETH gets to $20,000, that’s about 50 Ethereum to make a million… by the end of the cycle, by the next presidential election.”

So Hayes maintains conviction on Ethereum’s institutional future. But that doesn’t mean he can’t take tactical positions or manage portfolio exposure along the way.

Market Conditions Stay Mixed

Ethereum struggled recently despite positive narratives. Spot ETH ETFs recorded notable outflows in mid-December. That reflects cautious sentiment among traditional investors.

Meanwhile, on-chain activity continues migrating to Layer-2 rollups. That keeps transaction costs low, which users love. But it limits fee capture on Ethereum’s base layer, which affects the economics.

Implied volatility in derivatives markets compressed recently. That suggests traders expect less dramatic price movement in the near term. It’s caution, not panic.

Still, Ethereum hasn’t sustained momentum above $3,000 for long. The market seems to be waiting for catalysts that make Hayes’ institutional adoption thesis materialize.

What This Move Really Signals

Hayes’ transfer likely represents tactical positioning rather than a change in conviction. He still holds the vast majority of his Ethereum. His public thesis remains bullish.

But even true believers manage risk. Taking some profits or rebalancing exposure makes sense after major moves. Ethereum rallied significantly in recent years despite current consolidation.

Plus, institutional players like Hayes operate differently than retail holders. They use OTC desks, maintain multiple positions, and rebalance regularly. A $1.5 million transfer is portfolio management, not an exit.

The market may be reading too much into a routine transaction. Or Hayes could be preparing for near-term volatility while maintaining long-term conviction. Both can be true simultaneously.

Hayes’ core argument stands. If stablecoins and institutional on-chain finance scale as expected, Ethereum captures that value. The infrastructure, security, and network effects are already in place.

But markets don’t move in straight lines. Even believers take chips off the table sometimes. That’s smart risk management, not a reversal of thesis.

For now, Ethereum needs to prove Hayes’ institutional adoption story with actual on-chain growth. The narrative is compelling. The execution timeline remains uncertain.