The Bank of England is backtracking. Sort of.

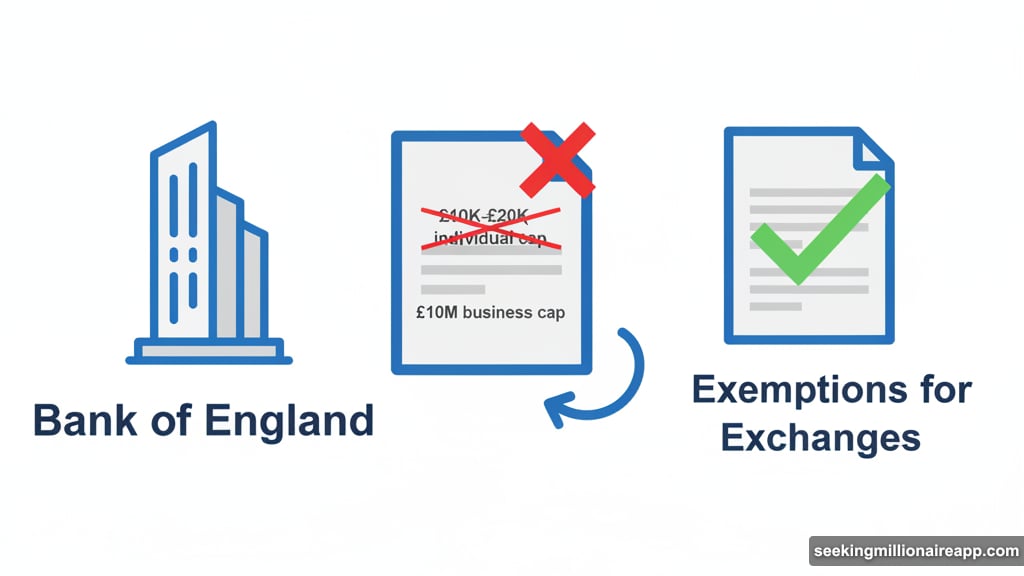

After proposing strict limits on stablecoin holdings that the crypto industry called unworkable, UK regulators now plan exemptions for businesses that actually need these tokens. Bloomberg reported Tuesday that crypto exchanges and similar firms will get waivers to hold larger amounts.

This marks a subtle but important shift. The BoE initially wanted to cap individual holdings at 10,000-20,000 pounds and business holdings at 10 million pounds. Now they’re admitting those rigid limits don’t work for real-world crypto operations.

Exchanges Get a Pass

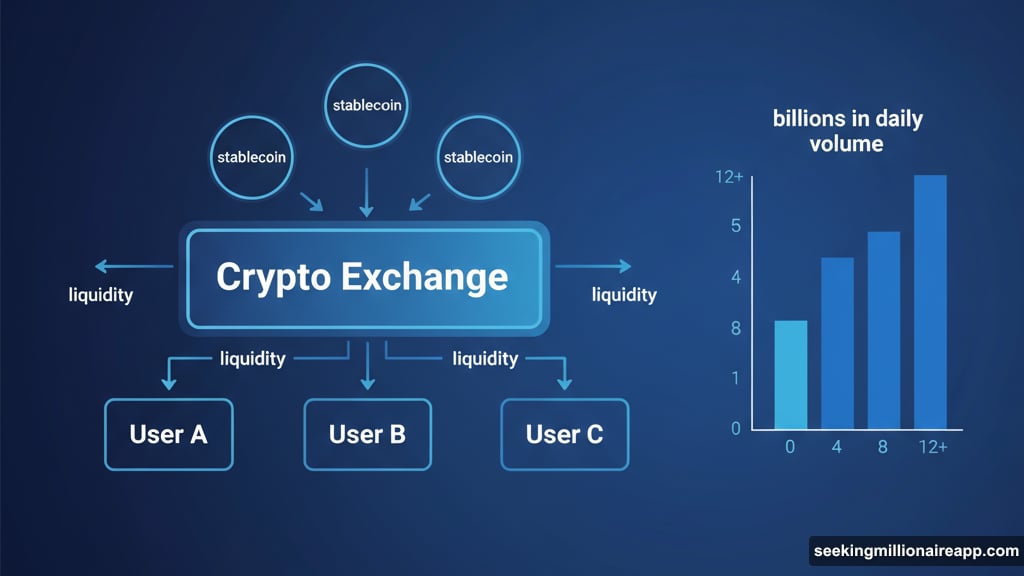

Crypto exchanges need to hold substantial stablecoin reserves. That’s basic infrastructure. Without large holdings, they can’t facilitate trades or maintain liquidity for users.

So the BoE will grant waivers to firms that demonstrate legitimate need for higher caps. Think of it like liquidity requirements banks face. Exchanges aren’t hoarding stablecoins for speculation. They’re holding them to make markets function.

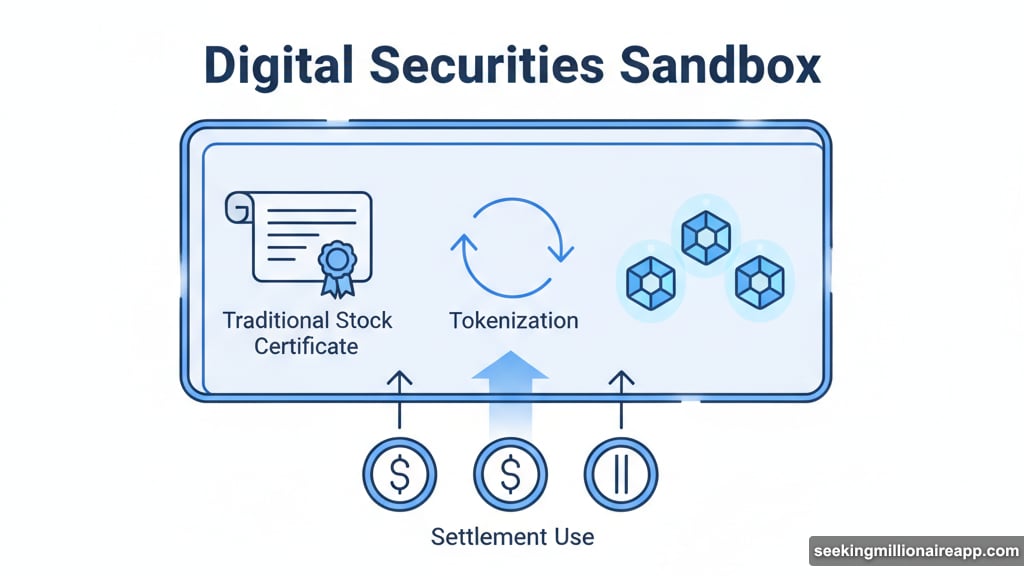

Plus, the central bank will allow stablecoin use for settlement in its Digital Securities Sandbox. That’s the testing ground for tokenized traditional assets. Clearly, they recognize stablecoins serve practical purposes beyond retail speculation.

The Original Plan Drew Fire

When news broke last month about the proposed caps, industry reaction was swift and harsh. Digital asset firms called the limits unworkable for a reason.

Consider the math. A 10 million pound business cap sounds generous. But for an exchange processing billions in daily volume, that’s nothing. They’d hit the limit in minutes during normal operations.

Individual caps of 10,000-20,000 pounds posed different problems. Wealthy users or institutional traders need flexibility. Artificial limits just push activity offshore to friendlier jurisdictions.

BoE governor Andrew Bailey hasn’t hidden his skepticism about stablecoins. In July, he warned about financial stability risks and told global investment banks to avoid developing their own tokens. His caution isn’t unfounded. But blanket restrictions ignore how these tools actually work.

UK Playing Catch-Up

Other major financial centers moved faster on stablecoin regulation. The US and Hong Kong both introduced formal frameworks this year. Meanwhile, the UK seemed stuck debating whether to embrace or restrict the technology.

That hesitation put Britain out of step with its competitors. Financial firms want regulatory clarity, not endless debate. When London delays, crypto businesses look to New York or Singapore instead.

The proposed exemptions suggest UK officials realize they can’t ignore global trends. Stablecoins aren’t going away. They’ve become essential infrastructure for digital asset markets.

In fact, traditional finance institutions show growing interest. Banks explore stablecoin settlement. Payment companies integrate them into existing systems. The technology solves real problems around cross-border transactions and 24/7 settlement.

Still Room for Concern

Yet the exemption approach raises questions. Who decides which firms qualify for waivers? What criteria determine legitimate need versus excessive holding?

Without clear standards, the process could become arbitrary. One firm might get approved while a competitor faces rejection. That creates uneven playing fields and potential favoritism concerns.

Moreover, the base caps remain in place for most users and businesses. So the fundamental restriction still exists. The BoE is just carving out exceptions rather than rethinking the entire framework.

A better approach might involve risk-based regulation. Focus on how stablecoins are used and managed rather than arbitrary quantity limits. Require robust reserves and transparency. Mandate regular audits. But don’t cap holdings that serve legitimate business functions.

What Comes Next

The BoE hasn’t formally announced these changes. Bloomberg’s report cited unnamed sources familiar with the matter. That means details could shift before any official policy update.

But the direction is clear. UK regulators recognize their initial approach was too restrictive. They’re adding flexibility while maintaining oversight.

The crypto industry should welcome this shift. However, the exemption process needs transparency. Clear guidelines. Consistent application. No room for regulatory favoritism or opaque decision-making.

Britain still has work to do catching up with other financial centers on crypto regulation. These exemptions represent progress. But they’re a patch on flawed initial policy rather than comprehensive reform.

Watch how this develops. The exemption details will matter enormously for crypto firms considering UK operations. Get the implementation right and London remains competitive. Botch it and businesses will continue looking elsewhere.