Berachain shocked traders with a violent 210% surge during Wednesday’s session. BERA price rocketed from relative obscurity to market-wide attention in hours.

But here’s the problem. On-chain data reveals a harsh truth about this rally. Capital didn’t actually flow into the asset. Instead, forced liquidations created an artificial price explosion that could reverse just as quickly.

Traders celebrating gains may want to check the exit signs. This rally shows classic warning signs of an impending correction.

Massive Short Squeeze Triggered the Surge

The explosive move wasn’t driven by genuine demand. Rather, a brutal short squeeze caught bearish traders completely off guard.

Funding rates collapsed to negative 5,900% as the rally began. That extreme reading signals a massive imbalance in derivatives positioning. Basically, too many traders bet against BERA at the wrong moment.

When price started climbing, those short positions faced forced liquidation. So exchanges automatically closed bearish bets, which required buying BERA tokens. That buying pressure pushed prices even higher, triggering more liquidations in a vicious cycle.

Trading volume exploded to $2.23 billion within 24 hours. For context, that’s astronomical for an altcoin of BERA’s size. However, most of that volume came from forced buying, not organic investor interest.

Short squeezes create spectacular price fireworks. But they rarely provide lasting support. Once the squeeze ends, price typically retraces as the artificial buying pressure disappears.

Capital Flows Tell a Darker Story

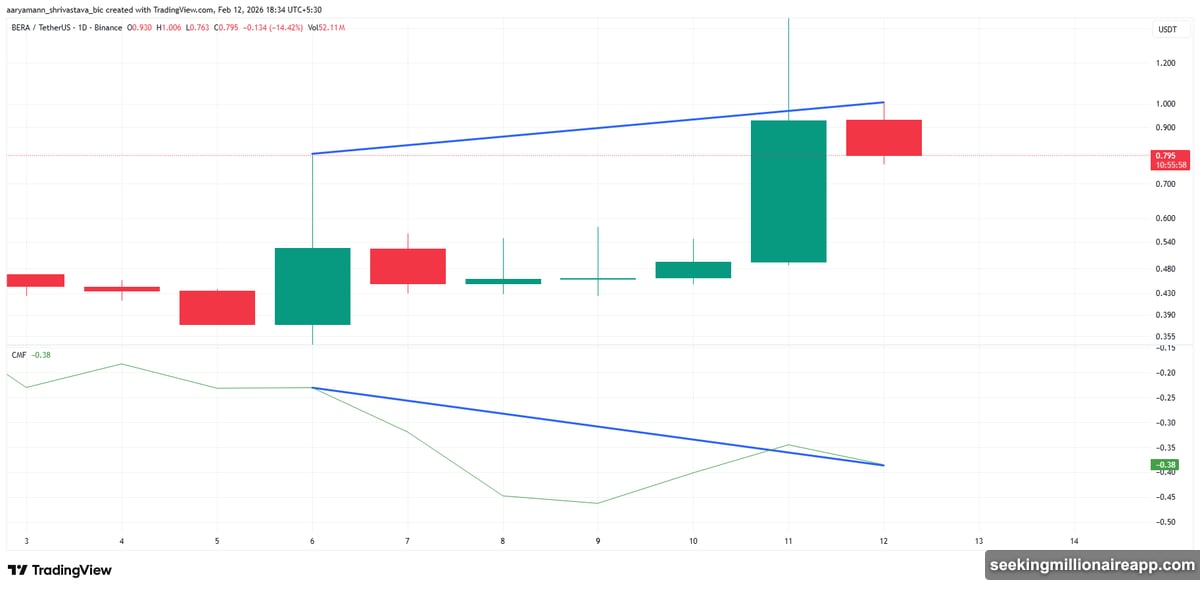

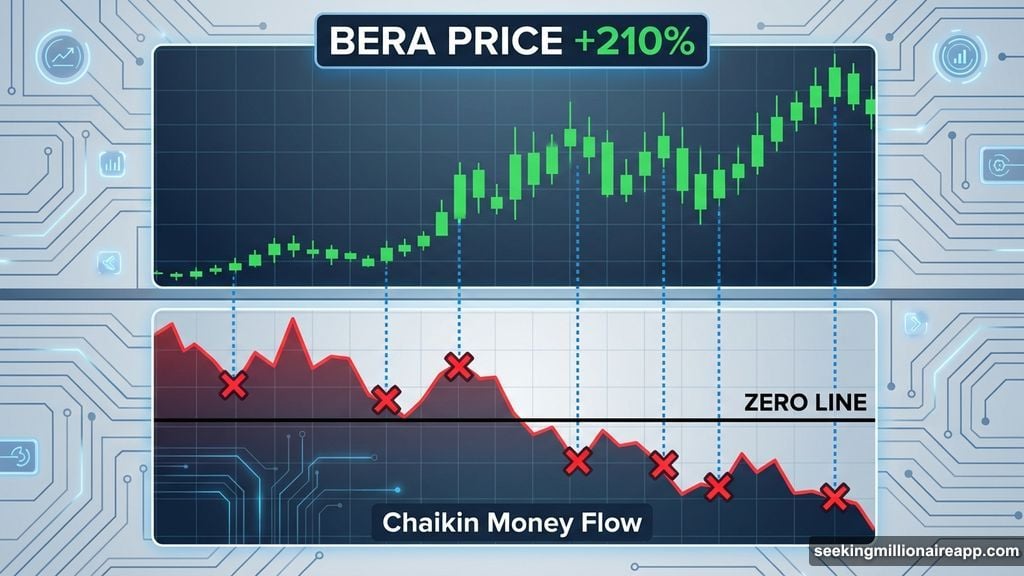

The Chaikin Money Flow indicator reveals concerning weakness beneath the surface. Despite BERA’s 210% price jump, CMF remained stuck below the zero line throughout the entire rally.

What does that mean? Money continued flowing OUT of the asset even as price climbed. That’s the opposite of what you want to see during a legitimate bullish breakout.

Moreover, a textbook bearish divergence formed on the chart. Price printed a higher high during the surge. But CMF posted a lower high at the same time. That divergence suggests weakening momentum beneath the flashy price action.

Bearish divergences often precede corrections. When buying pressure fades while price reaches new highs, the rally typically can’t sustain itself. So the technical setup now favors downside pressure returning soon.

Think of it like a car accelerating while the engine loses power. The speed might increase briefly, but physics eventually wins.

Long Traders Face Liquidation Risk

Derivatives markets now show dangerous vulnerability for bullish positions. As momentum fades, leveraged long traders could face their own liquidation cascade.

Market heat maps identify a major liquidation cluster just above $0.620. Approximately $5.26 million in long positions sit vulnerable near that level. If BERA drops below $0.626, those positions get automatically liquidated.

Cascading liquidations accelerate downside moves. As longs get forced out, they create selling pressure that triggers more liquidations. That domino effect can send prices plunging much faster than they rose.

Retail traders holding aggressive long exposure face amplified risk here. Many probably jumped into BERA during the rally, attracted by the explosive gains. But late entries often become exit liquidity when momentum reverses.

Plus, the speculative nature of the initial surge makes this setup even riskier. Since the rally wasn’t based on fundamental demand, there’s no real support structure underneath current prices.

Price Correction Looks Increasingly Likely

BERA trades at $0.823 as the initial surge fades. That’s still up dramatically from pre-rally levels, but momentum clearly shifted.

The bearish CMF divergence combined with derivatives positioning suggests further downside ahead. A confirmed break below $0.795 support would open the door to $0.620. That move would trigger the liquidation cluster and potentially accelerate losses toward $0.438.

Think about the math. From current levels, a drop to $0.620 represents roughly 25% downside. For traders who entered near the top, losses could exceed 40% if selling intensifies.

However, one scenario could invalidate the bearish outlook. If renewed investor confidence stabilizes price near $0.795, and capital inflows actually strengthen, BERA might rebound toward $1.077. Sustained trading above that level would suggest the rally has real legs.

But that requires genuine buying interest, not just speculation. The current data doesn’t support that optimistic view.

The Bigger Picture Nobody Wants to Hear

Short squeezes create phenomenal trading opportunities. But they’re terrible foundation for sustained price appreciation.

What happened with BERA resembles countless other altcoin pumps over the years. Extreme leverage imbalances trigger violent moves in one direction. Traders pile in hoping to catch more upside. Then reality reasserts itself as artificial buying pressure evaporates.

The lack of capital inflows during this rally is particularly troubling. It suggests that smart money stayed on the sidelines while retail traders chased the move. That’s rarely a recipe for continued gains.

So while BERA’s 210% surge makes for exciting headlines, the underlying weakness points toward correction risk. Traders holding positions should carefully consider whether the risk-reward still makes sense. Those contemplating new long entries might want to wait for clearer evidence of genuine demand.

The crypto market rewards patience more often than FOMO. This looks like one of those times when patience pays off.