Binance just got caught in an awkward situation. Meme coins keep appearing seconds before the exchange tweets. Now executives are pushing back hard against allegations they’re secretly promoting these tokens.

Here’s what happened. Plus, why this controversy reveals deeper problems with how crypto exchanges communicate in the meme coin era.

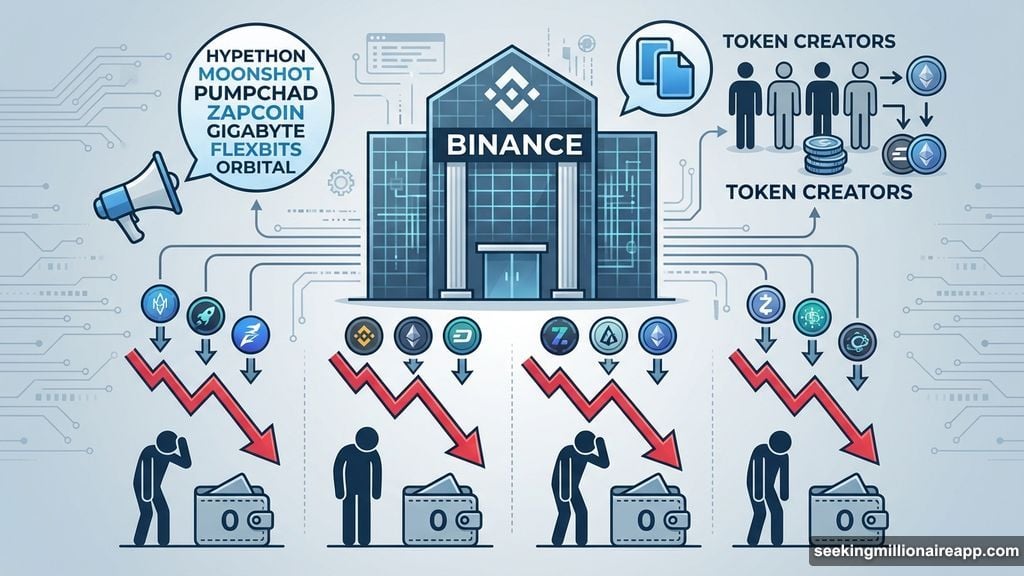

The Suspicious Pattern Everyone Noticed

Someone’s been watching Binance’s Twitter account very closely. Too closely, actually.

On December 7th, Binance Futures posted about “the year of the yellow fruit and harvest.” Within minutes, a token using that exact phrase appeared on-chain. The timing seemed impossible to explain as coincidence.

Crypto detective Nineteen caught the pattern. He showed that the token existed before Binance’s tweet went live. That timing fueled immediate suspicion. Did someone inside Binance tip off token creators? Or worse, create the token themselves?

Similar patterns emerged with other Binance posts. Words from official tweets kept turning into instant meme coins. Each time, traders rushed in hoping for exchange endorsement. Many lost money when the tokens crashed.

Co-Founder Yi He Fires Back

Binance co-founder Yi He rejected the allegations outright. She stressed that the company has zero agreements with influencers to promote meme coin launches.

Instead, she explained what’s really happening. Token creators are copying Binance’s public messaging. Then they launch tokens using those exact phrases. Their goal? Trick traders into thinking Binance endorsed them.

“Currently, the community is engaging in community behavior unrelated to Binance by issuing coins based on Binance’s official Twitter,” she said. The exchange can’t stop posting just because opportunists might exploit their words.

Yi He emphasized that Binance’s social media team chooses its own phrasing freely. But that creative freedom doesn’t extend to creating tokens. The company strictly bars employees from issuing or promoting cryptocurrencies.

Still, the explanation raises questions. If token contracts appeared before tweets, how did creators know what Binance would post? Either someone leaked information, or the timing is an incredible coincidence.

Former CEO Backs Leadership Response

Former Binance CEO Changpeng Zhao echoed Yi He’s defense. He made clear the exchange won’t change how it communicates just because scammers exploit their words.

“Just because people make meme coins of words we use cannot prevent us from using them again,” Zhao wrote on X. Any words in Binance tweets are not endorsements of any tokens or memes.

That stance makes sense from a business perspective. Binance shouldn’t have to sanitize every tweet to prevent exploitation. But it creates a real problem for traders.

When the world’s largest crypto exchange by volume posts something, markets move. Bad actors know this. So they weaponize Binance’s social media presence against unsuspecting traders.

Meanwhile, Binance launched an internal review to determine what actually happened. The company wants to understand how token creators consistently predicted their messaging. That investigation continues.

The Bigger Problem Nobody’s Solving

This controversy exposes a fundamental tension in crypto. Exchanges wield enormous influence over token prices. Yet they claim no responsibility when that influence gets exploited.

Consider the incentives at play. Token creators know Binance tweets drive attention. So they front-run official posts by creating tokens with matching names. Even if Binance never endorses them, traders assume the exchange blessed the launch.

That creates a no-win situation for exchanges. Either they stop posting freely, or they accept that scammers will exploit their words. Neither option seems sustainable.

Plus, the meme coin ecosystem thrives on this chaos. Traders chase anything connected to major exchanges or influencers. The faster you spot a “signal,” the more profit you might capture. That creates pressure to find connections everywhere, even imaginary ones.

Binance’s employee ban on token creation helps. But it doesn’t solve the core issue. As long as the exchange’s words move markets, opportunists will find ways to capitalize on that influence.

What This Means for Traders

The situation puts crypto traders in a tough spot. Every Binance post now carries hidden risk. Will someone launch a scam token using those exact words? Will you accidentally buy it thinking the exchange endorsed it?

Here’s the brutal truth. Binance can’t police every token that copies their messaging. The blockchain moves too fast. By the time they identify a scam, traders have already lost money.

So the burden falls on you. Don’t assume any token is “official” just because it matches exchange messaging. Check contract addresses. Verify claims independently. Treat meme coins as extremely high-risk speculation, not endorsed investments.

Moreover, watch for timing discrepancies. If a token appears before or immediately after an exchange tweet, that’s a red flag. Someone either leaked information or is exploiting predictable patterns in exchange communications.

The exchange maintains strict policies against employee involvement in token launches. But ultimately, you can’t rely on exchanges to protect you from scammers who exploit their words.