Binance just put a massive price on fraud. The world’s largest crypto exchange now offers up to $5 million to anyone exposing fake listing agents.

The move comes at a critical time. Binance faces intense scrutiny over insider trading allegations and questionable listing practices. So this bounty program signals a serious attempt to clean house and rebuild trust.

The Blacklist Nobody Saw Coming

Internal audits revealed something ugly. Seven individuals and firms were falsely claiming they could influence Binance listings.

The exchange didn’t just issue warnings. It published names and promised legal action. The blacklist includes BitABC, Central Research, May/Dannie, Andrew Lee, Suki Yang, Fiona Lee, and Kenny Z.

Here’s where it gets interesting. Central Research previously backed multiple crypto projects. Blockchain data shows connections to Fireverse, Nebula Revelation, AKI Network, Fusionist, and Artyfact.

Only Fusionist (ACE) currently trades on Binance. However, the exchange stopped short of linking the blacklist to past listing decisions. That silence speaks volumes.

How the Scam Actually Worked

These fake agents targeted desperate project founders. They promised guaranteed listings in exchange for hefty fees. Some claimed direct connections to Binance decision-makers.

The pitch was simple. “Pay us, and we’ll get your token listed on Binance Spot or Futures.” Project teams, eager for exchange exposure, often fell for it.

But Binance never authorized external brokers or consultants. The exchange made this crystal clear in Wednesday’s announcement. All legitimate listing applications must come through official channels only.

Plus, Binance doesn’t charge listing fees. Any party demanding payment is committing fraud, plain and simple.

The Insider Trading Connection

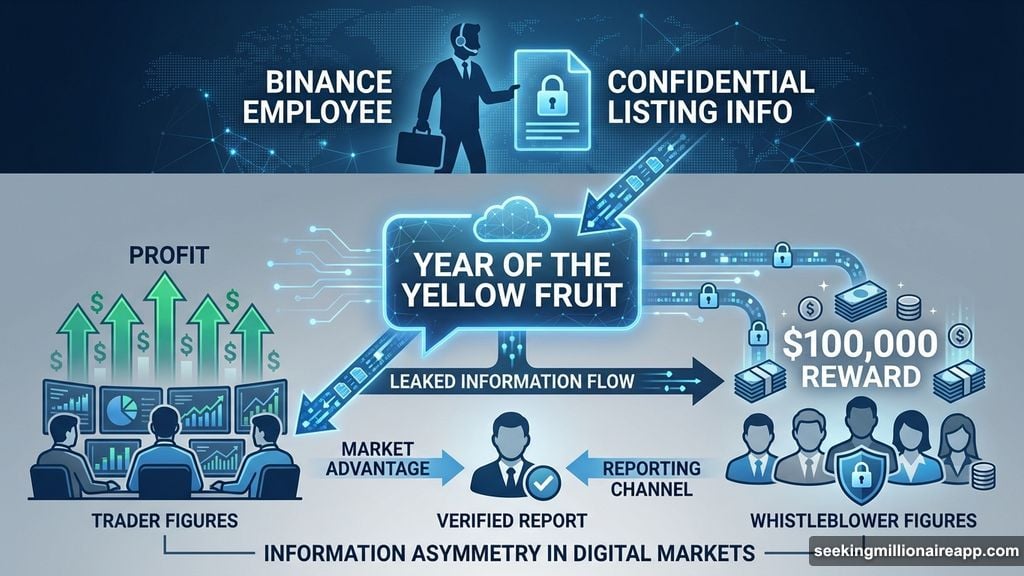

This crackdown didn’t happen in a vacuum. Earlier this month, Binance confirmed an employee leaked confidential listing information.

The incident involved the “year of the yellow fruit” meme coin. Someone inside Binance shared advance notice of the listing. Traders with that information made quick profits before the public announcement.

Co-CEO Yi He addressed the controversy directly. She acknowledged community speculation around official tweets and statements. But she stopped short of promising significant changes to public communications.

Binance distributed $100,000 to five whistleblowers who exposed that misconduct. So the exchange clearly values insider information about fraud and leaks.

Whistleblower Rewards Scale With Impact

The $5 million bounty isn’t guaranteed to every tipster. Reward amounts depend on evidence quality and impact.

Binance wants verifiable proof of fraudulent activity. Screenshots of conversations help. Payment records are even better. The more concrete the evidence, the larger the potential payout.

Moreover, early reporting increases reward chances. The exchange wants to stop fraud before it spreads. So whistleblowers who act quickly may receive priority consideration and higher payouts.

Projects that proactively report fake agents get special treatment too. Binance promises priority listing reviews for teams who help expose fraud targeting them.

Stricter Listing Rules Take Effect Immediately

Wednesday’s announcement detailed exactly how projects should approach Binance. The exchange published a breakdown covering Binance Alpha, Futures, and Spot markets.

All communications must come directly from a project’s core team. No intermediaries. No consultants. No agents claiming special relationships.

Projects caught using middlemen face immediate disqualification. That ban extends to future listing applications, not just current ones. So teams risk permanent blacklisting by working with fake agents.

The exchange emphasized its listing process remains free. Projects don’t pay application fees. They don’t pay review fees. Any party demanding money is operating a scam.

Central Research’s Clouded Track Record

The blacklist highlighted Central Research specifically. That firm previously backed several crypto projects, according to RootData.

Some of those projects gained significant traction. Fusionist even secured a Binance listing. But the exchange made no connection between Central Research’s backing and that listing decision.

The timing raises questions though. Did Central Research use legitimate backing relationships to falsely claim listing influence with other projects? Binance’s statement doesn’t clarify this point.

What’s clear is that Central Research now faces potential legal action. The exchange said it would pursue cases “where appropriate.” That suggests investigations are ongoing.

Why This Matters Beyond Binance

Fake listing agents plague the entire crypto industry. Every major exchange deals with intermediaries making false promises to desperate projects.

These scams hurt legitimate teams. Projects waste money on fraudulent services instead of developing their products. Some abandon promising ideas after losing funds to listing scams.

Plus, fake agents damage exchange reputations. When projects get scammed, they often blame the exchange publicly. That creates negative publicity even though the exchange wasn’t involved.

So Binance’s aggressive response sets a new standard. Other exchanges may follow with similar bounty programs and blacklists. The industry benefits when major players actively combat fraud.

The Transparency Pressure Builds

Exchanges face mounting pressure to demonstrate fair practices. Regulators worldwide scrutinize listing processes for conflicts of interest and market manipulation.

Binance’s recent troubles amplified that scrutiny. The insider trading incident revealed internal control weaknesses. Critics questioned whether more misconduct remained hidden.

This bounty program directly addresses those concerns. By incentivizing whistleblowers, Binance signals willingness to expose problems publicly. That’s a significant shift from the traditional crypto industry approach of quietly handling issues internally.

However, critics will note that Binance created these problems through inadequate controls. The exchange now pays millions to fix issues that proper procedures should have prevented.

Projects Face Tough Choices

Legitimate crypto projects now navigate a tricky landscape. Getting listed on major exchanges remains crucial for success. But the path forward just got more complicated.

Projects must avoid anyone claiming Binance connections. That includes well-connected crypto consultants who might legitimately know exchange employees. The risk of disqualification is too high.

Instead, teams should focus on building strong fundamentals. Solid technology, active communities, and real-world use cases matter more than backdoor connections ever could.

Yet many projects still believe shortcuts exist. The prevalence of fake listing agents proves that desperation drives poor decisions. Founders want to believe someone can expedite the process.

What Comes Next

Binance’s bounty program represents just one step in a longer cleanup process. The exchange must rebuild trust through consistent transparency and strong internal controls.

Expect more blacklist additions as investigations continue. The seven named parties probably represent a fraction of fraudulent actors operating in this space. More names will surface.

Other exchanges should watch closely. If Binance’s bounty program successfully exposes widespread fraud, competitors may launch similar initiatives. That would benefit the entire industry by raising standards and punishing scammers.

Meanwhile, projects must stay vigilant. Fake agents will adapt tactics to avoid detection. Some may claim they’re not promising listings but just “increasing chances” or “making introductions.” Those semantic games change nothing about the fundamental fraud.

Binance made its position clear. Any external party offering listing-related services for payment is operating illegally. That bright line rule leaves no gray area.

The crypto industry desperately needs this kind of clarity. Too many bad actors exploit confusion and desperation. So Binance’s aggressive stance, backed by meaningful financial incentives, could finally curb these scams.

But ultimately, lasting change requires more than bounties. Exchanges need robust internal controls preventing employees from leaking information. They need transparent listing criteria so projects understand evaluation processes. And they need consistent enforcement showing that rules apply equally to everyone.

Binance’s $5 million bounty is a strong start. Whether it leads to meaningful reform or just temporarily drives scammers underground remains to be seen. The next few months will reveal which outcome prevails.