South Korea just unfroze a deal everyone thought was dead. Binance’s attempt to crack the Korean market through GOPAX might finally happen after sitting in regulatory limbo since 2023.

The Financial Intelligence Unit started reviewing the acquisition again this month. That’s notable. They’ve been sitting on Binance’s paperwork for over two years while the exchange fought legal battles in the US.

Now those battles are over. And suddenly, Korean regulators are moving forward.

The Deal That Wouldn’t Die

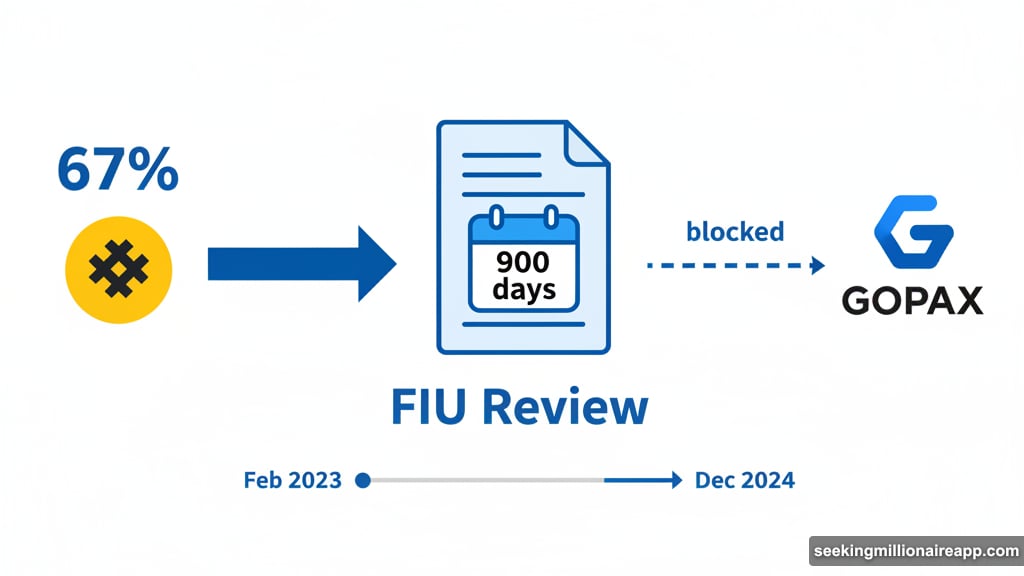

Binance bought a 67% stake in GOPAX back in February 2023. Then they filed the required executive change report with the FIU in March. Korean law gives regulators 45 days to approve or deny these filings.

The FIU took 900 days instead.

They kept requesting more documents. More clarifications. More evidence that Binance wouldn’t turn Korea’s crypto market into a money laundering playground. The review became an unofficial suitability test for Binance’s leadership.

Korea has strict rules. Anyone convicted of money laundering or terrorism financing can’t operate a crypto business there. The FIU needed proof that Binance’s executives cleared that bar.

Why Regulators Stalled

The FIU’s concerns weren’t paranoid. They were watching Binance get hammered by US regulators in real time.

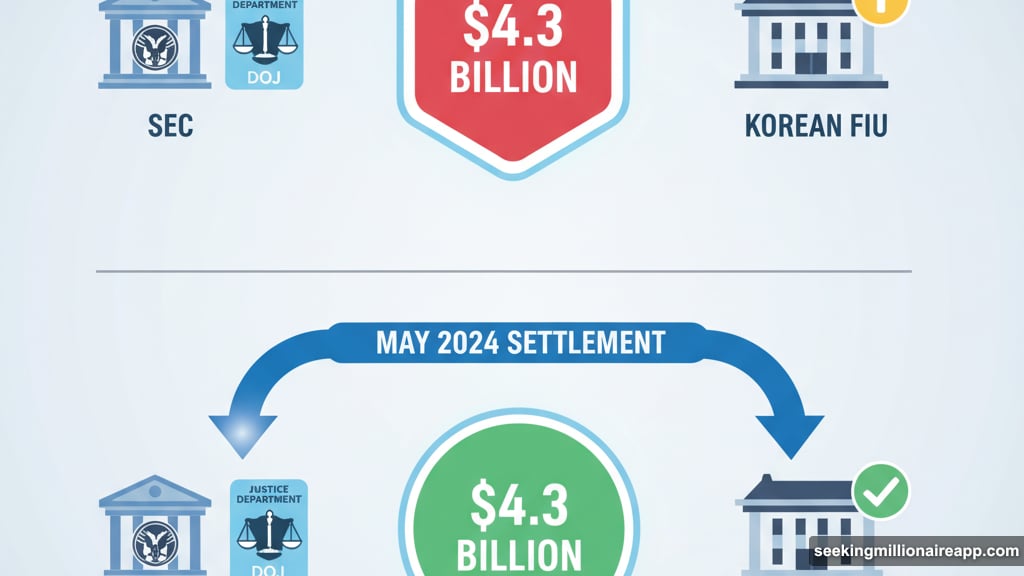

The SEC sued Binance in June 2023 for illegally serving American users and misusing customer funds. Then the Justice Department piled on with anti-money laundering charges. Binance ended up paying $4.3 billion in fines.

Korean regulators saw that chaos and hit pause. Nobody wanted to approve an acquisition while the target company faced billions in penalties and criminal charges. So they waited.

Smart move, actually. The alternative was approving Binance only to watch them collapse under regulatory pressure.

US Legal Storm Clears

Things changed dramatically in May. The SEC dropped its lawsuit against Binance and founder Changpeng Zhao. The Justice Department and Treasury followed suit after Binance paid its fines.

Suddenly, Binance was clean. Or at least clean enough.

That resolution removed the FIU’s biggest objection. With US charges settled, Korean regulators could move forward without worrying about approving a company mid-crisis. The timing isn’t coincidental.

What Approval Actually Means

If the FIU approves this deal by year-end, Binance gets direct access to Korea’s crypto market. That’s huge.

Korea is one of crypto’s most active markets. Trading volumes rival much larger countries. Korean users are sophisticated, high-volume traders. It’s exactly the kind of market global exchanges crave.

GOPAX gives Binance instant local infrastructure. They won’t need to build from scratch or navigate Korea’s notoriously complex regulatory setup. They’ll step into an existing, approved exchange with established users.

But there’s a catch. Always is.

The Liquidation Question Nobody’s Asking

Korean authorities might dig into recent accusations about Binance’s liquidation reporting. These allegations surfaced after last Friday’s market chaos.

President Trump announced new China tariffs. Crypto markets tanked. Over $19 billion in positions got liquidated in 24 hours. Binance alone saw $706.2 million in liquidations.

Or did it? Some industry insiders claim that number is suspiciously low.

Jeff Yan, CEO of Hyperliquid, posted on X that Binance might underreport liquidations by 100x in some conditions. His explanation: Binance only reports one liquidation order per second even when thousands occur simultaneously.

If true, actual liquidation volumes could dwarf official figures. That matters because liquidation data affects how traders perceive platform risk and stability. Underreporting makes platforms look safer than they are.

Why This Matters Now

The FIU hasn’t indicated they’ll investigate Yan’s claims. But they could. Approval of the GOPAX acquisition doesn’t mean regulators stop watching Binance’s operations.

Korea takes financial transparency seriously. If evidence suggests systematic underreporting of liquidations, that becomes a compliance issue. The kind that derails deals even after they’re approved.

So Binance faces two timelines. The first runs until year-end: will the FIU approve the GOPAX acquisition? The second extends indefinitely: will Korean regulators dig into platform operations and find problems?

The Bigger Picture

This isn’t just about one exchange entering one market. It’s about whether major crypto platforms can operate globally under serious regulatory scrutiny.

Binance survived its US legal battles by paying massive fines and making structural changes. Now they’re testing whether that’s enough for other major markets. Korea’s decision sets a precedent.

If Korea approves despite past controversies, other countries might follow. If they reject or impose heavy conditions, Binance’s international expansion hits a wall. Other exchanges watch closely because they face similar challenges.

The crypto industry spent years operating in regulatory gray zones. Those days are over. Now it’s about proving you can play by the rules while still running a profitable exchange. Binance is the test case.

Korean regulators hold the answer. We’ll know by December if Binance passed the test or if two years of waiting was just the beginning of their problems.

Post Title:

Meta Description: