The crypto ETF party just hit a wall. Hard.

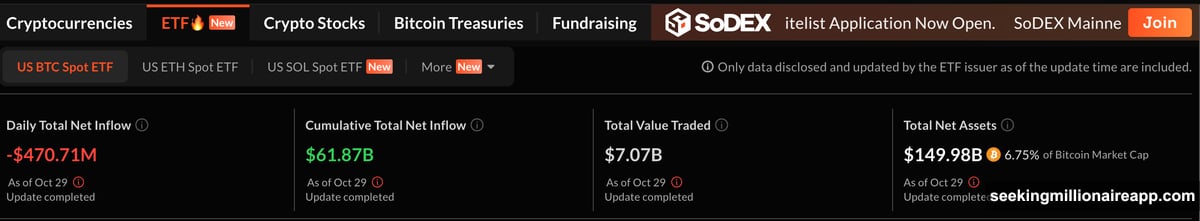

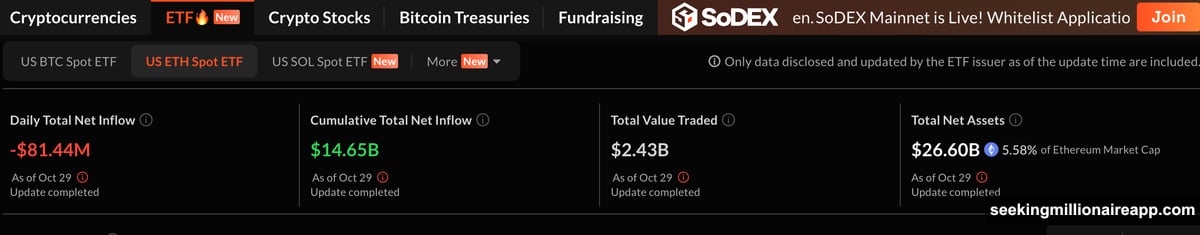

US spot Bitcoin ETFs hemorrhaged $471 million in a single day. Ethereum ETFs lost another $81 million. Not one of the twelve major Bitcoin funds saw money coming in. Zero.

This wasn’t a minor correction. This was investors running for the exits.

The Numbers Tell a Brutal Story

Wednesday’s outflows paint a stark picture. Every single Bitcoin ETF tracking fund posted withdrawals. No exceptions. Meanwhile, Ethereum fared slightly better but still suffered massive bleeding.

The Fear & Greed Index crashed to 34 out of 100. That’s down from 51 just one day earlier. According to SoSoValue data, the market firmly entered “fear” territory.

Only one fund bucked the trend. BlackRock’s ETHA managed to pull in new money while everything around it burned. That tells you something about brand power when markets panic.

Plus, there’s a twist. A Solana spot ETF grabbed $46.5 million in fresh capital. So money didn’t leave crypto entirely. It just abandoned the mainstream options.

Why Investors Are Bailing Now

Three forces are squeezing crypto ETF holders simultaneously. First, interest rates keep climbing. That makes cash and bonds look more attractive compared to volatile digital assets.

Second, inflation refuses to die. The US economy keeps sending mixed signals. Investors hate uncertainty more than they hate losses.

Third, regulatory fog remains thick. Nobody knows what rules will look like next month, let alone next year. That makes long-term crypto bets feel riskier.

But here’s what really matters. Institutional investors are recalibrating their risk exposure. They’re not necessarily abandoning crypto forever. They’re just stepping back until conditions improve.

Some are locking in gains from earlier rallies. Others face redemption pressures elsewhere in their portfolios. When your tech stocks tank, you might need to pull money from crypto to cover margin calls.

The speed of the reversal is what shocks observers. Earlier this year, these same funds attracted billions. Now that momentum flipped in days, not months.

What Makes BlackRock’s Fund Different

ETHA stood alone with positive inflows. Why did one fund succeed while eleven others failed?

Brand reputation matters during panics. Investors trust BlackRock’s name and infrastructure. Lower fees help too. When you’re nervous about markets, every basis point of cost savings feels important.

Scale provides another advantage. Larger funds typically offer better liquidity. That means you can exit faster if things get worse. During fear cycles, that exit option becomes incredibly valuable.

Moreover, newer investors might not fully understand the differences between ETF providers. They see “BlackRock” and feel safer than with less familiar names. Fair or not, that psychology drives billions in capital flows.

The Solana ETF inflows tell a complementary story. Some investors aren’t fleeing crypto. They’re hunting for better opportunities beyond Bitcoin and Ethereum. That suggests sophistication, not panic.

The Bigger Picture for Crypto ETFs

These outflows expose uncomfortable truths about the crypto ETF ecosystem. The infrastructure is new. Investor confidence remains fragile. One bad macro week can reverse months of progress.

ETF flows work as market sentiment barometers. When money pours in, everyone cheers. When it rushes out, questions multiply. Are investors losing faith in crypto? Or just responding rationally to economic signals?

Analysts see “faster money” exiting first. That’s short-term capital chasing quick gains. It floods in during rallies and evacuates at the first sign of trouble. Long-term institutional money moves slower and less emotionally.

If outflows continue, they’ll pressure underlying crypto prices. Bitcoin and Ethereum might face downward spirals as ETF selling hits spot markets. That creates feedback loops where lower prices trigger more redemptions.

Fee structures will matter more going forward. Funds with higher costs will struggle to justify their existence. Investors will consolidate into a few dominant players with better economics and stronger brands.

However, don’t write off crypto ETFs entirely. They still represent the easiest way for institutions to gain crypto exposure through traditional finance rails. The infrastructure exists now. It just needs stable conditions to flourish again.

What This Means for Your Portfolio

Should you follow the herd out the door? Maybe. Maybe not.

If you invested in crypto ETFs for long-term exposure, these short-term flows shouldn’t matter much. Panic selling rarely beats patient holding over multi-year periods.

But if you’re trading actively or managing institutional capital, the macro picture demands attention. Higher interest rates and persistent inflation create legitimate headwinds. Those aren’t going away quickly.

Smart money is asking tough questions right now. Which funds offer the best cost structure? Where’s the liquidity when I need to exit fast? What’s my actual conviction level on crypto?

The Solana ETF inflows suggest opportunities exist for those willing to look beyond Bitcoin and Ethereum. Diversification within crypto might provide better risk-adjusted returns than concentrated bets.

Still, the Fear & Greed Index sitting at 34 means we’re not at peak panic yet. Markets can get much scarier before they recover. Cash on the sidelines lets you buy cheaper later if conditions worsen.

Whatever you decide, understand this. The US crypto ETF market just failed its first real stress test. How providers respond over the next few months will determine whether this asset class matures or stagnates.

Watch for regulatory clarity, fee competition, and product innovation. Those factors will separate winners from losers as the ecosystem evolves beyond its shaky early days.