Bitcoin stumbled hard entering February. Prices dropped below key support levels. Sentiment turned sour across markets.

But beneath the surface, something interesting is happening. Selling pressure appears to be easing. Early recovery signals are emerging from multiple data points. These aren’t screaming “bull market now” yet. However, they represent the first positive signs after weeks of relentless selling.

So let’s examine three concrete reasons why Bitcoin might not stay below $80,000 much longer.

US Demand Is Quietly Returning

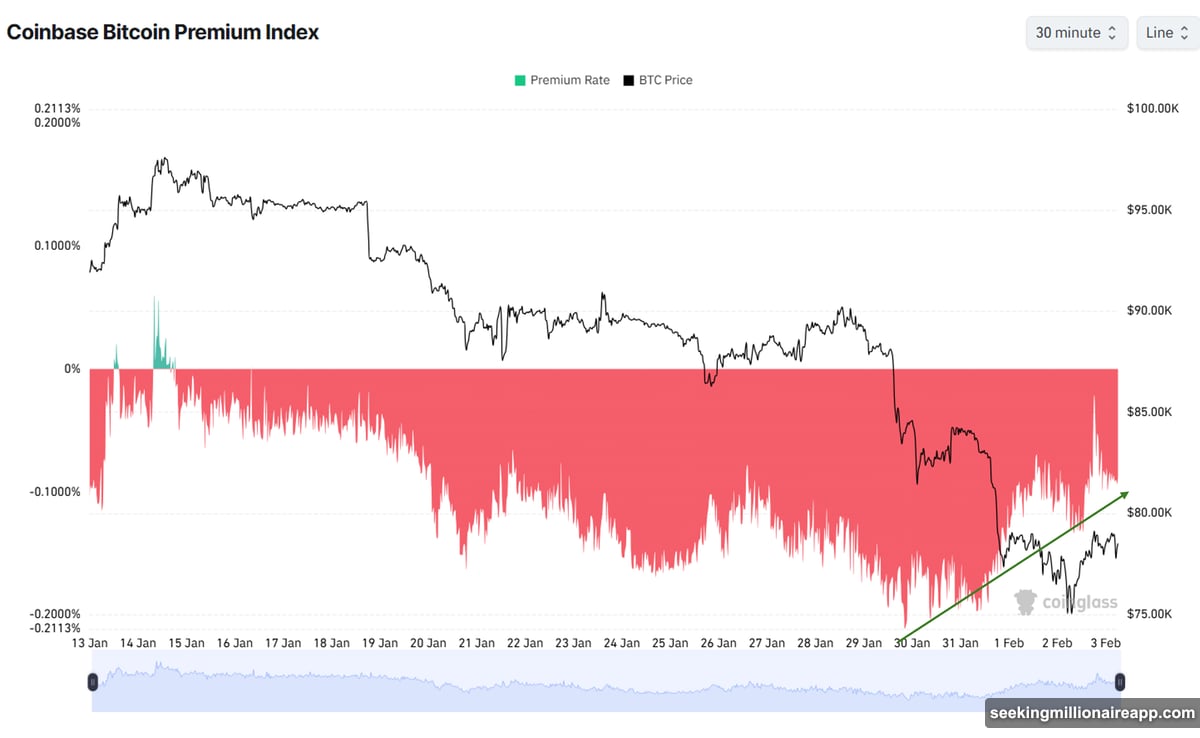

The Coinbase Premium Index tracks price differences between Coinbase and other exchanges. When US buyers step in aggressively, this premium goes positive. When they sell or stay away, it goes negative.

Right now? The index is still negative. But here’s the twist: it’s recovering steadily from recent lows. That suggests US buying demand is slowly returning through Coinbase, which dominates institutional and retail flows from America.

Historically, this recovery pattern precedes broader price reversals. The premium doesn’t need to go positive immediately. Instead, the trajectory matters more than the absolute level. And that trajectory is pointing up.

“Coinbase Bitcoin Premium is recovering. April 2025 lows have been taken. Not calling for a mega rally, but things are looking good for a relief rally,” investor Ted noted.

Meanwhile, crypto funds saw $1.7 billion in outflows last week. That reversed year-to-date inflows into net losses. Yet even amid this exodus, the Coinbase Premium is strengthening. That divergence hints that retail and institutional buyers are starting to reenter positions despite macro uncertainty.

Bitcoin Trades Below ETF Cost Basis

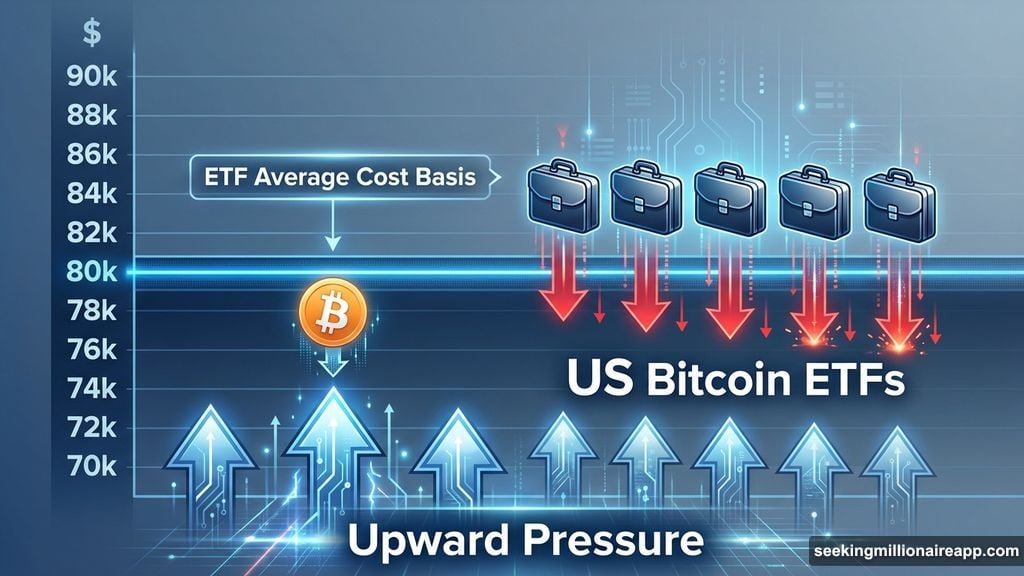

US Bitcoin ETFs now hold massive positions. CryptoQuant data shows their average cost basis sits around $79,000. Bitcoin currently trades below that level.

This matters because institutional investors and long-term ETF holders rarely sell at a loss. Their cost basis acts as psychological support. Plus, Wall Street firms managing these ETFs have little incentive to dump holdings below their entry prices.

History backs this up. Since US Bitcoin ETFs launched, Bitcoin has rarely stayed below their average cost basis for extended periods. During the bearish Q3 2024 phase, Bitcoin tested this level multiple times. Each time, the price recovered within one to two weeks.

“If you missed the sub-$80k boat, it just came back to pick you up. You’re now buying Bitcoin cheaper than the average price of every US ETF combined. Wall Street is down 10% on their entry, while you’re just getting started. Max pain for them equals max opportunity for you,” analyst Whale Factor commented.

Now Bitcoin sits in that same zone again. ETF holders are underwater. That creates buying pressure from two sources. First, institutions hesitate to sell at losses. Second, new buyers see value in entering below the “smart money” cost basis.

This dynamic doesn’t guarantee an immediate bounce. But it does suggest strong support exists at current levels. And historically, Bitcoin doesn’t linger in this zone for long.

Network Growth Meets Liquidity Recovery

Swissblock, a Swiss crypto analytics firm, spotted an interesting convergence in early February. Both network growth and liquidity metrics bottomed out together. Then both started recovering simultaneously.

Why does this matter? Network growth measures new addresses and on-chain activity. Liquidity tracks available capital flowing into Bitcoin markets. When both metrics hit lows and then recover together, it often signals the end of a correction phase.

Swissblock pointed to 2021 as the last time this exact pattern appeared. Back then, network growth and liquidity recovered from low levels simultaneously. What followed? Bitcoin reached a new all-time high shortly after.

“Sustained growth in these indicators could be the catalyst for one last push,” Swissblock predicted.

Obviously, past patterns don’t guarantee future results. Markets never repeat exactly. But this convergence represents rare technical alignment that has historically preceded major rallies.

Moreover, the timing matters. Network growth typically leads price action by several weeks. If more addresses are becoming active now, price often follows that activity higher. Combined with improving liquidity, the setup resembles early recovery phases from previous cycles.

Not Everyone Agrees

These positive signals exist. But so do serious concerns. Alex Thorn, Head of Research at Galaxy Digital, warned that Bitcoin’s weakness could persist. He sees potential for further decline toward the 200-week moving average near $58,000.

His reasoning? Declining liquidity and lack of short-term catalysts. Fair points. Macro conditions remain uncertain. Institutional flows could reverse again. And without clear positive catalysts, Bitcoin might drift lower before finding real support.

So the picture isn’t entirely rosy. Multiple conflicting signals exist right now. Some point toward recovery. Others suggest more pain ahead. That’s typical during transition phases between trends.

Still, the evidence suggests Bitcoin faces meaningful support at current levels. The Coinbase Premium recovery, ETF cost basis support, and network growth convergence all point toward potential strength below $80,000. These aren’t guarantees. But they’re more positive than anything we’ve seen in weeks.

Bitcoin might test lower levels briefly. But staying below $80,000 for extended periods looks increasingly unlikely based on these technical and on-chain indicators. The question isn’t if Bitcoin recovers. It’s how quickly the recovery unfolds once momentum shifts.

Markets transition slowly. Then all at once. These early signals suggest the slow transition phase might be ending.