Bitcoin just climbed past $123,000. That puts it within striking distance of its all-time high above $124,500.

But something feels different this time. The crypto surged nearly 15% over five days, marking one of its strongest October runs ever. More importantly, the forces driving this move look nothing like previous pumps.

Let’s break down what changed and why this rally might actually stick.

October Delivered Early

Bitcoin traded below $110,000 last weekend. Now it’s sitting at $123,300 after gaining roughly 3% in the past day alone.

October has always been kind to bitcoin. Traders call it “Uptober” for good reason. But this year’s performance stands out even by those standards.

From July through September, bitcoin barely moved. It traded in a tight range while stocks and gold kept hitting new records. That sideways action frustrated crypto investors watching traditional markets run higher.

Then momentum flipped hard heading into Q4. The breakout arrived with conviction, not the usual false starts that plagued earlier rallies.

Different Drivers This Time

Economist Noelle Acheson, who writes the Crypto is Macro Now newsletter, sees something new happening. Previous bitcoin rallies ran on speculation and retail FOMO. This one has different fuel.

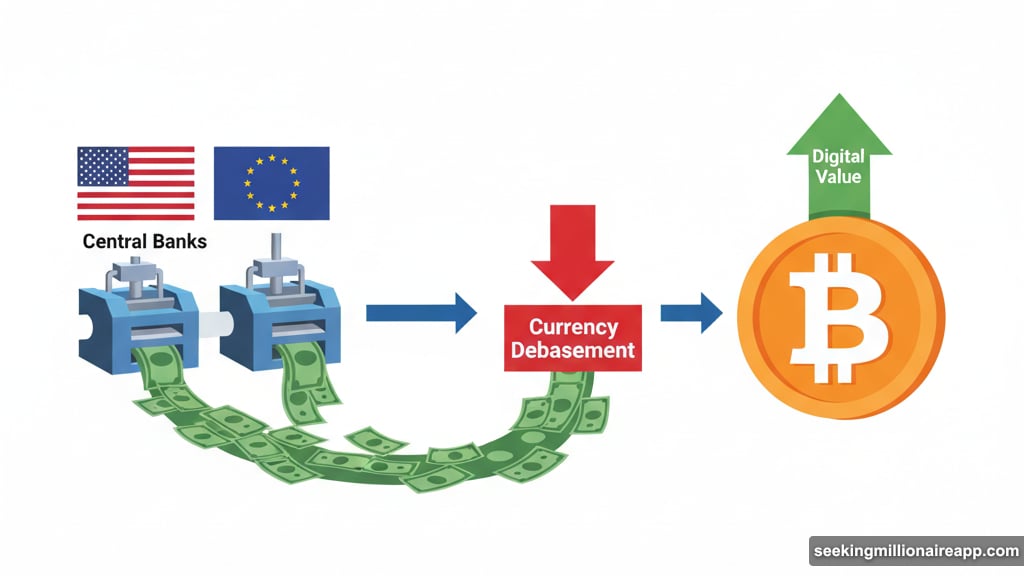

“In previous cycles we didn’t have this level of sustained global debasement,” Acheson explained on X. Central banks worldwide keep printing money. That erodes fiat currency value and pushes investors toward hard assets.

Plus, geopolitical uncertainty is mounting. Countries are slowly moving away from dollar dependence. Bitcoin benefits as a global, neutral alternative that no government controls.

Institutional money is flowing in steadily now. Not the quick-flip trading that dominated past cycles. Real capital allocation from funds and corporations looking for long-term positions.

Why This Rally Might Last

Here’s what worries me about most bitcoin pumps. They spike hard, hit new records, then crash violently. We saw exactly that in both July and August when brief highs got followed by brutal selloffs.

But the current rally feels sturdier. The buying isn’t just speculative fever. It’s driven by fundamental shifts in how institutions view bitcoin’s role in portfolios.

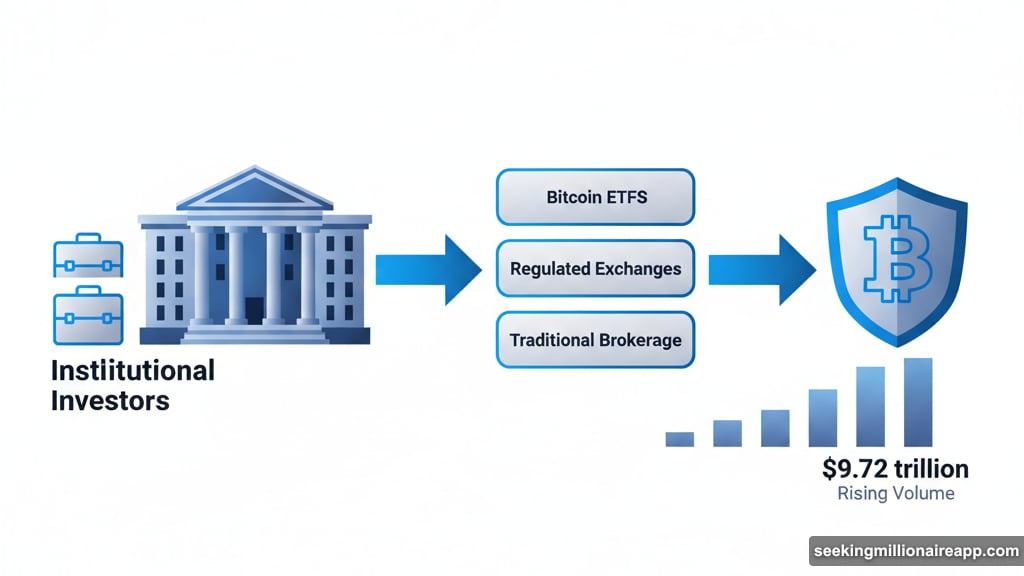

Acheson points out that the investor pool is larger now. More people can access bitcoin through ETFs, regulated exchanges, and traditional brokerage accounts. That brings sustained demand instead of boom-bust cycles.

The macro environment matters too. When fiat currencies lose purchasing power and geopolitical tensions rise, bitcoin becomes more attractive. Not as a speculative bet but as a genuine hedge.

Trading Volume Tells the Story

Centralized exchange volume hit $9.72 trillion in August. That’s the highest monthly total for all of 2025. Combined spot and derivatives trading jumped 7.58% from July.

Individual exchanges are seeing massive growth. Gate’s volume surged nearly 99% to $746 billion, making it the fourth-largest platform. That kind of expansion shows real user adoption, not just whale manipulation.

Open interest in derivatives markets rose 4.92% to $187 billion. More capital is betting on bitcoin’s future price movements. Plus, that indicates confidence from sophisticated traders who use leverage carefully.

The Cycle Isn’t Over

Some analysts claim Q4 marks the end of bitcoin’s bull market. But long-term indicators tell a different story.

Bitcoin’s 200-week moving average just crossed $53,000. The realized price, which tracks the average cost basis of all coins, sits above that at $54,000. Historically, when realized price stays above the 200-week moving average, bitcoin tends to keep climbing.

Those metrics have accurately predicted past cycles. They’re only consistently upward-trending indicators that bitcoin offers. Right now, both suggest plenty of room left to run.

Standard Chartered bank recently forecast a quick move to $135,000 and beyond. That might sound aggressive. But given current momentum and institutional demand, it’s not crazy.

What Makes Me Nervous

I’ve watched bitcoin long enough to stay skeptical during rallies. Past runs to record highs often ended badly for late buyers. The July and August peaks both reversed fast.

So what’s different now? Mainly the composition of buyers. Retail FOMO drove previous tops. This rally has more institutional backing and macro justification. That doesn’t guarantee smooth sailing, but it does suggest more stability.

The other concern is government shutdown uncertainty. If U.S. fiscal chaos intensifies, markets could get choppy. Bitcoin might catch some volatility from traditional market selloffs.

Still, the long-term case for bitcoin strengthens as global monetary instability grows. Short-term pullbacks seem likely. But the overall trend points higher as long as central banks keep debasing currencies and institutions keep allocating capital.

Where Bitcoin Goes Next

Bitcoin sits just 1-2% below its all-time high. Breaking through that ceiling would open psychological space for $130,000 or beyond. But resistance at records is always fierce.

Traders will take profits near all-time highs. That’s normal and healthy. Sharp pullbacks shouldn’t surprise anyone. Yet if the fundamental drivers remain intact, dips will likely get bought aggressively.

The real test comes if bitcoin pushes significantly above $125,000. That would be uncharted territory where no one has prior positions. New price discovery could get volatile as the market searches for equilibrium.

Acheson’s right that this cycle feels different. Bitcoin finally has the macro tailwinds and institutional participation it always needed. Whether that translates to sustained gains or just higher volatility remains to be seen.

But for the first time in months, bitcoin bulls have legitimate reasons for optimism beyond hopium and moon memes.