The crypto market just jolted to life. Bitcoin smashed through resistance levels investors watched for weeks. Plus, one obscure altcoin surged 25% in a single day while traders scrambled to figure out what sparked the move.

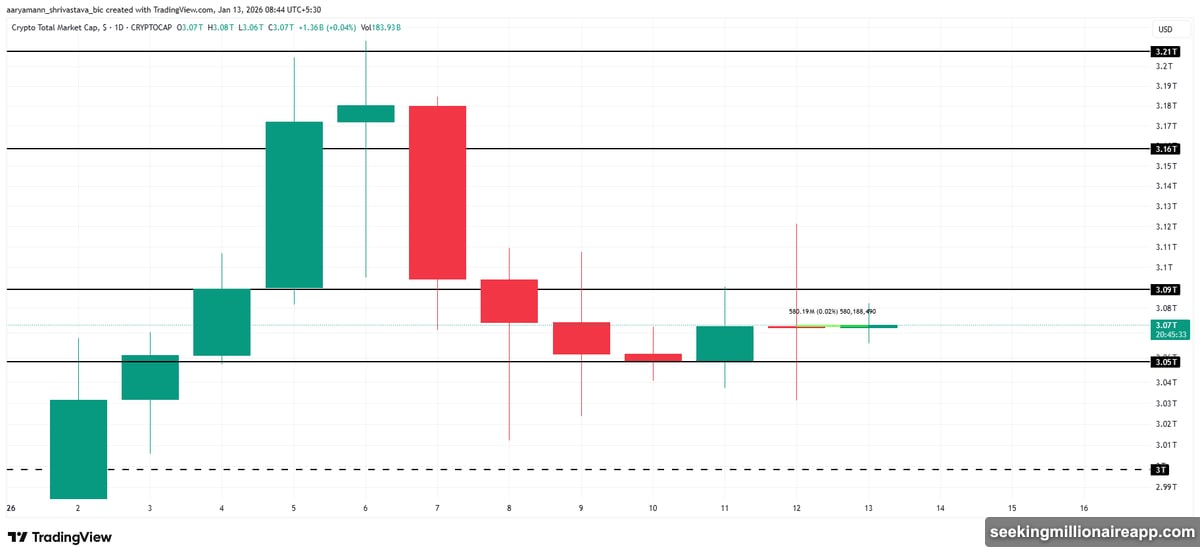

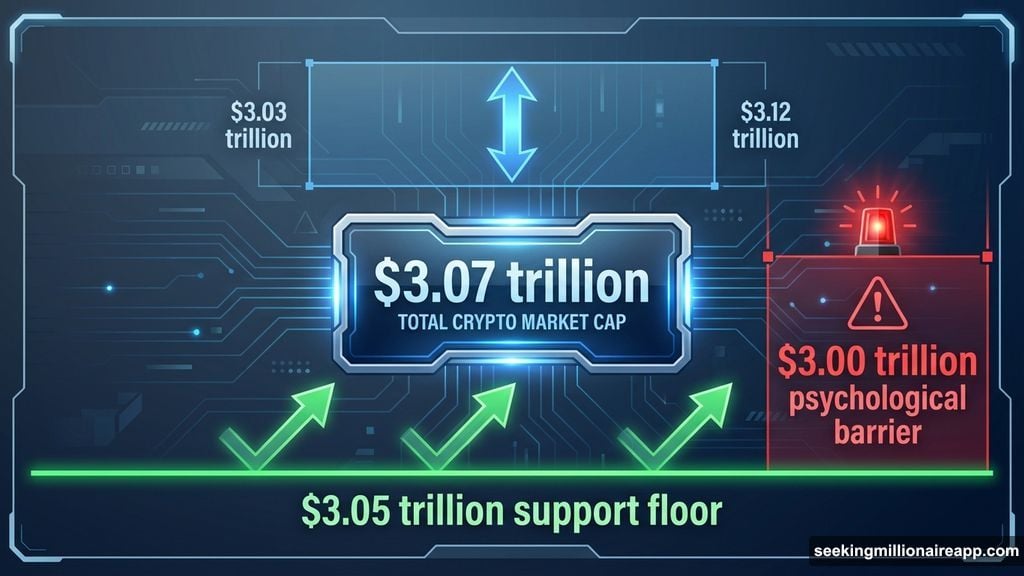

The total crypto market cap barely budged at first glance, adding just $580 million to reach $3.07 trillion. But that calm surface hides wild swings underneath. Prices whipsawed between $3.03 trillion and $3.12 trillion within 24 hours. So the market isn’t consolidating peacefully. It’s coiling up.

Meanwhile, Bitcoin traders stared at the $91,511 resistance level like it held some mystical power. Spoiler: it did. Breaking that barrier changed everything.

Bitcoin Finally Cleared the Hurdle

Bitcoin spent days grinding against $91,511, unable to punch through. Each attempt failed. Sellers defended that level aggressively, pushing BTC back down toward $91,000 repeatedly. Frustration built among bulls who expected a clean breakout.

Then momentum shifted. Bitcoin blasted past $91,511 and kept climbing, eventually hitting $93,000 after favorable US inflation data landed. The CPI print showed inflation cooling, which reduced fears of prolonged high interest rates. That matters because crypto thrives when money stays cheap.

Now BTC sits near $93,471, the next meaningful resistance zone. If buyers maintain pressure, Bitcoin could test $95,000 within days. That’s where psychological resistance kicks in. Round numbers always matter in trading, especially in crypto where sentiment drives action more than fundamentals.

However, danger lurks below. The Relative Strength Index (RSI) started turning lower before the latest surge, suggesting weakening momentum existed. Plus, profit-taking pressure intensifies as traders who bought lower look to cash out gains. A failed rally above $93,000 could trigger a sharp reversal toward $90,000 or even $89,241.

The $3 Trillion Floor Keeps Holding

The total crypto market capitalization bounced off $3.05 trillion support three times in recent sessions. Each test held firm. Buyers stepped in aggressively at that level, preventing deeper losses across altcoins and Bitcoin simultaneously.

This support zone matters more than most realize. Below $3.05 trillion, the next major support sits at $3.00 trillion. Losing that psychological barrier would panic retail investors and trigger automated sell orders from leveraged positions. The cascade effect could push the entire market down 5-10% quickly.

Yet the repeated defense of $3.05 trillion shows institutional buyers remain active. Large wallets accumulated during dips rather than panicking. On-chain data confirms whales added positions when prices dropped, providing liquidity that stabilized markets.

Still, volatility remains extreme. The $90 billion swing between the daily high and low demonstrates how fragile current sentiment is. Mixed signals dominate. Buyers and sellers battle without clear victory, creating choppy conditions that frustrate traders expecting clear trends.

One Altcoin Crushed the Market

Story (IP) exploded 25.5% while most altcoins traded sideways or dropped. The decentralized intellectual property protocol suddenly attracted massive buying interest, pushing its price from around $2.30 to $2.88 within 24 hours.

What triggered the move? Probably a combination of factors. Technical analysis shows the Parabolic SAR indicator flipped bullish days ago, signaling trend reversal. Smart traders who watch momentum indicators likely accumulated positions ahead of the breakout.

Plus, Story benefits from a relatively small market cap compared to major altcoins. That makes it easier to move aggressively on modest volume. When a few large buyers enter simultaneously, prices can spike dramatically.

Now IP approaches the critical $3.00 psychological level. Breaking above that barrier would open the path toward $3.29, the next technical resistance. Momentum indicators support further upside if buying pressure continues.

But risk is building fast. Sharp rallies attract profit-takers who bought weeks earlier at lower prices. A 25% move in one day practically begs for a correction. If early buyers start selling, IP could reverse hard toward $2.70 or even $2.50 within days.

Leverage Blew Up a Crypto Whale

While some traders celebrated gains, others faced devastating losses. Crypto whale Machi Big Brother opened a massive $34 million leveraged Ethereum long on Hyperliquid on January 12. The position immediately moved against him, generating a $325,000 unrealized loss within hours.

Things got worse from there. His account now shows $22.5 million in cumulative losses, down more than $67 million from peak equity. That’s not a typo. One trader lost $67 million from bad timing and excessive leverage.

This disaster illustrates the danger of leveraged crypto trading. Markets whipsaw violently without warning. Even experienced whales with deep pockets get wrecked when volatility spikes. Leverage amplifies losses just as aggressively as it magnifies gains.

Moreover, liquidation cascades create additional downward pressure. When large leveraged positions get liquidated, exchanges automatically sell collateral, pushing prices lower. That triggers more liquidations, accelerating the decline. This feedback loop caused the brief drop to $3.03 trillion in total market cap.

Retail traders should learn from this. Leverage seems tempting during bullish moments. But crypto markets remain fundamentally unstable. One unexpected news event or whale transaction can reverse trends instantly, wiping out leveraged positions before traders react.

Regulation Uncertainty Hangs Over Markets

The US Senate postponed a key vote on the Digital Asset Market Structure CLARITY Act, disappointing advocates who hoped for regulatory progress in early 2026. Senate Agriculture Committee Chair John Boozman delayed the bill’s markup until late January without explanation.

This matters because clear regulations would unlock institutional capital sitting on the sidelines. Banks, hedge funds, and pension funds want to allocate to crypto but face compliance uncertainty. Many institutions won’t invest without explicit legal frameworks protecting them from regulatory backlash.

The delay extends this uncertainty. Traders expected the bill to advance quickly with a Republican-controlled Senate. Now doubts are emerging about whether meaningful crypto legislation passes this year at all. Political priorities shift constantly, and crypto may not rank high enough to force action.

Still, some optimism remains justified. The crypto industry has more Congressional supporters than ever before. Several lawmakers own Bitcoin personally and understand the technology’s potential. Plus, lobbying efforts intensified dramatically over the past year, increasing industry influence in Washington.

Realistically, traders should expect continued regulatory ambiguity through 2026. That creates both opportunities and risks. Without clear rules, crypto remains volatile and unpredictable. But that same chaos allows for massive gains when sentiment shifts positive.

What Happens Next Depends on $93,000

Bitcoin’s ability to hold above $93,000 determines short-term market direction. A sustained break above this level would confirm bullish momentum, likely pulling altcoins higher simultaneously. Traders watching from the sidelines would pile in, creating the FOMO-driven rally crypto markets love.

However, rejection at $93,000 would disappoint bulls and trigger profit-taking. Bitcoin could easily drop back toward $90,000 within days if sellers regain control. The recent volatility shows conviction remains weak on both sides.

Altcoins will follow Bitcoin’s lead. If BTC rallies toward $95,000, expect Story and similar small-cap tokens to surge again. Money flows into riskier assets when Bitcoin momentum is clearly positive. Conversely, a Bitcoin decline would crush altcoin gains quickly.

The total crypto market cap needs to break above $3.12 trillion decisively to confirm a broader uptrend. Until that happens, the market is just chopping sideways in a wide range. Patience matters more than aggressive positioning right now.

Watch leverage ratios closely. High open interest in futures markets signals danger. If too many traders use leverage, any sudden move triggers liquidation cascades that amplify volatility. Current conditions suggest another violent shakeout could happen anytime.

Stay cautious. Markets that move this erratically rarely reward overconfidence.