Nearly $4 billion in Bitcoin and Ethereum options contracts expire today. Yet traders refuse to abandon their bullish bets despite brutal price drops this week.

The expiry hits Deribit at 8:00 UTC. Both assets show call-heavy positioning that signals cautious optimism. However, current prices sit dangerously below key strike levels, threatening massive losses for option holders.

Bitcoin Traders Hold Twice as Many Calls as Puts

Bitcoin traded at $86,195 at press time. That marks a sharp 7% decline over 24 hours. Still, the options market tells a different story about trader sentiment.

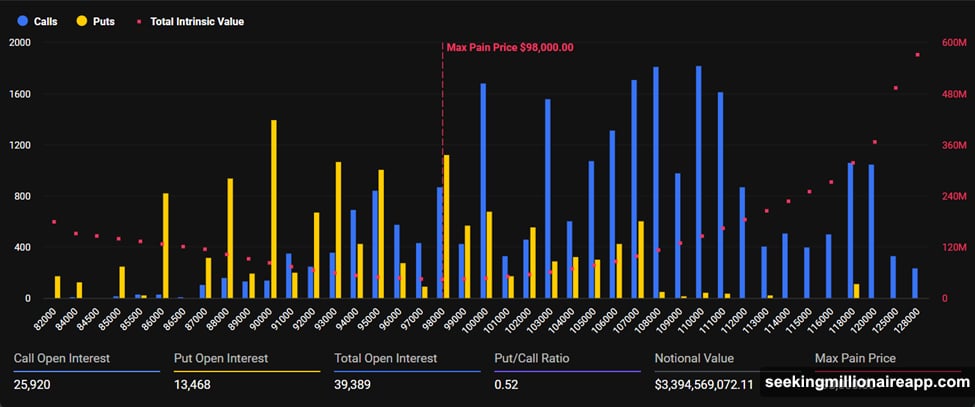

Some 39,389 BTC contracts worth $3.39 billion in notional value expire today. The positioning heavily favors calls over puts. Specifically, traders hold 25,920 call contracts against just 13,468 puts.

That creates a put-call ratio of 0.52. In other words, traders hold nearly twice as many bullish bets as bearish ones heading into expiry. This reflects persistent expectations of upside potential despite the recent selloff.

But here’s the problem. Bitcoin’s max pain price sits at $98,000, roughly 14% above current trading levels. Max pain represents the strike price where most options expire worthless, maximizing losses for holders.

The pronounced gap suggests many call holders face significant losses today. Those losses grow larger as price stays below that $98,000 strike. Plus, Bitcoin already dropped from its October 6 record high of $126,080, intensifying pressure on bullish positions.

Ethereum Shows Similar Call Bias With Focused Strike Activity

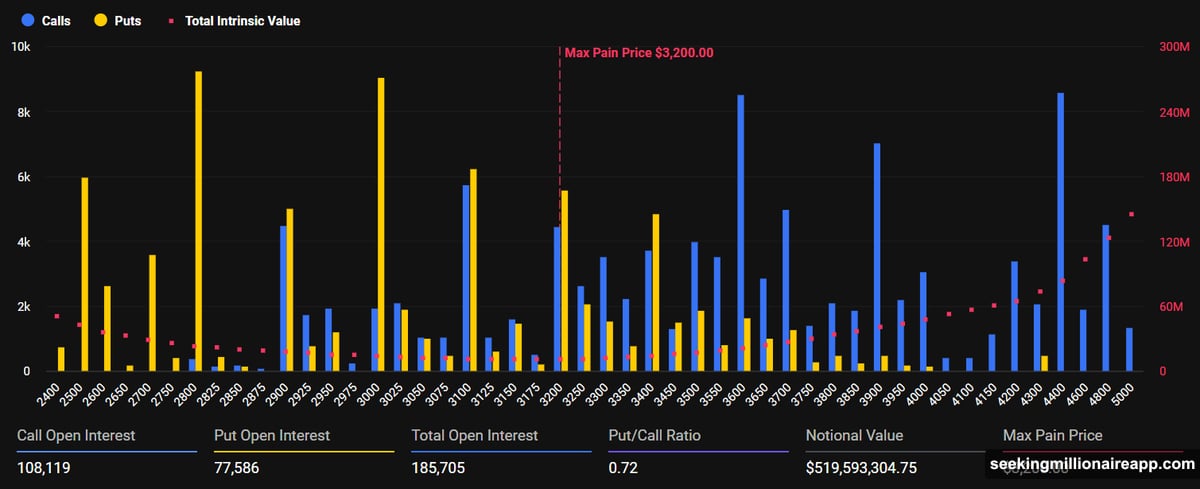

Ethereum experienced comparable pressure, trading at $2,822 after dropping nearly 7% in 24 hours. The expiry covers 185,730 ETH contracts valued at $524 million notional.

The breakdown shows 108,166 calls versus 77,564 puts. That creates a put-call ratio of 0.72, indicating less bullishness than Bitcoin but still favoring calls over puts.

Moreover, trading concentrated heavily on December 2025 expiry dates at 2,900 and 3,100 strike prices. This suggests traders expect a rebound to those levels despite current weakness.

Ethereum’s max pain price hits $3,200, approximately 13% above current trading levels. That mirrors Bitcoin’s profile, with many options likely expiring out of the money. Yet persistent call exposure shows traders maintain bullish outlooks even after steep declines.

Light Hedging Reveals Confidence Amid Market Volatility

The derivatives market structure reveals nuanced sentiment as expiry approaches. Traders maintained considerable call exposure rather than increasing protection through puts or closing positions entirely.

According to Deribit analysts, “Flows lean toward calls across the upper strikes while downside hedging remains light.” They added that positioning doesn’t signal a major risk-off move, though traders remain cautious after this week’s sharp drop.

Light downside hedging suggests many view this dip as normal correction rather than the start of a lasting bear market. However, the presence of caution indicates volatility could persist around expiry time.

For Ethereum specifically, traders leaving call exposure open through expiry demonstrates confidence. This differs from typical risk-off scenarios where participants quickly hedge or exit bullish trades when prices fall before expiry.

In fact, the combination of strong call positioning, high open interest, and light downside protection may trigger pronounced market moves today. If prices recover toward max pain levels, short-dated call buyers could see relief. But if markets drop further, additional selling pressure could arise as bullish bets face mounting losses.

Expiry Could Trigger Sharp Price Swings Either Direction

Today’s expiry matters because of the sheer size and positioning. Nearly $4 billion in contracts creates significant incentive for price manipulation near key strike levels.

Market makers and large traders often push prices toward max pain levels to maximize their profits at expiry. For Bitcoin, that means potential upward pressure toward $98,000. For Ethereum, the target sits at $3,200.

However, the recent selloff complicates that scenario. Bitcoin dropped from its October high when the Fear and Greed Index hit extreme greed levels of 93 in late 2024. That suggests some froth came out of the market already.

So two scenarios could play out. Either prices recover sharply toward max pain levels as expiry approaches, rewarding call holders. Or prices continue declining, wiping out billions in bullish bets and potentially triggering further selling pressure.

The light hedging means traders aren’t fully prepared for continued downside. That leaves the market vulnerable to cascading liquidations if prices break lower. Yet the persistent call exposure suggests many still bet on recovery.

What This Expiry Reveals About Market Psychology

The real story isn’t just about today’s price action. It’s what this expiry reveals about trader psychology after Bitcoin’s record run and subsequent correction.

Traders held onto bullish positions despite steep declines this week. That shows conviction but also potentially dangerous overconfidence. The gap between current prices and max pain levels grew wider rather than narrower as expiry approached.

Moreover, the preference for calls over puts persists even after corrections. That suggests traders still expect higher prices ahead, viewing dips as buying opportunities rather than warning signs.

However, the cautious tone from Deribit analysts highlights the tension. Positioning shows optimism, but behavior reveals uncertainty. Traders aren’t aggressively hedging downside, yet they’re not fully committing to upside either.

Upcoming sessions will determine whether this cautious optimism pays off. If prices stabilize and recover, today’s expiry could mark a turning point. But if weakness continues, billions in bullish bets evaporate, potentially triggering deeper corrections.

Watch price action closely around 8:00 UTC today. The resolution of these contracts will provide crucial signals about where Bitcoin and Ethereum head next.