Bitcoin closed November in total chaos. Fear spread everywhere. Investors who watched their portfolios bleed for weeks finally gave up and sold.

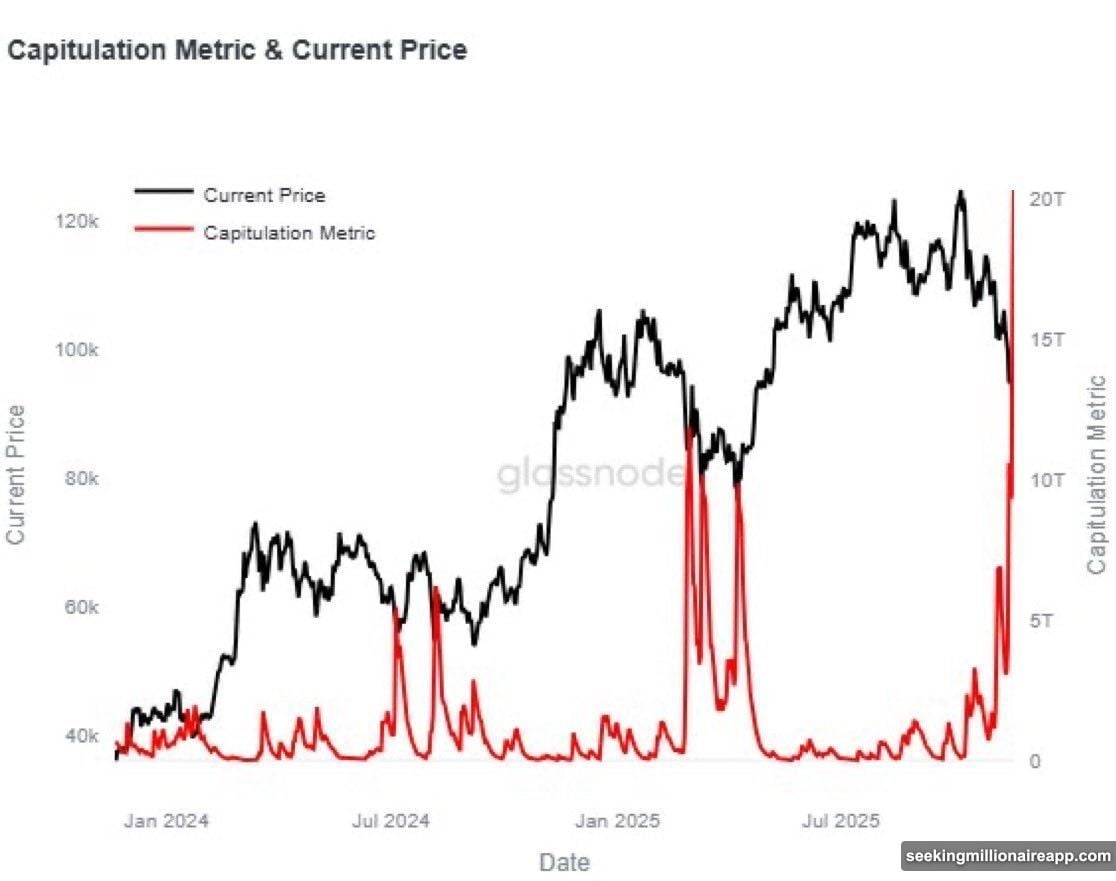

But here’s the twist. Historical data shows these moments of maximum pain often mark the perfect entry point. The Bitcoin Capitulation Metric just hit an all-time high. That matters more than most people realize.

What This Metric Actually Measures

The Capitulation Metric tracks investor suffering in real time. Developers built it using Cost Basis Distribution, which shows how many coins people bought at different prices.

When losses pile up beyond what investors can handle, they panic sell. These desperate exits create what traders call “weak hands” transferring coins to “strong hands.” That transfer marks the bottom.

Historical patterns back this up. Every time this metric spiked (shown in red on Glassnode’s chart), Bitcoin’s price formed a local bottom shortly after. It happened in Q3 2024. Then again in Q2 2025.

Now the metric reached its highest point ever. Analyst Vivek Sen put it bluntly: “Last time this happened, the price skyrocketed 50%.”

Plus, stablecoin market cap started climbing again after four straight weeks of decline. That’s significant. Stablecoins provide the market’s main buying power. Rising stablecoin supply suggests investors are positioning to buy the dip.

Why Peter Brandt Stays Cautious

Not everyone’s celebrating yet. Legendary trader Peter Brandt sees a bigger picture that tempers excitement.

The metric can’t tell you exactly when the reversal happens. Back in Q3 2024, it spiked twice before Bitcoin bottomed. In Q2 2025, it needed three separate spikes. So if this current spike cools down and surges again, Bitcoin might drop even further.

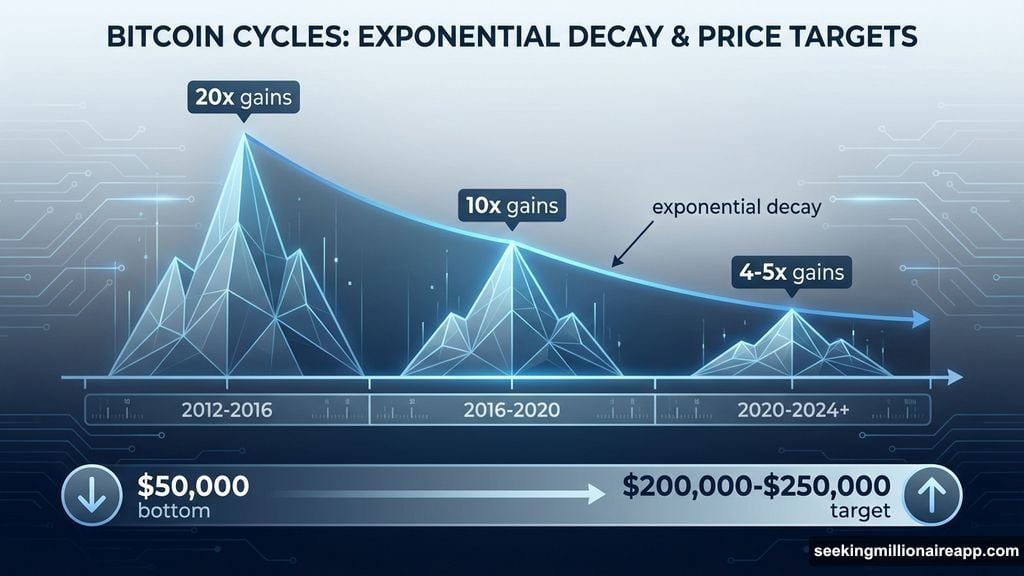

Brandt’s latest analysis projects a bottom around $50,000. From there, he expects the next bull run to push Bitcoin toward $200,000 to $250,000. But here’s the catch.

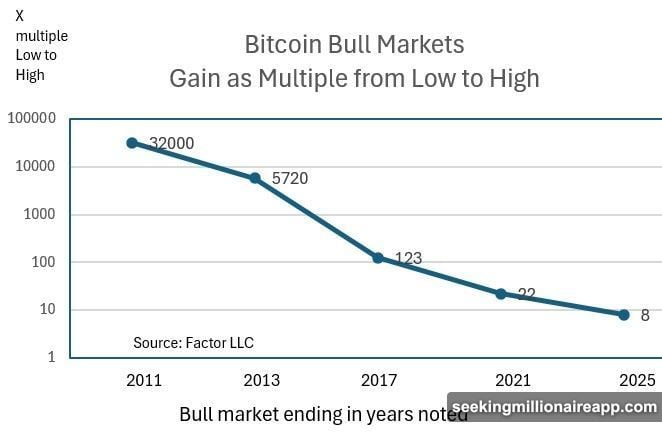

He emphasized something called “exponential decay.” Each Bitcoin cycle produces smaller percentage gains than the last. The asset is maturing. Wild 10x or 20x moves from cycle lows probably won’t happen anymore.

Instead, we’re looking at four to five times the bottom price. Still impressive. Just not the explosive gains early Bitcoin investors experienced.

Three Scenarios Playing Out

Market conditions point to three possible paths forward.

Scenario one: The capitulation spike marks the bottom right now. Bitcoin reverses within days or weeks. Strong hands accumulated enough supply. Fear transforms into greed quickly.

Scenario two: This spike represents just the first wave. The metric cools temporarily, then surges again as Bitcoin drops to $50,000 or lower. That creates the real bottom. Reversal follows the second or third spike.

Scenario three: Bitcoin stabilizes here without a strong reversal. Sideways movement dominates December. The real bull run waits until Q1 2025 when macro conditions improve.

Nobody knows which scenario unfolds. But the Capitulation Metric hitting all-time highs provides crucial context. Maximum fear usually precedes opportunity.

What Smart Money Does Now

Timing bottoms perfectly is impossible. Anyone claiming they can is lying.

Instead, focus on probability and position sizing. The data suggests we’re near a bottom, even if we can’t pinpoint the exact day. That means conservative accumulation makes sense for those with long-term conviction.

Here’s what that looks like practically. Split your intended Bitcoin allocation into three or four parts. Deploy one portion now. Save the rest for potential further drops. If Bitcoin rebounds quickly, you caught some of the bottom. If it drops more, you have powder dry.

Also, watch stablecoin flows closely. Rising stablecoin market cap provides early warning that buyers are preparing to enter. When that capital actually deploys into Bitcoin, the reversal confirms.

Remember Brandt’s point about exponential decay. This cycle won’t mirror 2017 or 2021. Expect more modest gains relative to the bottom. But “modest” in Bitcoin terms still means potentially 4-5x returns from here.

The capitulation is real. The fear is maximum. That’s exactly when opportunity shows up wearing a disguise nobody recognizes until later.

December just got interesting.