The broader crypto market has been in freefall since last September. Nearly $2 trillion has left the space. And yet Bitcoin Cash is quietly setting all-time records.

That’s not the story most people expected. But the data tells a compelling tale, and large investors appear to be paying close attention.

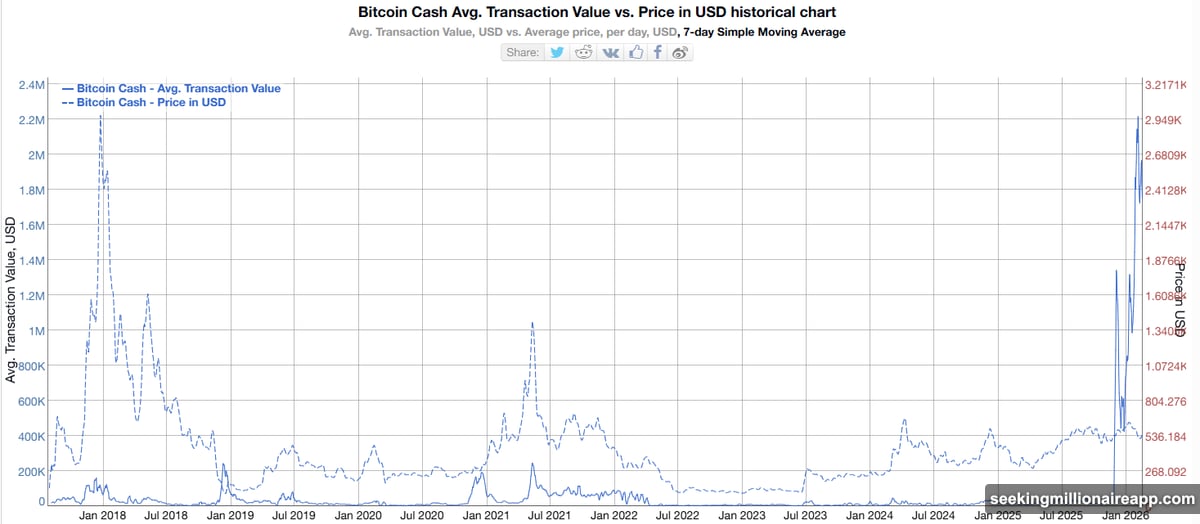

BCH Average Transaction Value Hits $2 Million All-Time High

Here’s the headline number that caught everyone’s attention. The average transaction value on the Bitcoin Cash network just surpassed $2 million. That’s a new all-time high since BCH forked from Bitcoin back in 2017.

For context, that figure hovered around $20,000 just last year. So we’re looking at a 100-fold increase in roughly twelve months. That’s not a rounding error. That’s a meaningful shift in how large players are moving money through the network.

Historical patterns make this even more interesting. According to data from Bitinfocharts, previous spikes in average transaction value have tended to precede major price rallies. We saw similar patterns play out in 2018 and again in 2021. Whether history repeats isn’t guaranteed, but the signal is hard to ignore.

The most likely explanation? Large investors, often called whales, are returning to Bitcoin Cash in significant numbers. When the average transaction value jumps this dramatically, it typically reflects institutional or high-net-worth activity rather than retail volume.

BCH Market Dominance Quietly Climbs While Competitors Shrink

The transaction value record isn’t the only milestone worth noting. Bitcoin Cash Dominance (BCH.D), which measures BCH’s share of the total cryptocurrency market cap, has been steadily rising since last September.

According to TradingView data, BCH.D climbed from 0.25% to 0.48% during the same period that nearly $2 trillion exited the broader market. That puts BCH.D at its highest level since April 2024.

Think about what that means practically. While other assets were losing ground and investors were heading for the exits, BCH holders largely stayed put. That kind of conviction during a prolonged downturn is unusual and worth noting.

The result? BCH has maintained a price level around $560 for several consecutive months. Not explosive growth, but remarkable stability when the rest of the market has been posting painful losses.

The Layla Upgrade Is Driving Accumulation

So why are holders sticking around? The upcoming Layla upgrade appears to be a major factor.

Scheduled for activation in May 2026, the Layla upgrade is considered one of the most significant updates to the Bitcoin Cash network since its original fork from Bitcoin. BCH developer Jason Dreyzehner has outlined three core improvements the upgrade brings to the table.

First, enhanced token utility, making BCH more functional as a platform for digital assets. Second, improved resistance to quantum computing threats, a growing concern across the entire crypto industry. Third, strengthened privacy features, bringing BCH closer to competing with dedicated privacy coins.

That last point is generating real buzz. Crypto investor Hexdrunker summed up the community conversation well: “CT starts shilling BCH. Triggers are simple, but will it work out as with ZEC, XMR, and other privacy?”

It’s a fair question. Privacy-focused cryptocurrencies like Monero (XMR) and Zcash (ZEC) have historically attracted dedicated communities and periodic price surges when attention focuses on financial privacy. If BCH can capture some of that narrative with the Layla upgrade, the timing could be favorable.

What the Price Outlook Looks Like

Based on current momentum and Layla upgrade expectations, a recent BeInCrypto analysis suggests BCH could push toward $650 in the near term. That would represent roughly a 16% gain from current levels around $560.

That’s not an outrageous target given the record-setting network activity. But it’s worth keeping perspective here. The broader crypto market is still deeply uncertain. Capital continues leaving the space. And price predictions in crypto carry obvious risks.

What makes this situation genuinely interesting isn’t just the price target. It’s the combination of factors converging at once. Record transaction values suggesting whale accumulation. Rising market dominance despite industry-wide outflows. A significant technical upgrade on the near-term horizon. And a growing privacy narrative that could attract a new category of investor.

Each factor alone would be mildly interesting. Together, they paint a picture of an asset that’s quietly building momentum while nobody’s paying full attention.

Whether BCH can convert these signals into a sustained price breakout remains to be seen. But if you’re watching the crypto market and wondering where pockets of genuine strength exist right now, Bitcoin Cash has made a compelling case to be on your radar.