Bitcoin is barely hanging on. The price sits at $111,000 after a brutal weekend that wiped half a trillion dollars from the total crypto market.

That’s not a typo. Half a trillion, gone. BTC crashed from $121,000 to $110,000 in just days. Now traders are asking whether this is a brief pause or the start of something worse.

Let’s look at what the data actually tells us.

Altcoins Got Crushed Even Harder

While Bitcoin lost around 9%, some altcoins faced complete destruction. Plasma (XPL) dropped 58% in a week. That’s more than half its value, evaporated.

Meanwhile, other tokens didn’t fare much better. FET, OP, and ETHFI each shed over 35% in the same period. So if you thought Bitcoin’s decline hurt, altcoin holders are nursing much deeper wounds.

The pattern is familiar. When Bitcoin sneezes, altcoins catch pneumonia. This time proved no exception to that brutal rule.

Derivatives Market Sends Confusing Messages

Futures traders appear cautiously neutral right now. Open interest holds steady at $25.5 billion, showing no panic selling or aggressive positioning. Plus, the 3-month annualized basis sits in a modest 5-6% range.

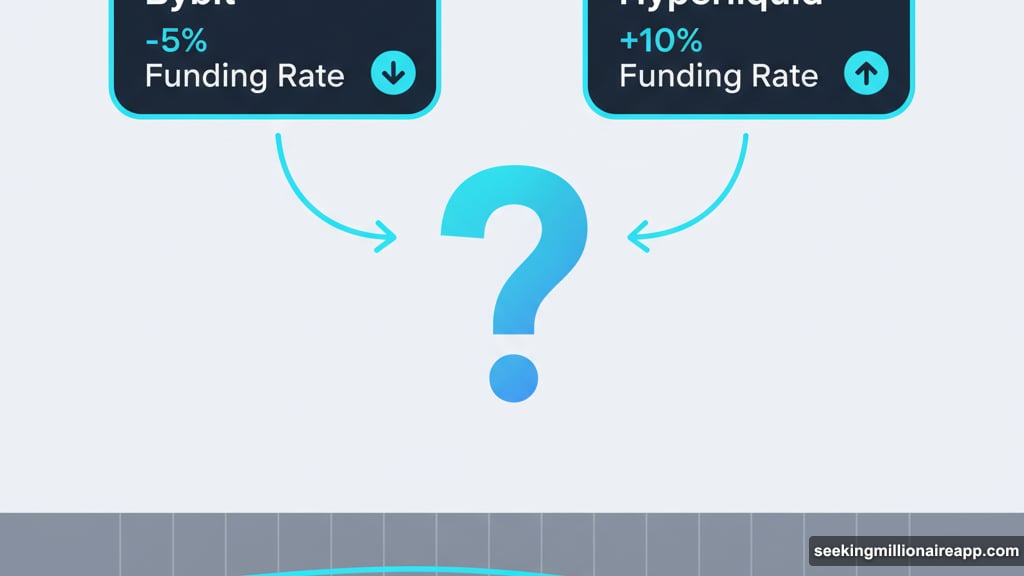

But here’s where things get weird. Funding rates tell completely different stories depending on the exchange. Bybit shows -5% funding, meaning shorts are paying longs. Yet Hyperliquid displays +10% funding, indicating the opposite.

So what does this mean? Traders are deeply divided. Some platforms show strong bearish conviction. Others reveal bullish positioning. Nobody seems to agree on what comes next.

Options Traders Bet Big on Recovery

The options market paints a surprisingly optimistic picture. The 1-week 25 Delta Skew jumped to 12.62%, a massive number. That means call options cost way more than puts relative to their strike distances.

Translation? Traders are paying hefty premiums for the right to buy Bitcoin higher. They’re betting on a rebound, not a continued crash. And they’re willing to pay extra for that exposure.

Meanwhile, the Put/Call Volume ratio now sits at 50-50, balanced between bullish and bearish trades. Earlier, calls dominated. Now the market looks more uncertain, but still tilted toward cautious optimism based on pricing.

Liquidations Hit $627 Million in 24 Hours

Coinglass data shows carnage across the board. Over $600 million in positions got liquidated, with longs taking 70% of the damage. That’s $438 million worth of bullish bets completely wiped out.

ETH led the bloodbath with $185 million in liquidations. Bitcoin followed with $125 million. Other altcoins contributed another $69 million to the total.

The Binance liquidation heatmap highlights $110,600 as a critical level. If Bitcoin breaks below that price, another cascade of forced selling could trigger. So that’s the line in the sand traders are watching obsessively.

Plasma Continues Its Painful Slide

Remember when Plasma (XPL) launched at $0.05 per token? Early ICO buyers who sold at today’s $0.41 price made 8x returns. Good for them.

But anyone who bought after exchange listings is drowning. The token fell another 13.5% on Tuesday alone, extending its post-debut losses to 52%. And the pain probably isn’t over.

Why? Tokenomics look terrible. Only 1.8 billion tokens circulate now against a 10 billion total supply. That means years of potential sell pressure as vested tokens unlock. In fact, a major unlock hits in Q2 2026, which could flood the market with fresh supply.

So unless the project delivers exceptional growth, gravity keeps pulling the price down. ICOdrops data confirms this concern, and analysts expect continued weakness.

What This All Means

Bitcoin holding $110,000 matters enormously right now. That level represents critical support. Break below it, and we could see another leg down toward $100,000 or worse.

But the mixed signals from derivatives markets make predicting the next move nearly impossible. Futures traders look cautious. Options traders bet on recovery. Funding rates split between exchanges. Nobody has a clear edge.

Meanwhile, altcoins face even worse prospects. The 35-58% losses across major tokens show how fragile sentiment has become. One more Bitcoin drop could trigger another altcoin massacre.

For now, all eyes stay glued to that $110,600 liquidation level. If it holds, we might see stability return. If it breaks, buckle up for more pain.

The crypto market always rewards patience and punishes panic. But lately, it’s been punishing everyone pretty equally.