The crypto market just hemorrhaged $115 billion in 24 hours. Bitcoin’s plunge toward $72,900 triggered the kind of cascade that wipes out overleveraged traders in minutes.

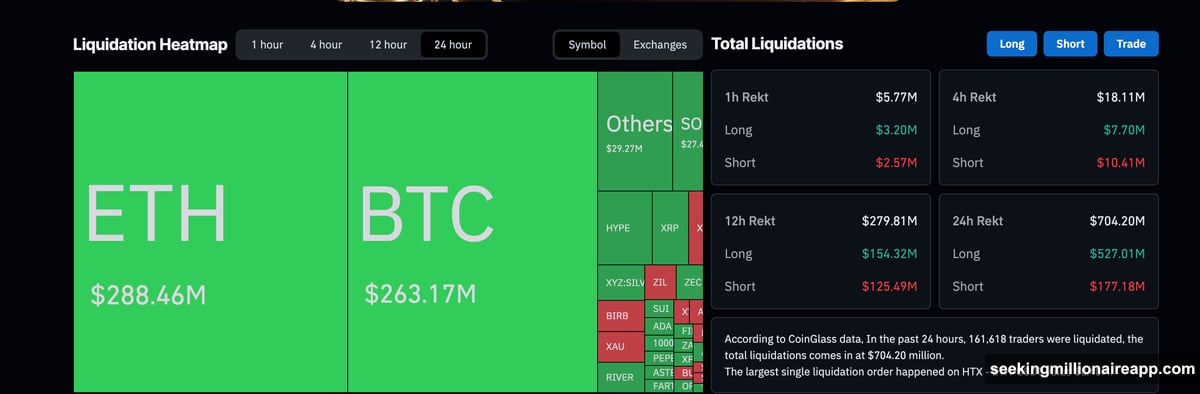

This wasn’t a gentle correction. Over $704 million in leveraged positions got liquidated as stop-losses fired and margin calls forced closures. Bitcoin and Ethereum bore the brunt, but even tokens that rallied hard recently couldn’t escape the sell-off.

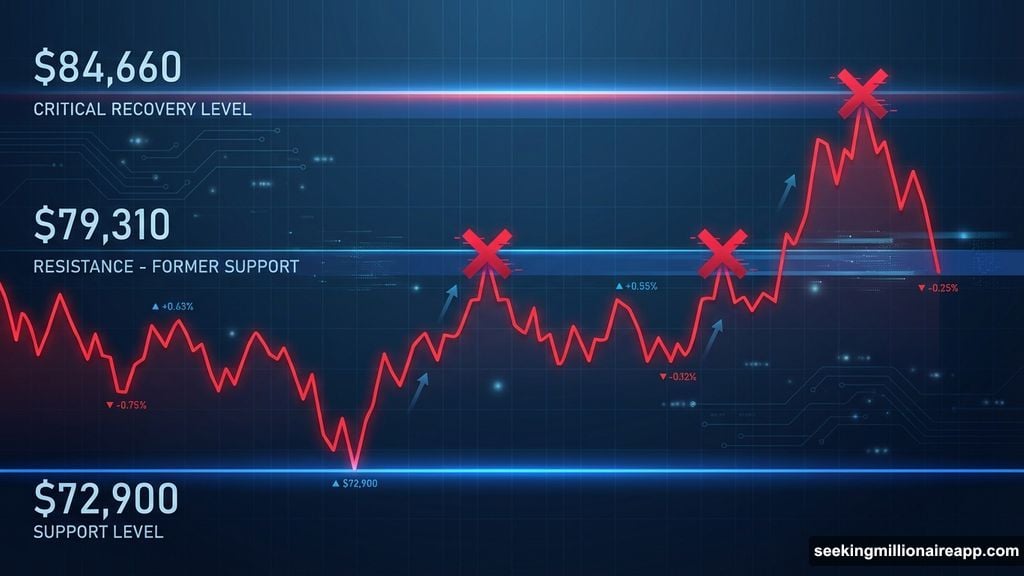

Now traders are watching critical levels. Bitcoin needs to reclaim $84,660 to signal real recovery. Below that, the market stays fragile.

Liquidation Tsunami Wipes Out Leveraged Longs

The total crypto market cap crashed from $2.56 trillion to $2.45 trillion before bouncing modestly. That $115 billion evaporated fast once Bitcoin broke below $73,000.

Traditional markets triggered the initial weakness. But leverage amplified everything. Forced liquidations turned a dip into a rout.

Over $704 million in positions got closed out. Long traders took brutal losses as Bitcoin and Ethereum led the carnage. Thin liquidity made it worse. Each liquidation fed into the next, creating a self-reinforcing spiral downward.

The market briefly stabilized near $2.45 trillion. However, that bounce looks driven by short-covering rather than fresh buying. Real demand hasn’t returned yet.

Key Resistance Levels Block Recovery Path

The crypto market now faces major technical hurdles. First barrier sits at $2.66 trillion. Beyond that, $2.82 trillion represents stronger resistance.

The psychological $3 trillion level remains distant. Until the market reclaims that zone, confidence stays shaken. Moreover, leverage needs to cool significantly before sustained upside becomes possible.

Risk-off sentiment dominates right now. Macro uncertainty keeps buyers cautious. So the market remains vulnerable to another wave of selling if Bitcoin fails to hold current levels.

Bitcoin Can’t Find Footing Above $79,300

Bitcoin’s drop toward $72,900 marked its worst level in months. That move alone triggered over $260 million in long liquidations.

Traders using leverage got crushed. Stop-losses activated across the board. Then margin calls forced additional selling, which pushed prices even lower in already thin markets.

Right now, Bitcoin trades near $76,660 after recovering from the worst levels. But the bounce feels fragile. Technical structure hasn’t healed yet.

The first resistance appears at $79,310. That level previously offered support. Now it’s turned into a supply zone where sellers are waiting.

Recovery Requires Breaking $84,660 Barrier

A real recovery demands Bitcoin reclaim $84,660. That marks the critical structural level. Until price moves decisively above it, upside momentum stays limited.

Multiple rebound attempts already failed there. Each rejection reinforced that zone as major resistance. So bulls need volume and conviction to break through.

On the downside, $72,900 remains crucial support. A clean breakdown below that level would reopen serious downside risk. More liquidations would follow. Bitcoin could spiral lower in another forced selling wave.

For now, the path of least resistance points to continued chop between $72,900 and $84,660. Traders are waiting for a decisive break in either direction.

HYPE Crashes 11% After 87% Rally Fades

Hyperliquid dropped nearly 12% in 24 hours despite strong monthly gains. The token still sits about 25% higher over the past month. But yesterday’s weakness stood out.

This follows an explosive 87% rally between January 21 and February 3. After such a sharp move, consolidation makes sense. Short-term traders are locking profits. Momentum is resetting.

Technical indicators don’t show structural breakdown yet. Between January 28 and February 4, price drifted lower while the Relative Strength Index moved in sync. That suggests controlled profit-taking rather than panic distribution.

Still, HYPE needs to defend the $32 level. A slip toward $28 would still qualify as healthy consolidation. But a sustained break below $28 exposes $23 support and shifts sentiment bearish.

Technical Outlook Hinges on $34 Reclaim

On the upside, reclaiming $34 would signal renewed strength. That move could restart momentum once consolidation finishes.

The RSI remains aligned with price action. So there’s no bearish divergence suggesting deeper trouble ahead. As long as that holds, the correction looks like a pause, not a reversal.

However, traders should watch volume closely. Low volume bounces often fail. Real recovery needs conviction and fresh buying pressure.

For now, HYPE sits in a consolidation zone. The next major move likely comes after Bitcoin establishes clear direction. Until then, expect choppy price action between support and resistance levels.

Macro Pressure Keeps Markets on Edge

Rising leverage stress combined with macro uncertainty is keeping the crypto market cautious. Traditional assets pulled back, triggering risk-off flows across markets.

Institutional players are reducing exposure. Retail traders are getting wiped out by liquidations. Smart money appears to be positioning for further downside, with one top trader opening $71 million in leveraged shorts on Ethereum and Solana.

That kind of positioning signals expectation of more weakness ahead. Plus, with leverage still elevated despite recent liquidations, the market remains vulnerable to additional cascades.

Until spot demand returns and risk appetite improves, the crypto market will struggle to sustain rallies. Recovery requires more than just short-covering bounces. It needs real buyers willing to step in at these levels.

The coming days will determine whether this was just a shakeout or the start of something worse.