Bitcoin just fell below $80,000 for the first time since April 2025. But here’s the twist nobody expected: new investors piled in while the price dropped.

Most people panic when major assets fall. Yet Bitcoin buyers did the opposite. They treated the dip like a clearance sale. Meanwhile, gold got hammered even harder, losing nearly 10% in two days. BTC only dropped 5.6% during the same period.

That performance gap tells a story about where smart money is moving during market stress.

Gold Crashed Harder Than Bitcoin

Traditional safe haven assets took a beating this week. Gold, the classic inflation hedge, plunged almost 10% between Thursday and Friday. Bitcoin fell too, but only about 5.6%.

Think about that for a second. The asset everyone calls “digital gold” actually held up better than real gold. This wasn’t just a one-day fluke either. The pattern held across multiple trading sessions.

So why does this matter? It signals a fundamental shift in how investors view risk. When markets get shaky, capital is flowing toward Bitcoin instead of traditional stores of value. That’s a massive change from even two years ago.

Plus, the smaller drawdown suggests Bitcoin has stronger underlying demand. While gold sellers rushed for exits, BTC buyers saw an opportunity. That buying pressure cushioned the fall and prevented deeper losses.

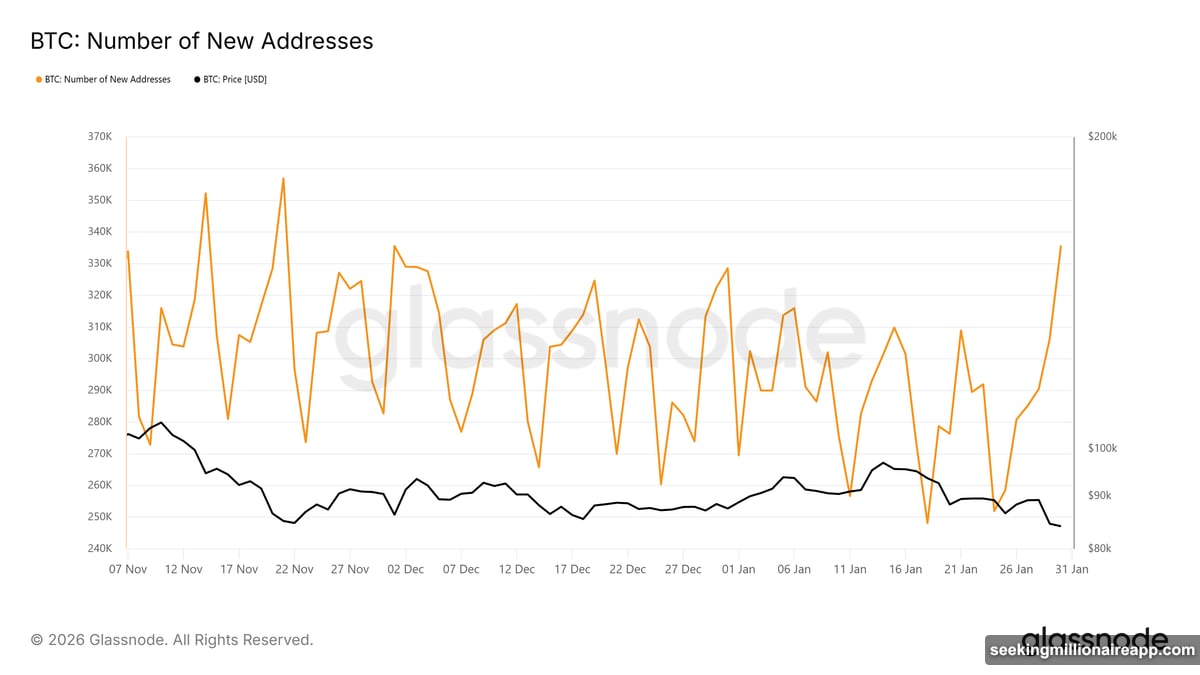

New Addresses Exploded During the Dip

Network data reveals what really happened during the selloff. Bitcoin added roughly 335,772 new addresses in just 24 hours. That’s the highest daily increase since November 2025, a full two-month high.

The timing matters here. These addresses appeared right as Bitcoin dropped toward $81,000. New participants clearly viewed falling prices as their chance to enter the market at better levels.

Fresh address growth typically signals expanding adoption. More wallets mean more people holding Bitcoin for the first time. These new entrants often become long-term holders, which strengthens price support over time.

Moreover, this spike happened during negative price action. Usually, retail investors flee when prices fall. Instead, these buyers jumped in. That contrarian behavior suggests growing confidence in Bitcoin’s long-term value proposition.

The influx also indicates market maturity. Seasoned investors recognize dips as buying opportunities rather than reasons to panic. This mindset shift could help stabilize Bitcoin during future corrections.

Technical Picture Shows Downside Risk

Bitcoin is currently trading around $78,000 at press time. But the chart setup looks concerning for bulls hoping for quick recovery.

Recently, BTC broke down from a broadening ascending wedge pattern. This bearish formation typically projects significant declines. In this case, technical analysts are eyeing $75,850 as the next major support level, roughly 12.6% below recent highs.

The selloff accelerated after Bitcoin lost the $82,503 support zone. That breakdown confirmed short-term bearish momentum took control. However, reclaiming this level could flip sentiment back in favor of buyers.

Still, there’s a path to recovery. Improving on-chain metrics and rising address growth increase chances of stabilization around current levels. If buying pressure continues from new entrants, Bitcoin might find footing before reaching lower targets.

For a stronger bounce, BTC needs to reclaim $87,210 as support. Achieving this would signal renewed buyer confidence and help recover recent losses. Bulls would then have breathing room to push toward previous highs.

But if the downtrend continues, risk remains significant. Failure to hold current levels sends Bitcoin toward $78,763 next. Losing that support opens the door to $75,895, which would invalidate the bullish outlook entirely.

Why This Dip Feels Different

Here’s what separates this correction from past crashes. Network fundamentals are improving even as price falls. That’s unusual and potentially bullish for medium-term outlook.

Traditional bear markets see both price and network activity decline together. Users leave, addresses shrink, and transaction volume dries up. None of that is happening now.

Instead, Bitcoin is adding users while bleeding value. This disconnect suggests the market is digesting gains rather than entering sustained decline. Healthy corrections shake out weak hands while stronger buyers accumulate.

The behavior also reflects growing institutional interest. Large players often buy during volatility when retail investors panic. That dynamic creates these counterintuitive situations where fundamentals strengthen during price weakness.

Plus, Bitcoin’s outperformance versus gold matters more than the nominal price drop. Relative strength indicates where capital wants to be deployed. Right now, it’s choosing Bitcoin over traditional safe havens.

That preference shift won’t reverse overnight. Even if BTC falls further short-term, the underlying trend favors digital assets over legacy stores of value. These structural changes take years to play out fully.

So don’t let the $80,000 break fool you. The real story is happening beneath the surface. New buyers are entering. Network activity is growing. And Bitcoin is proving more resilient than gold during market stress.

Those factors matter more than any single day’s price action.