Bitcoin just barely avoided a brutal breakdown this week. The price bounced back to $103,700 after briefly touching $98,900. That 2.1% recovery in 24 hours helped stabilize things. But don’t celebrate yet.

The market needs another 12% climb from here to actually confirm a real recovery. Until Bitcoin reclaims $116,500, this bounce remains fragile and vulnerable to another leg down.

Technical Signals Flash Warning Despite Bounce

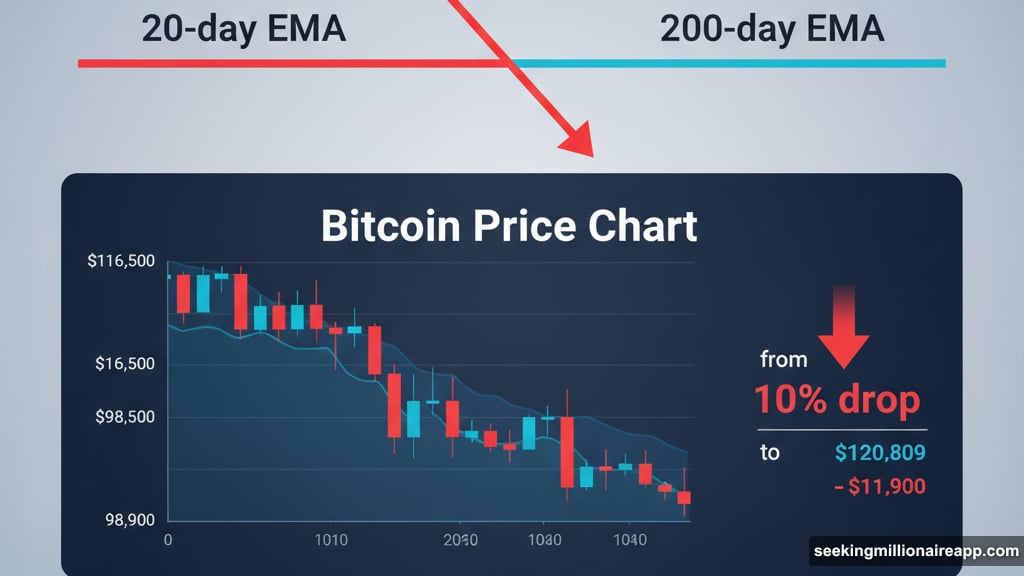

Two key indicators show why traders should stay cautious. First, the moving averages are setting up for trouble.

The 20-day Exponential Moving Average (EMA) is about to cross below the 200-day EMA. EMAs track price trends by smoothing out daily noise. When a shorter timeframe crosses under a longer one, it signals weakening buyer momentum. Plus, a similar crossover on November 4 already triggered a sharp 10% drop.

Meanwhile, the Chaikin Money Flow (CMF) indicator tells an equally concerning story. CMF measures whether money is flowing into or out of Bitcoin. Since late October, it’s stayed negative and trapped below a downtrend line from October 4.

That negative reading means large wallet holders are still sitting on the sidelines. Real institutional money hasn’t returned yet. So even though price bounced, the underlying capital flows remain weak.

Long-Term Holders Keep Selling Into Strength

Here’s the most troubling part. Even during Bitcoin’s recovery, long-term holders didn’t start buying again.

The Hodler Net Position Change tracks whether older wallets are accumulating or distributing their Bitcoin. Between November 2 and November 5, this metric dropped from –43,810 BTC to –52,250 BTC. That’s an additional 8,400 BTC sold in just three days.

Think about that. While Bitcoin bounced 2%, the smartest money in crypto sold another $870 million worth of coins. These holders typically represent the most informed participants. So their continued selling signals low conviction in this recovery.

Historically, meaningful Bitcoin rallies only stick when long-term holders start accumulating. Their ongoing distribution suggests this bounce might just be short-term traders taking profits rather than a true trend reversal.

What Comes Next for Bitcoin Price

Bitcoin faces a critical test ahead. The price must hold above $103,000 and reclaim $105,600 in the near term. But the real confirmation level sits at $116,500, which represents that crucial 12% gain from current prices.

A break above $116,500 would invalidate the bearish head and shoulders pattern forming on the charts. That would finally shift the structure from cautious to confident. But until then, Bitcoin remains stuck in no man’s land.

On the downside, failure to hold $103,000 would be problematic. A daily close below $98,900 would trigger a neckline breakdown. And that could send Bitcoin tumbling toward $83,100, the pattern’s projected downside target.

The Market Remains Fragile Despite Bounce

Bitcoin avoided disaster this week. The quick recovery from $98,900 prevented a deeper crash. But calling this safe would be premature.

The combination of negative money flow, weak holder activity, and pending bearish crossovers suggests this rebound lacks real support. Most of the buying appears to be short-term speculation rather than long-term accumulation.

So while Bitcoin escaped a breakdown, it’s far from being in the clear. The market needs to see two things before confirming a real recovery. First, large wallets need to start buying again, which would flip the CMF positive. Second, the price needs to gain that 12% and reclaim $116,500.

Until both happen, Bitcoin remains vulnerable to another leg down. The bounce bought some time. But it didn’t fix the underlying weakness that’s kept the market under pressure since late October.

Post Title: Bitcoin Needs 12% Rally to Confirm Recovery After Bounce

Meta Description: [Bitcoin](https://bitcoin.org) just barely avoided a brutal breakdown this week. The price bounced back to $103,700 after briefly touching $98,900. That 2.1% recovery in 24 hours