Bitcoin looked unstoppable three weeks ago. Standard Chartered predicted $135,000 by year-end. Crypto Twitter buzzed with moon talk.

Then October 10 happened. Markets crashed. Trade war fears exploded. And that rally? Dead in the water.

Now Geoffrey Kendrick, Standard Chartered’s head of digital asset research, just flipped his script. He’s calling for Bitcoin to fall below $100,000 soon. But here’s the twist—he thinks that dip could be your last chance to ever buy BTC at six figures.

What Changed Since October 6

Bitcoin hit $126,000 on October 6. That matched Kendrick’s near-term target perfectly. Then U.S.-China trade tensions erupted four days later.

The selloff crushed momentum across all risk assets. Bitcoin tumbled alongside stocks, gold, and pretty much everything else. And unlike previous dips, this bounce stayed weak.

So Kendrick revised his outlook. The $135,000 target? Still valid. Just not happening right now. Instead, he sees BTC dropping below $100,000 first before the next major leg up.

Three Signals That Could Mark the Bottom

Kendrick isn’t just guessing. He’s watching specific indicators that could signal when Bitcoin finds support.

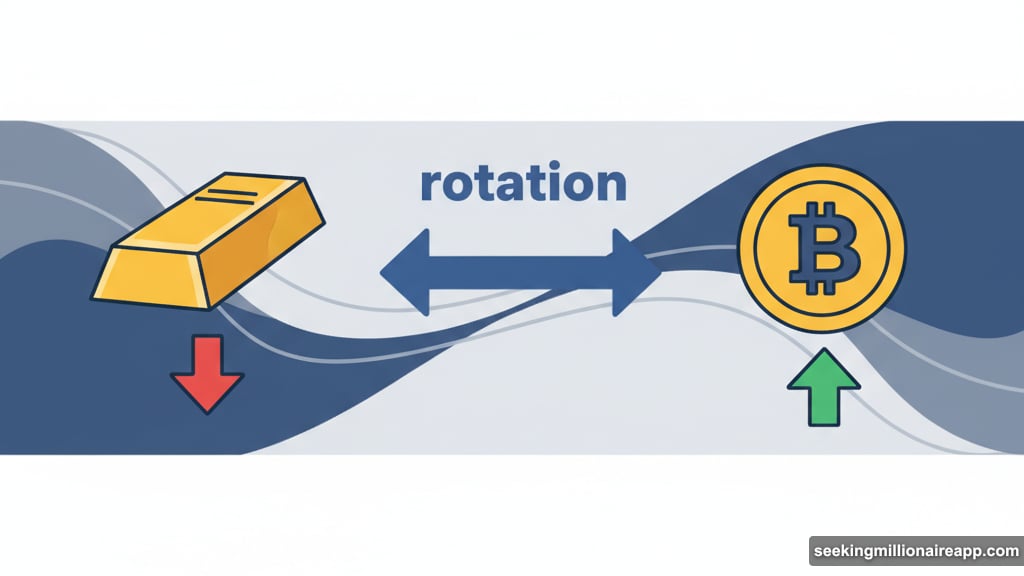

First, gold-to-bitcoin flows matter. This week gold sold off sharply while Bitcoin bounced intraday. That rotation suggests investors might be shifting from safe-haven gold back into crypto. More evidence of this pattern would confirm a bottom is forming.

Second, Federal Reserve liquidity measures are tightening. Multiple indicators show the Fed’s quantitative tightening continues to drain market liquidity. If the Fed pivots or pauses, that could provide the macro catalyst Bitcoin needs to rally again.

Third, technical support holds at the 50-week moving average. Since early 2023, Bitcoin consistently stayed above this level. Back then BTC traded around $25,000. Breaking below would be concerning. Holding above signals underlying strength remains intact.

Why This Dip Could Be Different

Kendrick doesn’t consider himself a technical analyst. But he sees this potential drop below $100,000 as fundamentally different from past corrections.

For one, Bitcoin’s adoption continues to accelerate. Institutional flows through ETFs haven’t stopped despite the recent weakness. Plus, macro conditions that drove BTC from $25,000 to $126,000 haven’t fundamentally changed.

Trade tensions create short-term volatility. Yet they don’t erase Bitcoin’s appeal as a non-sovereign asset uncorrelated to traditional finance. In fact, geopolitical uncertainty often strengthens the long-term case for crypto.

Moreover, Kendrick maintains his year-end price target of $200,000. That suggests he views any drop to $99,000 or below as temporary noise, not a trend reversal.

The Reality Check Nobody Wants to Hear

Markets don’t care about your targets or timelines. Kendrick nailed the $126,000 top but missed how fast sentiment could flip.

Three weeks ago, $135,000 looked “imminent.” Today, sub-$100,000 appears “inevitable.” That whiplash reflects how quickly macro conditions can override technical setups.

Trade wars are unpredictable. Fed policy remains uncertain. And Bitcoin’s volatility hasn’t disappeared just because institutions joined the party. These factors make precise timing nearly impossible.

Still, Kendrick’s core thesis holds weight. If you believe Bitcoin eventually reaches $200,000 or higher, then $99,000 represents a significant discount. Whether it happens next week or next month matters less than the broader trajectory.

Should You Buy the Dip?

That depends entirely on your risk tolerance and time horizon. Short-term traders might wait for clearer confirmation signals before entering. Long-term holders could view sub-$100,000 as an opportunity.

Remember that Kendrick called this the “last-ever chance” to buy BTC at six figures. Bold claim. Also impossible to verify until years from now.

What we know for sure: Bitcoin volatility remains high. Macro uncertainty persists. And predictions—even from major banks—shift quickly when conditions change.

So if you do buy the dip, make sure you can handle further downside. Because “inevitable” doesn’t mean “immediate,” and markets can stay irrational longer than you can stay solvent.

The next few weeks will reveal whether Kendrick’s revised outlook proves accurate. Until then, watch those three indicators and prepare for continued choppiness.