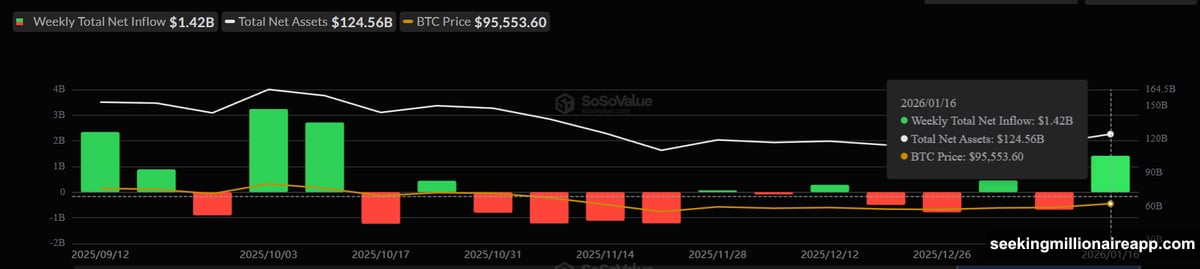

Bitcoin ETFs just absorbed $1.42 billion in fresh capital. That’s the biggest weekly haul in three months.

The timing feels off. Markets look shaky. Prices hover near support. Yet institutional money keeps flowing in. Something shifted beneath the surface that most traders missed.

Let’s unpack what this surge means and why it matters right now.

Record Inflows Hit During Market Uncertainty

Spot Bitcoin ETFs pulled $1.42 billion this week. That matches the strongest demand since October 2025, when flows reached $2.71 billion.

Here’s what makes it significant. This cash arrived while Bitcoin traded sideways near $95,000. No explosive rally. No breakthrough headlines. Just steady accumulation during a consolidation phase.

ETF flows reveal institutional positioning. Unlike retail traders chasing pumps, institutions build positions gradually. They buy during quiet periods when prices stabilize. This pattern suggests sophisticated investors expect higher prices ahead, even if timing remains uncertain.

Moreover, the inflows contrast sharply with cautious retail sentiment. Individual traders often wait for confirmation before jumping in. Institutions do the opposite. They accumulate before moves materialize.

Pi Cycle Indicator Shows Market Isn’t Overheated

Technical signals back up the bullish case. The Pi Cycle Top Indicator currently shows divergence, meaning Bitcoin markets aren’t overextended.

This tool compares two moving averages. Specifically, it tracks the 111-day simple moving average against the 2×365-day moving average. When these lines converge, markets typically peak. When they diverge, conditions remain healthy.

Right now, these averages are moving further apart. That separation historically aligns with early-to-mid bull market phases. In fact, similar setups preceded major rallies in past cycles.

So what does this mean practically? Markets have room to run. Bitcoin can rally without immediately hitting overbought conditions. That’s rare during strong uptrends and suggests sustainable momentum rather than speculative froth.

Bitcoin Holds Critical $95K Support Level

Bitcoin trades near $95,173 at the time of writing. That price sits just above crucial support at $95,000.

This level has held through multiple tests recently. Each time sellers pushed BTC down, buyers stepped in. That repeated defense signals strong demand around current prices.

Plus, the 200-day exponential moving average hovers near $95,986. Reclaiming that level would flip technical momentum back to bullish. It would also clear the path toward $98,000.

Breaking $98,000 opens the door to $100,000. That psychological threshold matters. Round numbers attract attention and often trigger breakouts as traders position for the next leg up.

What Could Push BTC Higher From Here

Three factors could drive Bitcoin toward $100,000 in coming weeks.

First, sustained ETF demand provides steady buying pressure. Institutions don’t chase pumps. They accumulate gradually. If $1.4 billion weekly inflows continue, that adds significant bid support.

Second, technical conditions remain constructive. The Pi Cycle divergence means markets aren’t overheated. Bitcoin can rally without immediately hitting resistance from overbought readings.

Third, current consolidation builds energy for the next move. Sideways trading between $95,000 and $98,000 compresses volatility. That compression often precedes sharp directional moves. Given the ETF flows and technical setup, the bias leans upward.

However, nothing guarantees smooth sailing. Markets can shift quickly based on macro developments or sentiment changes.

The Risk Nobody’s Talking About

What breaks the bullish case? Simple. ETF outflows.

If institutions reverse course and start pulling capital, the setup falls apart. Bitcoin would likely lose $95,000 support under that scenario. A breakdown there exposes $93,471 as the next level.

But here’s the thing. ETF flows don’t reverse randomly. They reflect institutional positioning based on longer-term views. Current inflows suggest those views remain constructive despite near-term uncertainty.

Still, watch the data. Weekly flow reports provide early warning if sentiment shifts. Sustained outflows would signal institutions are reducing exposure, which would weaken the bullish thesis significantly.

Institutions Are Positioning, Not Speculating

The $1.42 billion inflow tells a story beyond simple dollar amounts. It reveals positioning strategy.

Retail traders often buy after prices rally. They need confirmation before committing capital. Institutions do the opposite. They accumulate during quiet consolidation when prices stabilize.

That’s what’s happening now. Bitcoin hovers near $95,000 without dramatic moves. Yet institutions keep buying. This behavior suggests they expect appreciation but aren’t willing to chase higher prices. Instead, they build positions patiently.

Moreover, ETF flows indicate conviction. Allocating over a billion dollars weekly requires genuine belief in the asset’s prospects. That level of commitment doesn’t happen on short-term speculation. It reflects calculated positioning for expected future returns.

So while retail sentiment remains mixed, institutions are voting with capital. Their accumulation during this consolidation phase could fuel the next rally once momentum returns.

The setup looks constructive. ETF demand stays strong. Technical indicators show healthy market conditions. Support holds firm. If these factors persist, Bitcoin’s path toward $100,000 remains viable despite current uncertainty.