Mainstream Bitcoin buyers are underwater. The very investors expected to stabilize the market now face mounting losses with no rescue in sight.

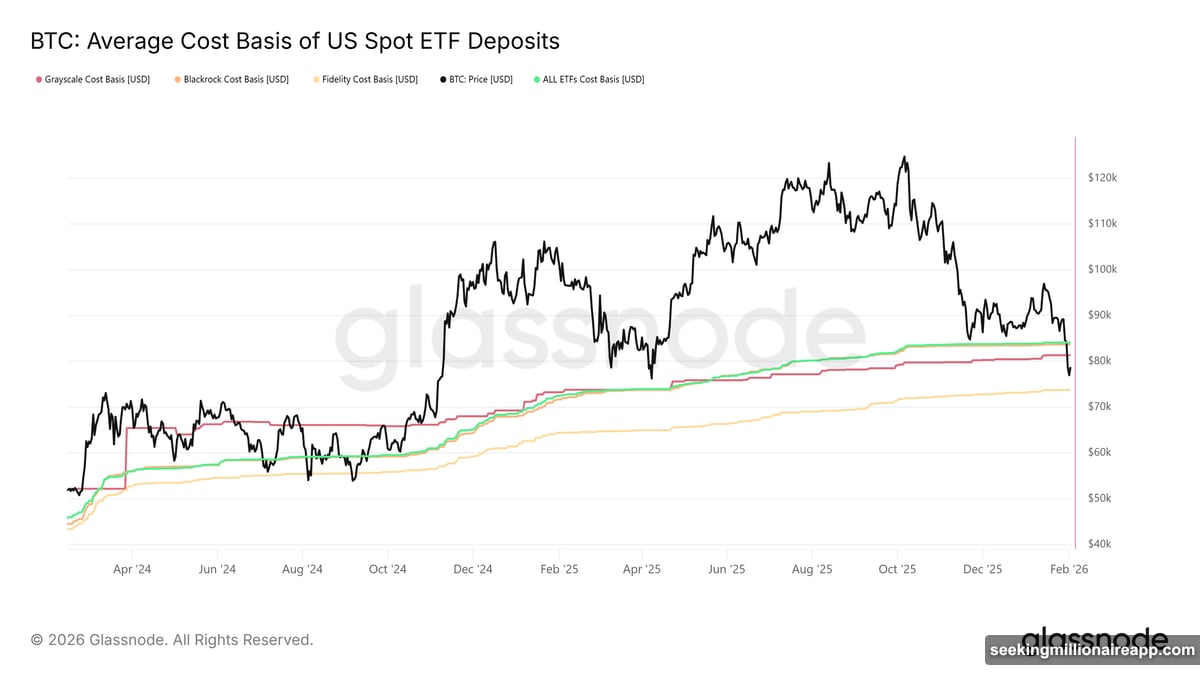

US spot Bitcoin ETF holders entered at an average price of $84,100 per BTC, according to Glassnode data. With Bitcoin trading near $78,657 after briefly dipping below $75,000 over the weekend, these investors are down roughly 8-9%. For regulated product buyers who expected stability, this drawdown tests their conviction in ways many didn’t anticipate.

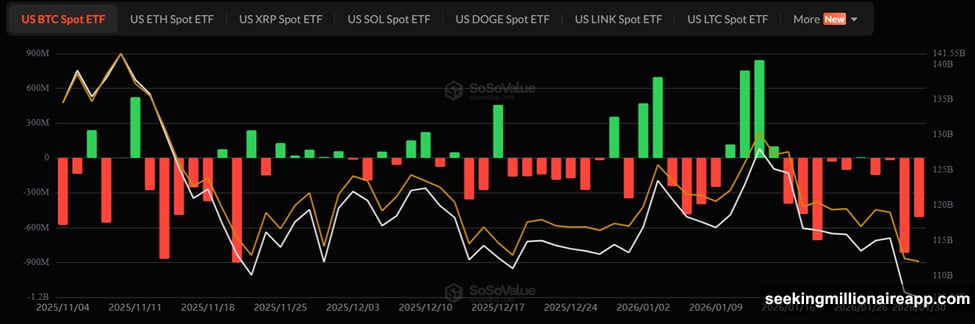

The pain is already showing up in outflows. Nearly $3 billion left Bitcoin ETFs in just two weeks. That’s not a blip. That’s a crisis of confidence.

The Dip-Buying Demand Vanished Completely

Remember when institutional investors were supposed to buy every Bitcoin dip? That narrative died quietly.

After strong inflows in early January, momentum reversed hard. Weekly redemptions hit $1.49 billion and $1.32 billion in consecutive weeks, erasing most of the year’s early optimism. Daily flow data paints an even grimmer picture: -$708.7 million on January 21, -$817.8 million on January 29, -$509.7 million on January 30.

The largest products bore the brunt of selling. BlackRock’s IBIT alone saw $528 million exit on January 30. Fidelity’s FBTC followed close behind. A single-day inflow of $419.8 million on February 2 provided brief relief before the selling resumed.

Here’s what analyst Jamie Coutts observed: “Aggregate ETF flows are not buying the dip. Net institutional demand is coming almost entirely from a shrinking group of Treasury-style buyers with remaining balance-sheet capacity.”

That’s not sustainable. Plus, a durable Bitcoin bottom likely requires these players to reverse their positioning—not just slow their selling.

Macro Narratives Collapsed While Bitcoin Fell 35%

Bitcoin is down more than 35% from its 2025 peak near $126,000. But the drop in price isn’t the only problem. The stories that once supported higher valuations have fallen apart.

Analysts point to three key failures. First, shrinking liquidity across financial markets. Second, tighter financial conditions that make risk assets less attractive. Third, Bitcoin’s apparent decoupling from traditional hedges.

Unlike prior cycles, Bitcoin failed to rally on dollar weakness. It also ignored heightened geopolitical risk. So the asset that once moved with gold or tech stocks now moves… nowhere predictable. That leaves speculative interest with no clear reason to return.

Moreover, the macro environment is hostile. Central banks aren’t printing money. Corporate treasuries aren’t expanding Bitcoin positions. Retail traders moved to memecoins and AI tokens. Meanwhile, the institutional bid everyone expected never materialized at scale.

This Underwater Position Has Happened Before

ETF investors slipped into the red once before. In November 2025, Bitcoin briefly fell below the then-average ETF cost basis near $89,600. Analysts flagged a similar stress test. Some warned of panic selling.

But this time feels different. Instead of panic, the market shows apathy. Investors aren’t rushing to exit en masse. However, they’re also not buying. That creates a dangerous holding pattern.

Sean Rose, senior analyst at Glassnode, told Bloomberg that investors appear more selective now. They’re waiting for clearer signals on macro conditions, liquidity, and whether Bitcoin can sustainably hold above prior highs before adding exposure.

In fact, slowing accumulation among public and private companies mirrors the ETF trend. MicroStrategy, once an aggressive buyer, has slowed purchases. Other corporate treasury buyers show similar caution.

The Feedback Loop Could Deepen Bitcoin’s Weakness

Without a fresh catalyst, this situation risks becoming self-reinforcing. Falling prices discourage buyers. Sidelined capital deepens weakness. Conviction erodes further.

Here’s how the loop works: Bitcoin drops, so ETF investors pull money. Lower demand pushes Bitcoin down more. That creates larger paper losses for remaining holders. More investors question their positions. The cycle repeats.

US spot Bitcoin ETFs collectively hold an estimated $104.48 billion in assets. That represents substantial long-term capital. But if that capital starts fleeing aggressively rather than just trickling out, Bitcoin could face pressure unlike anything seen since the ETF launches.

Plus, traditional support mechanisms aren’t working. The halving narrative? Priced in months ago. The institutional adoption story? Stalled by regulatory uncertainty and weak performance. The inflation hedge thesis? Undermined by Bitcoin’s failure to rally during actual inflationary periods.

What Would Break This Stalemate

Three things could reverse the trend. None look imminent.

First, renewed ETF inflows at scale. That requires either a sustained price rally to attract momentum buyers, or a major institutional announcement that reignites conviction. Neither seems likely in the near term.

Second, easing liquidity conditions. If central banks pivot to looser monetary policy or financial conditions improve broadly, risk assets including Bitcoin could catch a bid. But current policy trajectories point the opposite direction.

Third, a compelling new narrative. Bitcoin needs a fresh story that resonates with the current market environment. The original narratives—digital gold, inflation hedge, institutional adoption—all feel stale or disproven by recent price action.

Until one of these catalysts emerges, ETF investors remain trapped. They’re underwater enough to feel pain but not desperate enough to capitulate completely. That creates a soggy middle ground where nothing moves much, and everyone waits for someone else to blink first.

The irony cuts deep. Spot Bitcoin ETFs were supposed to bring stability through regulated, long-term capital. Instead, they’ve created a new cohort of bagholders learning that crypto volatility doesn’t care about your fund’s ticker symbol.