Bitcoin’s struggling right now. The price hovers just above $100,000, and the pressure keeps mounting.

What’s causing the trouble? Ironically, it’s the same Bitcoin ETFs that everyone celebrated just months ago. These investment vehicles are now bleeding capital fast. In fact, they’ve shed roughly $2 billion in just one week.

That’s not a small number. And it’s raising serious questions about whether Bitcoin can maintain its six-figure price tag.

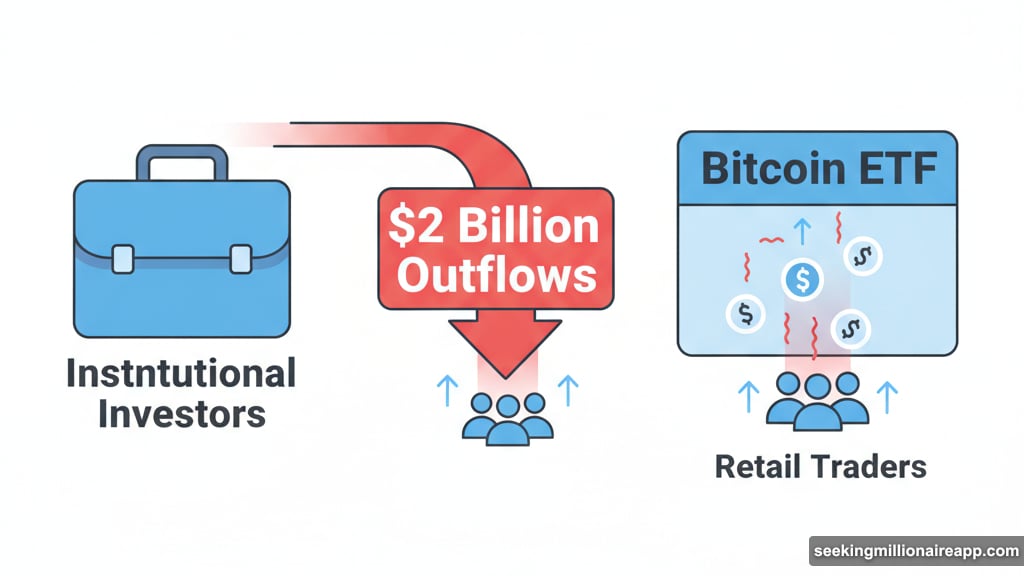

ETF Outflows Signal Weakening Institutional Demand

Spot Bitcoin ETFs just recorded one of their worst weeks since launching. About $2 billion worth of Bitcoin exited these funds over the past seven days.

Why the exodus? Broader market jitters are hitting hard. Treasury yields keep climbing. Risk appetite is shrinking. So institutional investors are pulling back instead of doubling down.

Plus, this isn’t just a temporary blip. The outflows suggest a sustained shift in sentiment. When big money moves to the sidelines, it creates serious selling pressure that retail traders can’t easily absorb.

According to Farside data, the withdrawal pattern shows clear institutional hesitation. These aren’t panic sellers dumping everything at once. Instead, measured exits reveal calculated risk reduction across portfolios.

However, if this trend continues, Bitcoin faces an uncomfortable reality. Without fresh institutional buying, the support that held BTC above $100,000 starts looking shaky.

Supply Metrics Show Growing Vulnerability

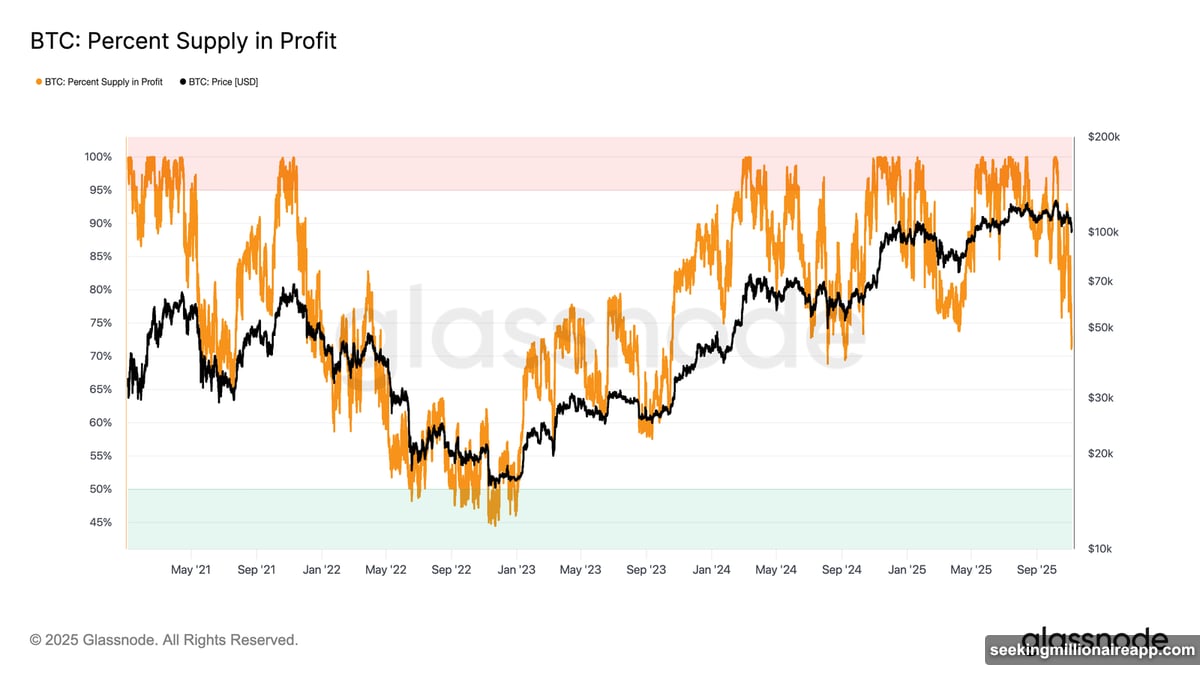

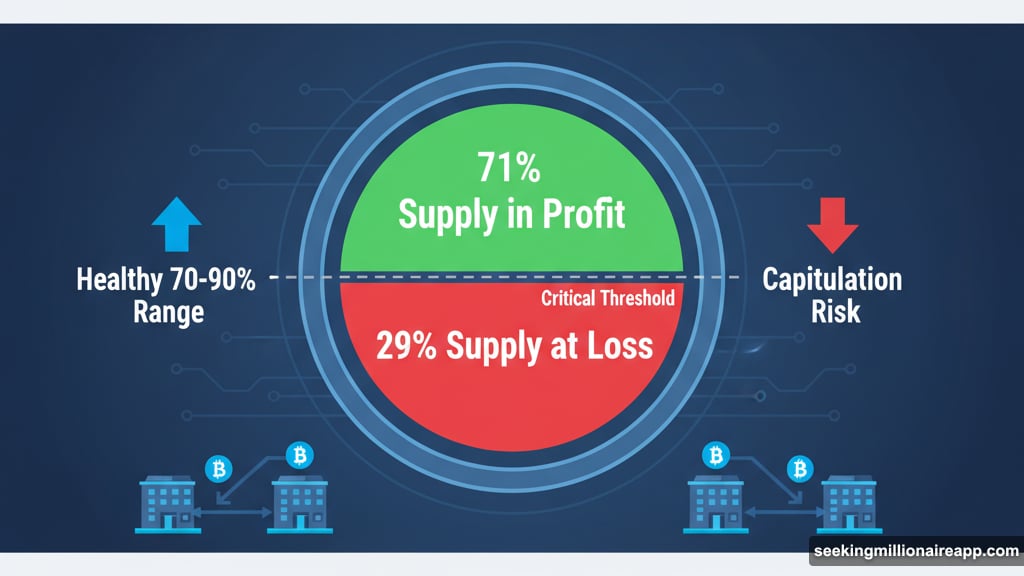

On-chain data paints a concerning picture. Bitcoin’s supply in profit has dropped to approximately 71% at current prices.

That matters because this range marks a critical threshold. Markets typically maintain 70-90% of supply in profit during healthy consolidations. But when that figure drops toward the lower end, trouble often follows.

Right now, Bitcoin sits dangerously close to breaking below that 70% floor. If more supply moves into loss territory, capitulation becomes a real possibility.

Glassnode’s metrics confirm this vulnerability. The market hasn’t seen this level of supply pressure since the last major correction. Back then, a breach of the 70% level triggered extended selling that pushed prices significantly lower.

Moreover, exchange balances tell a complementary story. Bitcoin continues flowing onto exchanges despite ETF outflows, suggesting holders are preparing to sell if prices drop further.

So the question becomes: will new buyers step in before the situation deteriorates? Because without fresh demand, these metrics point toward deeper declines ahead.

Key Price Levels That Matter Now

Bitcoin trades at $101,274 as I write this. That puts it barely above the psychologically important $100,000 mark.

This level isn’t just symbolic. It represents a line in the sand for many traders. Break below it, and panic selling could accelerate quickly.

Technical analysis suggests the next major support sits around $98,000. If Bitcoin loses $100,000, that becomes the first test. But given the momentum behind current outflows, even $98,000 might not hold.

In a worst-case scenario, Bitcoin could slide toward $95,000 or lower. That would represent a significant correction from recent highs near $110,000. Yet the ETF outflow data makes this path increasingly plausible.

On the flip side, there’s still hope for bulls. If Bitcoin attracts fresh capital inflows, it could rebound toward $105,000 relatively quickly. From there, reclaiming $110,000 becomes the next target.

But here’s the catch. That scenario requires renewed buying pressure that simply isn’t showing up right now. The ETF flows would need to reverse completely. Institutional sentiment would need to shift. And broader market conditions would need to stabilize.

None of those catalysts appear imminent.

The Bigger Picture Looks Uncertain

Bitcoin ETFs were supposed to bring stability and institutional legitimacy. Instead, they’re amplifying volatility during this downturn.

When funds flowed in, they pushed prices higher. Now that they’re flowing out, they’re accelerating the decline. This two-way dynamic makes Bitcoin more sensitive to institutional sentiment than ever before.

Plus, the current environment isn’t getting easier. Rising Treasury yields make risk assets less attractive. Macroeconomic uncertainty keeps investors cautious. And without a clear catalyst, Bitcoin faces an uphill battle.

I’ve watched plenty of Bitcoin corrections over the years. This one feels different because the ETF structure creates new selling dynamics. Traditional crypto market participants can’t simply HODL their way through institutional withdrawal waves.

The next few weeks will determine whether $100,000 becomes a floor or just another resistance level on the way down. Bitcoin needs to find new buyers fast. Otherwise, the math behind these outflows suggests lower prices ahead.

Watch the ETF flow data closely. It’s become the most reliable indicator of near-term price direction. And right now, it’s flashing red.