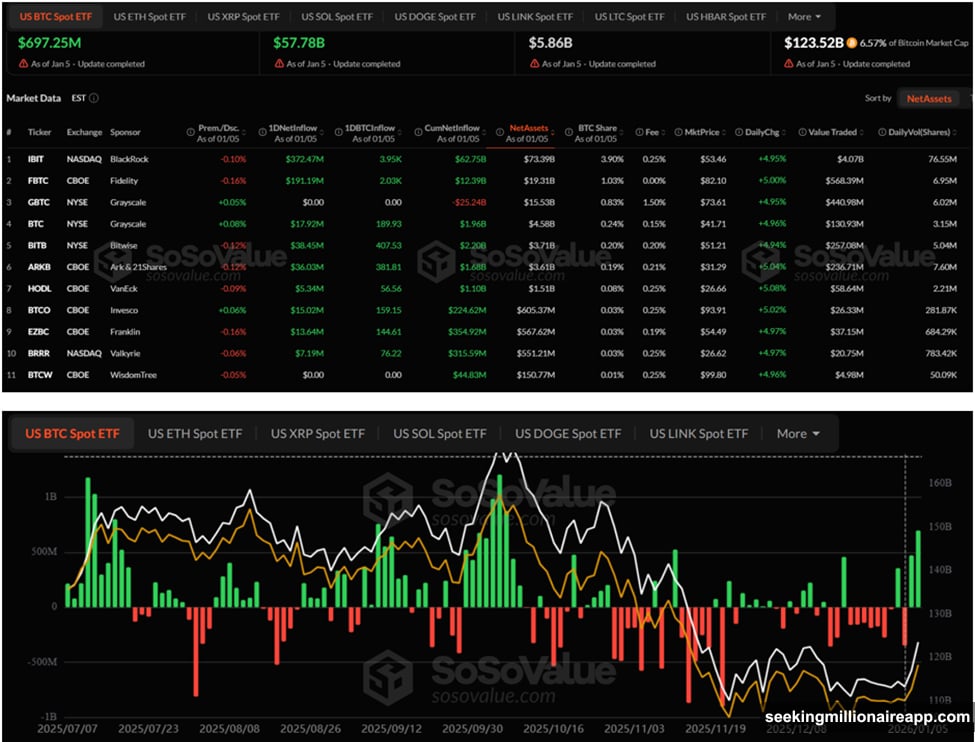

Bitcoin ETFs just recorded their strongest day in three months. Nearly $695 million flowed in on January 5, marking a sharp reversal from December’s quieter trading.

This wasn’t speculative money chasing a price pump. Instead, institutional buyers returned with coordinated purchases across nearly every major ETF issuer. Plus, BlackRock released a new investment thesis reframing crypto as financial infrastructure rather than a risky bet.

The timing suggests something shifted in how large allocators view digital assets.

BlackRock and Fidelity Lead Coordinated Buying

BlackRock’s iShares Bitcoin Trust (IBIT) captured $371.9 million of the day’s inflows. Fidelity’s FBTC followed with $191.2 million, according to SoSoValue data.

But the buying spread far beyond these two giants. Bitwise’s BITB added $38.5 million, while Ark’s ARKB brought in $36 million. Invesco, Franklin Templeton, Valkyrie, and VanEck all posted positive net flows as well.

This broad-based participation signals portfolio rebalancing rather than opportunistic speculation. When nearly every issuer sees inflows on the same day, institutional allocators are executing planned positions rather than chasing momentum.

Moreover, Grayscale’s legacy GBTC recorded zero outflows. That’s significant given the fund has bled more than $25 billion in cumulative withdrawals since converting to a trust structure. A day without redemptions suggests the worst of that exodus may be ending.

Trading Volume Rebounds Alongside Institutional Return

Trading activity jumped in tandem with the inflows. That combination matters because it confirms renewed institutional engagement rather than passive accumulation.

Bitcoin held above $90,000 throughout the session. The price stability during heavy buying suggests strong bid support from institutional desks executing size without pushing markets.

January’s opening week saw $671 million in total inflows across spot Bitcoin ETFs. Friday’s $695 million represented the bulk of that volume, making it the largest single-day inflow since October.

The synchronized timing points to calendar-driven rebalancing. Many institutions adjust portfolio allocations at year-end or in early January. This suggests some allocators increased their crypto exposure as part of their 2026 investment strategy.

Ethereum Sees Parallel Institutional Accumulation

Institutional appetite extended beyond Bitcoin. BlackRock clients purchased 31,737 ETH worth approximately $100.2 million on the same day, according to Whale Insider data.

Spot Ethereum ETFs pulled in $168.13 million on Friday. That represents strong cross-asset accumulation rather than Bitcoin-only positioning.

The multi-asset buying suggests large allocators view crypto as an asset class rather than a single-token bet. They’re building diversified digital asset exposure across settlement layers and smart contract platforms.

This mirrors how institutions approach traditional equity markets. They don’t just buy S&P 500 exposure. They also allocate to mid-caps, international stocks, and sector-specific funds. The same portfolio construction logic now appears to be extending into crypto.

BlackRock Reframes Crypto as Financial Plumbing

The timing of these inflows coincides with BlackRock’s release of a new investment outlook. The asset manager explicitly reframes cryptocurrency as core financial infrastructure rather than speculative technology.

BlackRock’s report identifies three primary crypto use cases: settlements, liquidity rails, and tokenization. None of these emphasize price appreciation or trading profits. Instead, they focus on operational improvements to existing financial workflows.

Stablecoins feature prominently in BlackRock’s thesis. The firm describes them as a bridge between traditional finance and digital liquidity. In some jurisdictions, they note, dollar-backed stablecoins could displace local currencies entirely.

That’s a striking claim from the world’s largest asset manager. It suggests BlackRock views stablecoin adoption as a structural shift rather than a niche payment method.

The report also warns that stablecoin growth places pressure on traditional banks. Deposits and yield are migrating toward crypto-native products. Banks face competition from protocols offering higher yields and faster settlement times.

ETF Approvals Signal Institutional Validation

BlackRock frames the existence of spot Bitcoin and Ethereum ETFs as factual validation of digital assets. These aren’t experimental products. They’re standardized investment vehicles that large allocators can embed in traditional portfolio construction.

The fast growth of crypto ETFs reinforces this view. IBIT alone has accumulated more than $50 billion in assets since launching in January 2024. That places it among the most successful ETF launches in history.

Fidelity’s FBTC has similarly attracted billions in institutional capital. The combined success of these products demonstrates genuine demand from wealth managers, pension funds, and financial advisors.

ETFs also provide regulatory cover. Advisors who previously couldn’t recommend direct crypto exposure can now allocate to SEC-approved products. That expands the addressable market significantly.

AI and Capital Deepening Drive Structural Market Shifts

BlackRock’s report places artificial intelligence at the center of current macro changes. AI-driven shifts in energy demand, productivity, and capital allocation are accelerating structural transformations across markets.

The firm argues that traditional market cycles are breaking down. Capital is concentrating in long-duration thematic exposures rather than cycling through predictable boom-bust patterns.

In this environment, BlackRock cautions against the “illusion of diversification.” Many traditional assets now move together because the same macro forces drive them. Correlation has increased across stocks, bonds, and commodities.

Digital assets, the firm suggests, emerge as alternative exposures precisely because they operate on different rails. They don’t depend on central bank policy or traditional credit markets. That structural separation provides actual diversification rather than nominal asset class labels.

This framing positions crypto as a solution to a portfolio construction problem. As traditional diversification strategies fail, allocators need genuinely uncorrelated exposures. Crypto offers that precisely because it functions outside legacy financial infrastructure.

Market Structure Matures as GBTC Bleeding Stops

The January 5 data reveals a maturing ETF market. Participation spread across nearly all major issuers. No single fund dominated flows, suggesting diversified buying rather than concentrated bets.

GBTC’s zero-outflow day marks another milestone. The fund has been bleeding assets since its conversion to a trust structure. A day without redemptions suggests that exodus may be exhausting itself.

This matters because GBTC outflows have been a persistent overhang on Bitcoin prices. Forced selling from investors moving to lower-fee alternatives created consistent downward pressure. If those flows stabilize, that removes a structural headwind.

The combination of broad-based inflows and stabilizing outflows points to a healthier market structure. Capital is entering through multiple channels while previous sources of selling pressure diminish.

Infrastructure Thesis Replaces Speculative Narrative

BlackRock’s framing shift matters because it influences how institutional allocators think about crypto. If the world’s largest asset manager describes crypto as infrastructure, other institutions will follow that framework.

Infrastructure investments typically feature long time horizons and lower volatility expectations. They focus on cash flows and operational utility rather than price appreciation. That mindset favors accumulation over trading.

The settlements, liquidity rails, and tokenization use cases that BlackRock emphasizes all generate actual economic activity. They create measurable efficiency gains rather than depending on greater-fool theory.

This represents a fundamental change from crypto’s earlier positioning as a hedge against inflation or a bet on monetary debasement. Those narratives attracted some capital but limited institutional adoption because they required macro predictions.

The infrastructure thesis sidesteps those debates. It argues crypto improves financial operations regardless of whether central banks succeed or fail. That’s a more defensible investment case for fiduciaries managing institutional capital.

What This Means for Crypto Markets

The January 5 inflows suggest institutional allocators returned from year-end breaks with fresh capital to deploy. The coordinated buying across multiple issuers points to deliberate positioning rather than momentum chasing.

BlackRock’s infrastructure framing provides intellectual cover for this allocation. Institutions can now argue they’re investing in financial technology infrastructure rather than speculating on internet money.

That distinction matters for compliance, risk management, and client communication. A pension fund can’t easily justify speculative crypto trading. But it can defend an allocation to settlement infrastructure that improves capital efficiency.

The parallel Ethereum accumulation reinforces this thesis. Institutions aren’t just buying Bitcoin. They’re building diversified crypto exposure across multiple protocols and use cases.

Stablecoin growth adds another dimension. As dollar-backed stablecoins scale globally, they create demand for underlying blockchain settlement capacity. That structural demand supports long-term value for settlement layer tokens.

The combination of institutional inflows, infrastructure framing, and stablecoin adoption suggests crypto is transitioning from speculative asset to operational necessity. That’s a far more durable foundation than narrative-driven trading cycles.

Institutions aren’t chasing price pumps anymore. They’re building positions in infrastructure they expect to use. That fundamental shift may prove more significant than any short-term price movement.