Bitcoin’s identity crisis just exploded into public view. One side welcomes institutional money through ETFs. The other warns that trusting third parties betrays Bitcoin’s core purpose.

This isn’t just philosophical posturing. The debate centers on theft resistance, exit rights, and whether corporations might eventually influence Bitcoin’s protocol. Plus, the stakes keep rising as institutional adoption accelerates.

Let’s break down what’s actually happening and why it matters for every Bitcoin holder.

The Dual-Strategy Proposal That Started Everything

Investor Fred Krueger recently endorsed crypto pioneer Nick Szabo’s middle-ground approach. His message? Welcome banks and ETFs while fiercely defending self-custody rights.

“The answer is BOTH,” Krueger argued. Support institutional adoption through traditional rails. But simultaneously encourage personal custody and protect that option legally.

This stance aims to bridge a widening gap. Bitcoin purists prize sovereignty above all else. Meanwhile, ETF defenders insist that mainstream scale requires familiar infrastructure like regulated custodians.

However, the proposal sparked fierce pushback from both camps. Some see compromise as surrender. Others view it as the only pragmatic path forward.

Why Szabo Thinks Bitcoin Still Has Problems

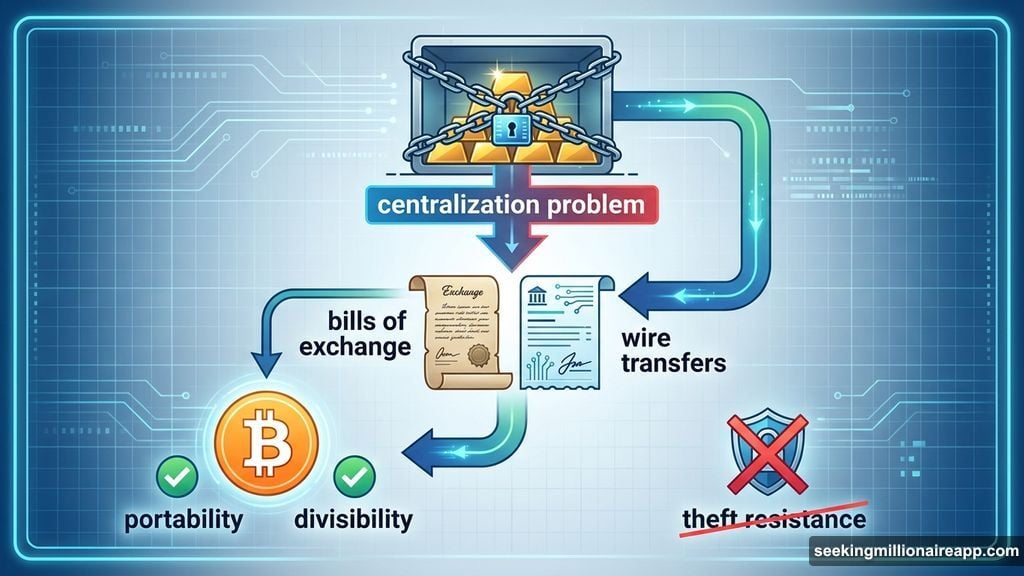

The debate traces back to Nick Szabo’s historical analysis of gold’s evolution. Gold worked so well as money that it eventually got replaced by paper notes created from nothing.

But here’s the catch. Gold’s centralization in vaults and poor theft resistance made trust-based alternatives more practical. Merchants and banks preferred bills of exchange and wire transfers over physically moving metal.

Bitcoin solves key weaknesses around transaction speed and verification. Yet Szabo argues it still lags in one critical area: theft resistance.

“Bitcoin is, without further work and as most commonly used, still below the best trust-based methods in its theft resistance,” Szabo wrote. That’s why Wall Street prefers third-party custody through institutions they already trust.

So Bitcoin improved on gold’s portability and divisibility. But it didn’t fully solve the security problem that pushed gold into vaults centuries ago.

The ETF Defense: Scale Requires Traditional Rails

Bloomberg analyst Eric Balchunas questioned why “snobby OGs” accept crypto exchanges holding Bitcoin but oppose ETFs. Both rely on outsourced custody, he noted.

His argument? ETFs are “waaay cheaper and safer” than exchanges. Plus, they accelerate adoption by spreading ownership across millions of investors who won’t manage private keys.

ETFs also help Bitcoin mature into a less volatile asset class. Institutional money flows through familiar structures. That increases liquidity and stabilizes price action over time.

Moreover, Balchunas argued that self-custody through exchanges costs 1.4% to 3% in conversion fees. ETFs charge lower annual fees without withdrawal spreads. For mainstream investors, that’s a better deal.

But his claims about cost sparked immediate controversy. Many platforms offer free Bitcoin withdrawals with minimal spreads. Plus, ETFs charge annual management fees that compound over years.

The Self-Custody Counterattack: Exit Rights Matter Most

Analyst Sam Wouters fired back with a crucial distinction. Exchange users can withdraw to self-custody anytime they want. ETF holders cannot.

“An ETF is a bird in a cage,” Wouters wrote. The value of self-custody lies in the option to exit, even if most users don’t exercise it today. That option disappears completely with ETFs.

This mirrors the debate around bank runs. Banks work fine until everyone wants their money at once. Then the system reveals its fragility. Bitcoin was designed to avoid exactly this dependency on institutional promises.

Plus, some argue that ETFs risk giving corporations perceived influence over Bitcoin’s protocol direction. Large custodians holding millions of Bitcoin could theoretically pressure developers or support contentious forks.

Wouters and others emphasize that Bitcoin exists precisely because we shouldn’t trust corporations on their word. Private keys eliminate counterparty risk entirely. Giving that up defeats the purpose.

What Balchunas Gets Wrong About Costs

Balchunas claimed self-custody is “a pain” and “very expensive” when buying through exchanges. He cited 1.4% conversion fees as proof.

But that’s misleading. Many reputable platforms offer competitive spreads under 0.5% with free withdrawals to personal wallets. Some even cover network fees for larger amounts.

Moreover, ETFs charge annual management fees ranging from 0.2% to 1.5%. Those fees compound over years. A one-time withdrawal spread often costs less than multi-year ETF fees.

Plus, Balchunas dismissed security concerns by claiming ETF issuers “don’t want power over protocol.” Yet history shows corporations always respond to regulatory pressure. Governments could demand transaction filtering or protocol changes through custodians.

So the cost comparison favors self-custody for long-term holders. And the security comparison isn’t even close when you factor in counterparty risk.

The Missing Middle Ground Nobody Mentions

Both sides miss an obvious solution. Bitcoin’s Lightning Network enables instant, low-fee transactions with self-custody intact.

Lightning wallets let users hold their own keys while enjoying instant settlement. No exchange custody required. No ETF management fees. Just direct peer-to-peer payments exactly as Bitcoin intended.

Moreover, multisignature wallets solve the theft resistance problem Szabo identified. Require multiple keys for spending. Store them in separate locations. Now theft becomes exponentially harder without sacrificing self-custody.

These tools exist today. They’re improving rapidly. Yet the debate focuses almost entirely on centralized custodians versus cold storage. That’s a false choice ignoring proven alternatives.

So maybe the real answer isn’t “both” institutional rails and self-custody. Maybe it’s better tools that make self-custody as convenient as custodial services without the trust requirements.

What This Means for Bitcoin’s Future

This debate matters because it shapes Bitcoin’s trajectory. Will it become a traditional asset class controlled by Wall Street? Or maintain its core property of permissionless, sovereign money?

ETF adoption brings institutional capital and regulatory legitimacy. That increases Bitcoin’s stability and mainstream acceptance. But it also concentrates holdings in custodial services vulnerable to government pressure.

Meanwhile, self-custody preserves Bitcoin’s revolutionary properties. Nobody can freeze your funds. Nobody can stop your transactions. You truly own your money for the first time in history.

Yet mainstream adoption requires convenience. Most people won’t manage seed phrases and hardware wallets. They’ll choose trusted intermediaries every time.

So Bitcoin’s success might depend on both paths coexisting. Let institutions handle retirement accounts and corporate treasuries. But defend the technology that enables self-custody for those who value sovereignty over convenience.

The real test comes when governments pressure custodians to censor transactions. Then we’ll discover whether Bitcoin maintained its exit rights or surrendered them for short-term adoption growth.

Choose your strategy carefully. Both have real tradeoffs. Just understand what you’re actually trading away.