Thursday delivered another gut punch to crypto bulls. Bitcoin slid 2% to $108,800, nearly erasing its bounce from Friday’s brutal crash. Meanwhile, gold hit fresh all-time highs near $4,300.

So what’s strangling the crypto rally? The answer lurks in the financial system’s plumbing. Liquidity is tightening fast. Banks are scrambling for cash. That spells trouble for risk assets like cryptocurrencies.

The Liquidity Squeeze Is Real

Two key metrics tell the story. First, the spread between SOFR (secured overnight financing rate) and EFFR (effective federal funds rate) jumped to 0.19. That’s up from just 0.02 one week ago.

What does that mean in plain English? Banks are paying more to borrow money overnight, even when they offer Treasury securities as collateral. When secured lending gets expensive, it signals stress in the financial system.

SOFR represents what banks pay to borrow cash using Treasuries as backing. EFFR tracks what banks charge each other for unsecured overnight loans. When SOFR rises above EFFR, lenders want higher returns even for super-safe lending.

That gap last hit this level in December 2024. Plus, it’s still far below the 2.95 peak during the 2019 repo crisis. But the trend matters more than the absolute number.

Banks Are Tapping Emergency Funds

Here’s the kicker. On Wednesday, banks withdrew $6.75 billion from the Federal Reserve’s standing repo facility (SRF). That’s the highest amount since the pandemic ended, excluding quarter-end periods.

The SRF acts as a liquidity backstop. It provides twice-daily overnight cash loans against U.S. Treasuries. Banks only tap this facility when they can’t easily find funding elsewhere.

Think of it as the financial system’s emergency valve. When usage spikes, it means banks are struggling to meet their short-term funding needs. That’s not a good sign for markets that depend on abundant liquidity.

Bitcoin Feels the Pressure First

Bitcoin gets hit hardest when liquidity dries up. Many investors treat BTC as a pure liquidity play. When cash flows freely, Bitcoin rallies. When money gets tight, Bitcoin tumbles.

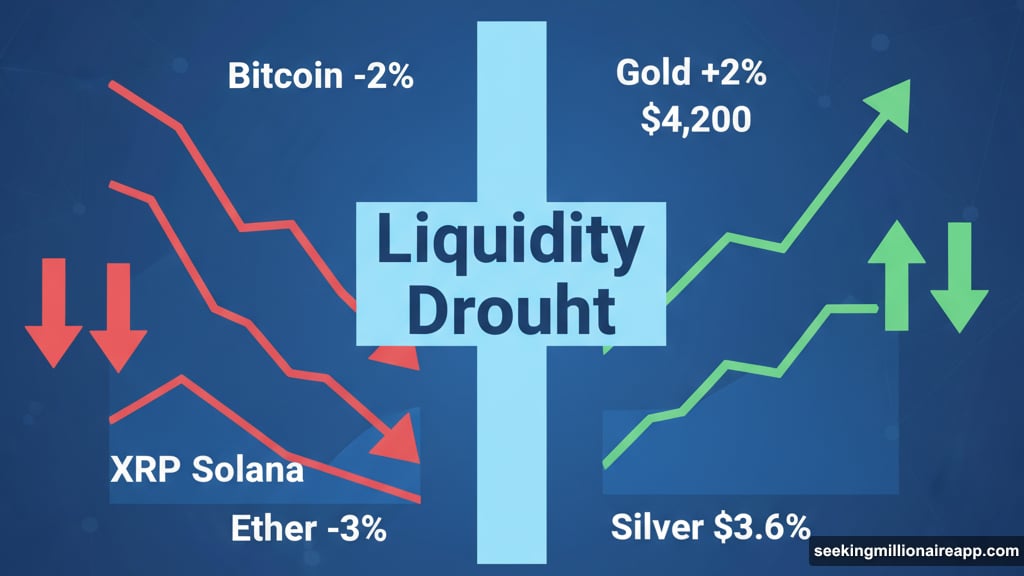

Thursday’s price action confirms this pattern. BTC dropped 2% in an hour. Ether fell 3%. XRP and Solana saw similar declines.

Meanwhile, gold and silver soared to new records. Gold climbed 2% above $4,200. Silver jumped 3.6%. Precious metals thrive during financial stress and liquidity crunches.

The divergence makes sense. Gold serves as a safe haven when the financial system shows cracks. Bitcoin, despite its “digital gold” narrative, still acts like a risk asset when liquidity evaporates.

Friday’s Leverage Flush Failed to Stick

Last Friday delivered a massive flush of overleveraged positions. Liquidations cascaded across exchanges. Bitcoin briefly dipped below key support levels.

Typically, such violent washouts clear the deck for fresh rallies. Excess leverage gets purged. Weak hands exit. Strong hands accumulate at better prices.

But this time, the bounce fizzled. BTC rallied initially but couldn’t maintain momentum. Now prices are sliding back toward Friday’s lows.

The culprit? That ongoing liquidity squeeze prevents new buyers from stepping in aggressively. Without abundant cash sloshing around, rallies run out of steam quickly.

Other Altcoins Are Getting Crushed

The pain extends well beyond Bitcoin. Ether dropped 3% over the same hour. XRP and Solana saw similar bloodletting.

Altcoins typically amplify Bitcoin’s moves in both directions. When BTC rallies, altcoins explode higher. When BTC falls, altcoins crater. That’s exactly what we’re seeing now.

The broader crypto market cap is shrinking as liquidity conditions worsen. Traders are pulling back risk across the board. Even meme coins and smaller tokens are bleeding hard.

This isn’t about individual project fundamentals. It’s about the macro environment turning hostile to speculative assets.

Central Bank Rescue Hopes Are Premature

Crypto social media is buzzing with speculation. Many believe central banks will soon step in to ease liquidity pressures. That could reignite the crypto rally and push Bitcoin to new highs.

But that’s wishful thinking. Central banks don’t move quickly. They wait for clear signs of systemic stress before intervening. A 0.19 SOFR-EFFR spread doesn’t trigger emergency action.

Plus, remember the context. Inflation remains a concern. Central banks prefer tighter money over another bout of surging prices. They’ll tolerate financial market volatility as long as the banking system stays stable.

So expecting a quick rescue seems naive. Liquidity conditions might stay tight for weeks or even months before any relief arrives.

The Spread Still Sits Below Crisis Levels

Let’s keep perspective. The current SOFR-EFFR spread of 0.19 remains far below the 2.95 peak from September 2019. That repo crisis forced the Federal Reserve to inject massive liquidity into markets.

We’re nowhere near that level of stress yet. Banks are managing. The system isn’t breaking. But the direction of travel matters.

Liquidity is tightening, not loosening. That headwind caps crypto’s upside potential. Until the spread narrows or central banks signal policy shifts, Bitcoin and altcoins will struggle.

Trading volumes are also declining. September saw a 17.5% drop in combined spot and derivatives volumes. That marks the fourth consecutive year of reduced September activity.

What This Means for Your Portfolio

Right now, patience beats aggression. Chasing rallies in this environment burns capital. The macro backdrop doesn’t support sustained upside in risk assets.

Bitcoin might find support near $107,000-$110,000. But don’t expect a quick recovery to new highs. Liquidity conditions need to improve first.

Gold and silver are telling us something. They’re screaming that investors want safety, not speculation. When precious metals hit records while crypto bleeds, the message is clear.

Consider reducing exposure to altcoins. They’ll get hammered if Bitcoin breaks key support levels. Focus on quality over quantity. Hold some stablecoins to deploy when conditions improve.

Most importantly, ignore the hype about imminent central bank rescues. Those hopes might materialize eventually. But “eventually” could be months away. Don’t position for a quick fix that might not come.