Bitcoin’s mining network just hit a rough patch. Hash rate fell 4% in 30 days—the steepest drop since April 2024.

Sounds bearish, right? But here’s the twist. Historical data suggests these miner capitulation events often mark price bottoms. Plus, technical patterns are forming that previously signaled major reversals.

Let’s dig into what’s really happening behind the scenes.

Miners Face Triple Threat

Bitcoin miners got hammered from multiple directions this month. First, BTC price slid 9% while volatility spiked above 45%—the highest since April 2025.

Then China’s Xinjiang province forced 400,000 mining machines offline last week. That wiped out 1.3 GW of capacity almost instantly. The province’s computing power dropped 100 exahashes per second within 24 hours.

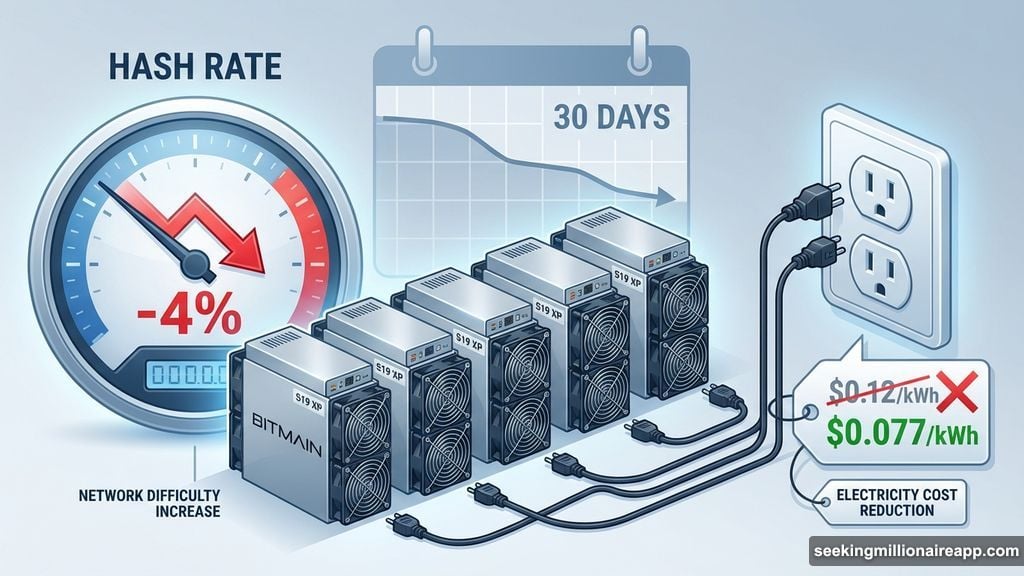

But the economics tell the harshest story. Breakeven electricity costs for a 2022-era Bitmain S19 XP miner crashed 36% in one year. It dropped from $0.12 per kilowatt-hour in December 2024 to just $0.077 by mid-December 2025.

VanEck analysts Matthew Sigel and Patrick Bush noted that many miners continue operating despite negative economics. Why? They believe in Bitcoin’s long-term future. In fact, up to 13 nations now mine with direct government support.

China Shifts Power to AI

The Xinjiang shutdown wasn’t random. Provincial authorities redirected that electricity to AI data centers instead.

This reflects a broader trend. China increasingly prioritizes artificial intelligence infrastructure over cryptocurrency mining. So miners face not just price pressure but also resource competition from one of tech’s hottest sectors.

The shift could permanently remove up to 10% of Bitcoin’s global mining capacity. That’s significant. But it also means the remaining hash power becomes more valuable and potentially more profitable for surviving miners.

Declining Hash Rate: A Contrarian Signal

Here’s where things get interesting. VanEck analyzed hash rate data going back to 2014. The findings contradict conventional wisdom.

When hash rate declined over 30 days, Bitcoin’s 90-day forward returns were positive 65% of the time. Compare that to just 54% during periods of rising hash rate.

The pattern strengthens over longer periods. Since 2014, there were 346 days when 90-day hash rate growth turned negative. On those days, Bitcoin’s 180-day forward returns were positive 77% of the time, averaging gains of 72%.

Outside those periods? Returns were positive only 61% of the time, averaging 48%.

So miner capitulation consistently preceded stronger Bitcoin performance. The logic makes sense. When weak miners shut down, supply pressure from forced selling decreases. Plus, surviving miners become more profitable as competition drops.

Technical Patterns Confirm Bottom Formation

Market technicians spotted additional bullish signals. Analyst Ted Pillows identified a 3-day bullish divergence pattern on Bitcoin’s chart.

This specific formation appeared only twice before in this market cycle. Both times, it marked exact price bottoms before significant rallies.

Another analyst, Jelle, confirmed the pattern locked in. “In this cycle, that usually meant the bottom is in,” he wrote on X (formerly Twitter).

Bullish divergence occurs when price makes lower lows while momentum indicators make higher lows. It suggests selling pressure is weakening despite continued price declines.

Of course, technical patterns aren’t guarantees. But when they align with fundamental data like hash rate trends, the signal strengthens considerably.

Why Government Mining Matters

VanEck’s report revealed something crucial about Bitcoin’s resilience. Up to 13 governments now actively support domestic mining operations.

This changes the game completely. Government-backed miners can weather price drops that would bankrupt private operations. They’re playing the long game with national strategic interests, not quarterly profit targets.

These state-sponsored miners provide a stability floor for the network. So even during severe price crashes, a baseline level of hash power remains operational. That makes the network more resilient and paradoxically more attractive to institutional investors who worry about security.

Current Price Action Remains Weak

Despite these potentially bullish signals, Bitcoin continues struggling in the short term. The cryptocurrency traded at $98,066 at press time, down 1.01% in 24 hours.

Realized volatility staying above 45% suggests continued uncertainty. Large holders might still be reducing positions. Plus, macro factors like interest rate concerns could override mining fundamentals temporarily.

So any bottom formation needs confirmation. Watch for decreasing volatility and sustained buying pressure above key support levels before assuming the worst is over.

The Bigger Picture

Miner capitulation events reveal Bitcoin’s true believers. When profitability disappears, only those with strong conviction or alternative advantages continue operating.

That shakeout process is healthy for the network long term. Weak hands exit. Efficient operations expand. Government-backed strategic miners stabilize baseline security. The system becomes more robust through adversity.

Historical data backs this view. Every major miner capitulation since 2014 eventually led to higher prices. The pattern suggests we’re witnessing another cycle of pain that precedes gain.

Whether this time follows the historical playbook remains uncertain. But the evidence points toward eventual recovery rather than prolonged decline. For investors who can stomach volatility, current weakness might represent opportunity rather than danger.