The total crypto market cap climbed back to $3.11 trillion today. That’s a $107 billion jump from yesterday’s low. Plus, Bitcoin’s defense of the $90,000 level kept everything from sliding further.

Bitcoin is up 2.3% in the past 24 hours. That leads most major cryptos. Meanwhile, fresh headlines about Do Kwon’s sentencing and JP Morgan’s Solana move kept broader attention on the space. So sentiment stabilized alongside price action.

Three Headlines That Shaped Today’s Move

Do Kwon received a 15-year sentence for the Terra collapse. Prosecutors noted his fraud exceeded $40 billion in losses. That’s far beyond what Sam Bankman-Fried caused. The case brought accountability back into focus after months of quiet on the regulatory front.

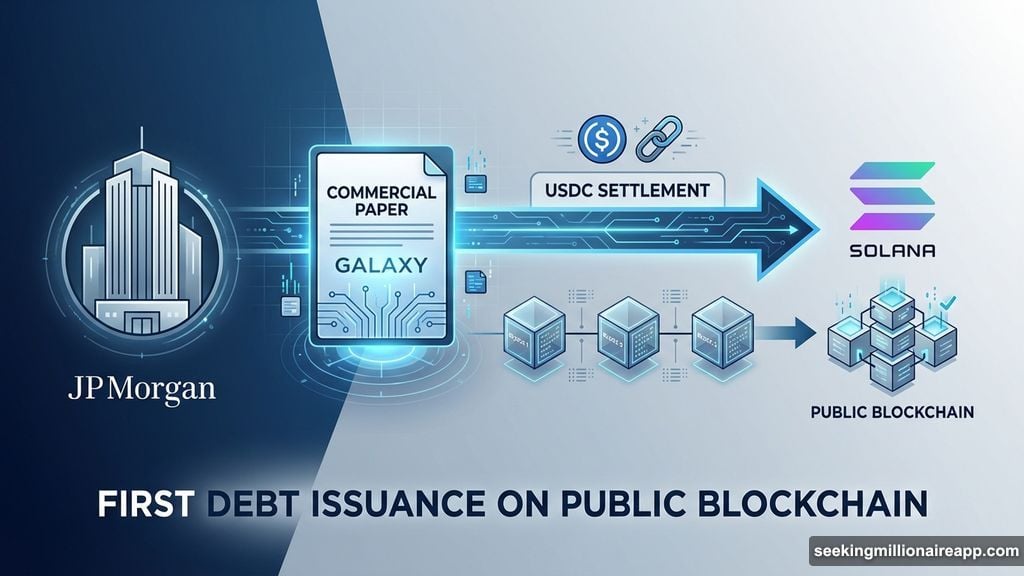

JP Morgan arranged a commercial paper deal for Galaxy on Solana. Everything settled in USDC. In fact, this marks one of the first debt issuances on a public blockchain. It’s not a test anymore. Real financial products are now moving onto crypto rails.

Peter Schiff pointed out the Fed’s plan to buy Treasuries even with reserves at $6.5 trillion. He called it a return to quantitative easing. QE means the Fed injects money by buying bonds. So markets may be reacting to hidden liquidity rather than the Fed’s cautious statements.

Total Market Cap Tests Key Resistance Again

The total crypto market cap sits at $3.11 trillion right now. That’s 3.56% above yesterday’s low. The chart held steady above $3.01 trillion since December 5. So that level continues to act as solid support.

However, resistance appears at $3.17 trillion. The market cap hasn’t managed a clean daily close above that zone in over a week. But if it breaks through, the next target becomes $3.24 trillion. That’s where sellers showed up before.

Bitcoin’s strength drives much of this stability. When Bitcoin holds major levels like $90,000, the total market cap usually follows. Dominance is high right now. Therefore, Bitcoin’s moves impact the entire market more than usual.

Yet the setup remains cautiously bullish. Holding $3.01 trillion matters most. Then reclaiming $3.17 trillion would confirm buyer strength and open the path toward $3.24 trillion next.

Bitcoin Eyes $95,700 for a Real Breakout

Bitcoin rose a little over 2% in the past 24 hours. The price reclaimed $92,400 after briefly dipping under it. Now the next test sits ahead at $95,700. That’s only 3.6% away.

That level was lost on November 14. Bitcoin hasn’t closed above it since. So a daily close above $95,700 would shift the tone from cautious to genuinely bullish. It would also give Bitcoin its first real structure improvement in weeks.

The Bull Bear Power indicator supports this view. This tool measures whether buyers or sellers control price action by comparing current levels to average drawdowns. As Bitcoin approaches resistance, the indicator turned green again. That means buyers still have an edge while the price sits just 3.6% below the breakout zone.

On the downside, $90,000 remains crucial support. Losing that level would send Bitcoin toward $88,200. That’s where buyers stepped in before. A deeper invalidation only happens if Bitcoin falls toward $80,500. But the chart stays constructive as long as price holds well above that region.

Zcash Surges Past 12% While Bitcoin Gains 2%

Bitcoin rose a little over 2% today. Ethereum climbed just above 1%. But Zcash jumped more than 12% in the past 24 hours. That makes it one of the strongest performers in the top 100.

This continues Zcash’s unusual run. The token gained over 800% in the past three months. That’s far ahead of the broader crypto market. So momentum remains strong even as other majors move slowly.

Zcash now pushes toward $470. That level was lost on November 28. The price hasn’t reclaimed it cleanly since. A daily close above $470 would confirm strength and open the way toward $547. Sellers appeared multiple times at that zone before.

If momentum continues, the next major target sits at $736. That level capped every major rally this year. So reaching it would signal a significant shift in trend.

For the bullish structure to stay firm, Zcash needs to hold above $423 on shorter pullbacks. A deeper retest toward $389 remains acceptable. But losing that level weakens the setup and raises the risk of a drop toward $302.

What Keeps This Rally Alive

Bitcoin’s defense of $90,000 support remains the most important factor. When Bitcoin stabilizes at major levels, the rest of the market tends to follow. So far, that pattern holds.

Institutional moves like JP Morgan’s Solana deal also matter. These aren’t tests anymore. Real financial products are moving onto crypto rails. That adds legitimacy and attracts more attention from traditional finance.

Yet the market still faces resistance. Bitcoin needs to break $95,700 for a confirmed bullish shift. The total market cap needs to reclaim $3.17 trillion. Until those levels fall, this remains a cautious recovery rather than a strong breakout.

Watch those levels closely. If Bitcoin closes above $95,700 and the market cap breaks $3.17 trillion, the setup improves significantly. Otherwise, consolidation near current levels seems more likely.