Friday’s crypto meltdown tells two very different stories. Bitcoin stumbled but stayed upright. Altcoins got absolutely demolished.

Wiston Capital Founder Charlie Erith walked through the damage in a Sunday breakdown. The numbers are brutal. Tokens excluding bitcoin, ether and stablecoins plunged about 33% in roughly 25 minutes on October 10. They bounced back later, but still closed down around 10.6% for the day.

Meanwhile, bitcoin’s drop was comparatively mild. The split matters because it reveals which assets actually hold up when markets panic.

$560 Billion Vanished Since Monday

Total crypto market value shed about $560 billion since October 6. That’s 13.1% gone in less than a week. Plus, the crash triggered approximately $18.7 billion in liquidations as leveraged positions got wiped out.

Erith traces the immediate trigger to President Trump’s threat of an additional 100% tariff on Chinese imports. But he argues the slide was already brewing. Stocks kept climbing while crypto “felt distinctly frail.” That divergence was the advance warning.

Here’s the kicker. Bitcoin behaved largely as expected, Erith says. It fell, but far less than everything else. That left bitcoin near a long-running uptrend from late 2022 while altcoins absorbed “immense technical damage.”

His fund emerged “largely unscathed” because they’d already positioned defensively. Turns out suspicion pays off when everyone else is still bullish.

This Was Pure Leverage Carnage

The speed tells you everything. A 33% drop in 25 minutes doesn’t happen because investors changed their minds about fundamentals. That’s forced selling from liquidations cascading through the system.

Leveraged traders get margin calls. They can’t meet them fast enough. Exchanges automatically close positions. Those sales push prices lower. More positions hit liquidation thresholds. The cycle feeds itself.

Bitcoin has deeper liquidity and broader institutional adoption. So it takes more pressure to move the price dramatically. Altcoins, even large ones, have thinner order books. When forced selling hits, prices gap down violently.

Erith noted that bitcoin’s market share rose during the chaos. Money fled to the most liquid asset available. That rotation accelerated a trend that was already underway.

Four Signals to Watch Before Adding Risk

Erith laid out specific levels he’s tracking before increasing exposure.

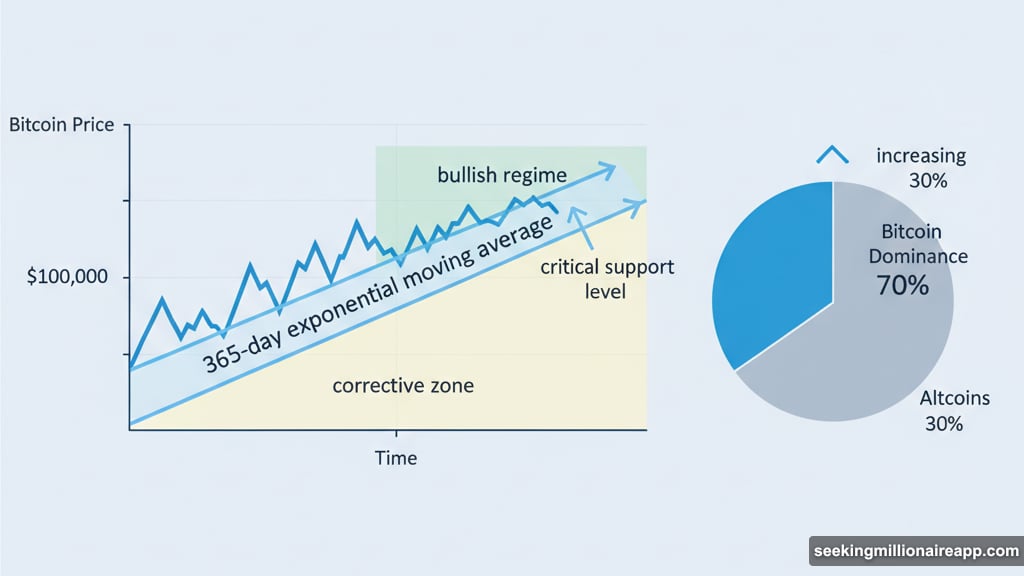

First, bitcoin’s 365-day exponential moving average. He views this line as separating bullish regimes from corrective ones. Bitcoin sitting around $100,000 and touching that average wouldn’t overturn his longer-term view, provided the level holds. But a sustained break below would raise the risk of a deeper reset.

Second, bitcoin dominance. The sell-off pushed bitcoin’s share of total crypto value higher. A continued rise alongside weak breadth would argue for caution in high-beta tokens until non-bitcoin charts rebuild. Translation: if altcoins stay broken, don’t rush back in.

Third, Strategy’s stock price. Erith uses it as a proxy for leverage and sentiment in the ecosystem. About four years ago, a decisive move below its 365-day average preceded a major bitcoin drawdown. Holding above that trend line would support the resilience narrative. A break below could foreshadow renewed selling pressure.

Fourth, the VIX volatility index. It has started to climb. Historically, better entries arrive when volatility spikes rather than during the early rise. So patience while equity-volatility stress plays out makes sense.

Erith Stays Invested But Won’t Touch Leverage

Wiston Capital remains invested but is avoiding leverage and carrying cash “waiting for the dust to settle.” Erith says moves of this sort have sometimes preceded broader downturns. That’s why he prefers to see the above signals stabilize before increasing exposure.

His positioning reflects a nuanced view. The bull case isn’t dead. But the evidence isn’t strong enough to bet big right now. So he stays in the game without taking amplified risk.

That’s the strategy many professionals adopt after violent moves. Recognize that the trend hasn’t definitively broken, but also acknowledge that conditions changed. Staying invested prevents missing a sharp recovery. Avoiding leverage prevents getting wiped out if another leg down arrives.

Bitcoin Looks Resilient. Altcoins Look Broken

Erith emphasized that the sell-off inflicted heavy damage on altcoins while bitcoin’s month-to-date decline is modest. He compared bitcoin’s performance to large-cap tech stocks. The similarity, he argues, shows growing resilience.

That comparison matters. Bitcoin increasingly trades like a risk asset with institutional backing rather than a speculative lottery ticket. Large-cap tech drops when macro conditions deteriorate, but it doesn’t crater 30% in minutes. Neither did bitcoin on Friday.

Altcoins, by contrast, still behave like pure speculation vehicles. When fear spikes, they get hit first and hardest. Some will recover. Many won’t. Separating wheat from chaff gets harder after violent moves scramble the charts.

The divergence also reveals investor priorities during stress. Liquidity and credibility matter more than potential upside when panic sets in. Bitcoin offers both. Most altcoins offer neither.

Tariff Threats Are Just the Surface Story

Trump’s tariff announcement provided convenient timing for the crash. But macro tensions were already building. Stocks and crypto moving in opposite directions before the announcement signaled fragility.

Markets don’t break from single headlines unless they were already cracking. Friday’s plunge released pressure that had been accumulating. The tariff threat was the match, not the gasoline.

So focusing purely on trade policy misses the bigger picture. Leverage was too high. Positioning was too crowded. Complacency was too widespread. Something was going to trigger a reset. It just happened to be tariffs.

That means watching trade headlines alone won’t tell you whether the worst is over. You need to track the signals Erith outlined: technical levels, breadth, leverage proxies, and volatility. Those reveal whether the system has stabilized or remains brittle.