Bitcoin just smashed through $125,000 for the first time. That’s the headline everyone’s talking about.

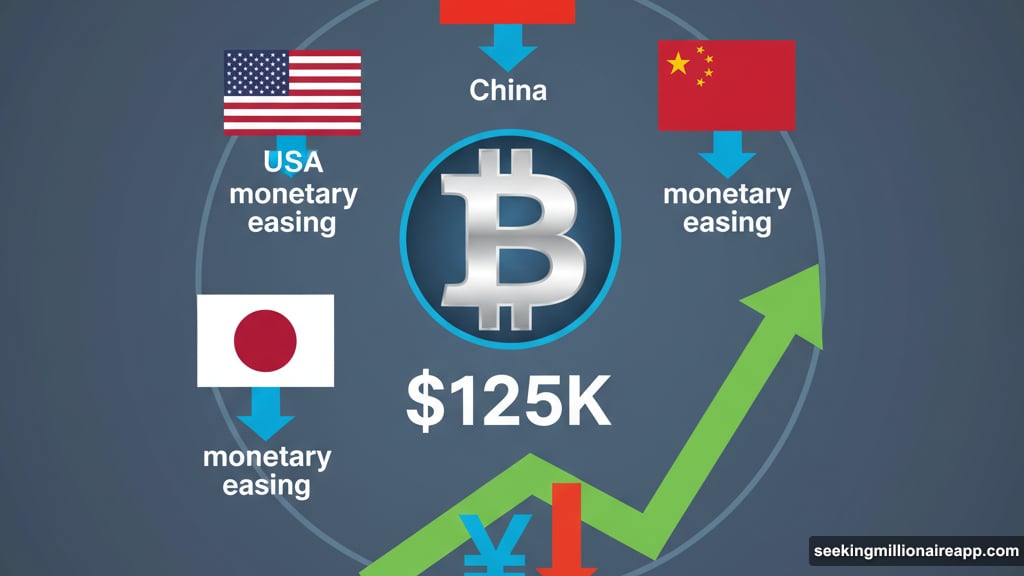

But here’s what matters more. The world’s three largest economies now all favor easier money policies. That’s massive support for risk assets. Plus, on-chain data shows big holders slowing their selling. So the bull case looks pretty solid.

Yet there’s one wrinkle worth watching.

Japan Just Changed the Game

Japan’s new prime minister openly backed “Abenomics.” That means aggressive monetary easing and fiscal stimulus. The yen weakened immediately. Bitcoin and Japanese stocks both hit record highs.

Why does this matter? Japan joins the U.S. and China in pursuing looser monetary policies. When the world’s economic giants all lean toward easing, asset prices typically rise. That includes crypto.

The yen dropped even as Japan’s Nikkei index surged to all-time highs. Meanwhile, bitcoin priced in yen reached its own record. That’s not coincidence. It’s currency debasement playing out in real time.

Whales Are Slowing Down Their Selling

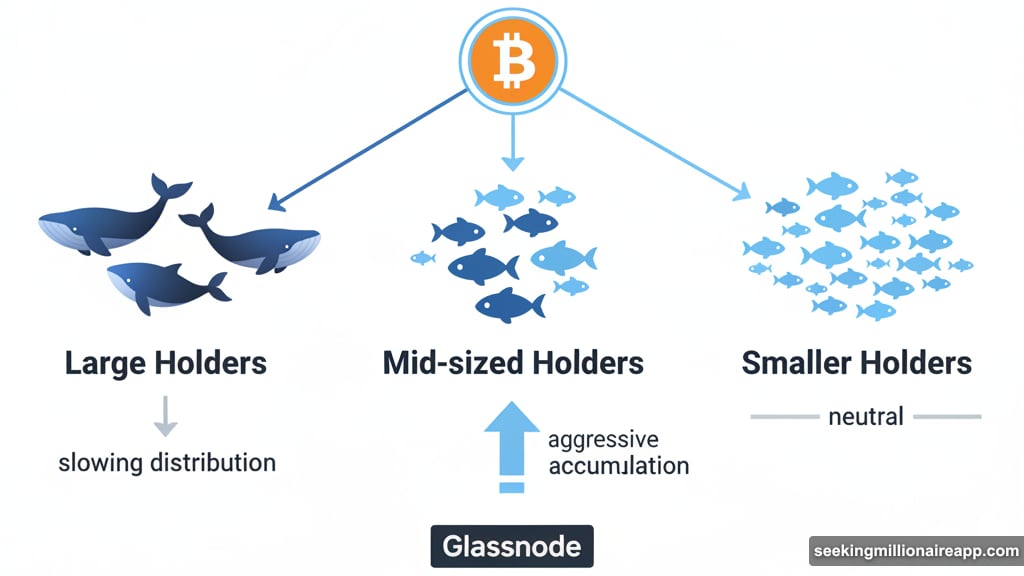

On-chain data reveals something interesting. Mid-sized bitcoin holders are accumulating aggressively. Large whale distribution has moderated. Smaller holders remain neutral.

Translation? Fresh demand is emerging despite continued selling from big holders. That’s a healthy sign for continued upside.

Glassnode noted that this pattern suggests “structural demand” rather than speculative froth. In past cycles, whale distribution accelerated before major corrections. This time, they’re slowing down even as prices hit new highs.

Plus, bitcoin dominance ticked up over the weekend. That means money is flowing into bitcoin specifically, not just crypto broadly. Traders are prioritizing the safest bet.

Record Inflows Keep Piling In

Digital asset products recorded $5.95 billion of inflows last week. That’s the biggest weekly total ever, according to CoinShares data.

Most of that money went into bitcoin ETFs. Spot BTC ETFs pulled in $985.1 million on Friday alone. Total holdings across these products now exceed 1.33 million bitcoin.

That’s real institutional capital. Not retail FOMO. Not leveraged speculation. Just steady accumulation from traditional finance players who previously sat on the sidelines.

Ethereum products also saw solid inflows of $233.5 million. Total ETH holdings in spot ETFs now exceed 6.74 million tokens.

Volatility Keeps Dropping

Here’s something counterintuitive. Bitcoin’s implied volatility keeps falling even as prices hit records.

Volmex’s bitcoin implied volatility index (BVIV) hovers near 40% annualized. That’s way down from 73% when BTC first crossed $100,000 last year.

Lower volatility signals market maturation. Six-figure prices no longer shock anyone. The market has adapted. That stability actually supports further upside because it attracts more conservative institutional buyers who avoid volatile assets.

Options markets show minimal fear too. Only short-term contracts display any call bias. Longer-dated options still lean slightly toward puts. That means traders aren’t pricing in explosive upside. No euphoria yet.

Altcoins Tell a Different Story

While bitcoin surged, most altcoins traded flat to negative on Monday. PUMP, ENA, NEAR and XMR all dropped over 5% in 24 hours.

The average relative strength index (RSI) across altcoins fell to 52.17, exiting overbought territory. That’s consolidation after recent gains.

Bitcoin dominance rising while altcoins stall suggests risk-off behavior within crypto. Traders are rotating from speculative tokens into bitcoin. That’s smart positioning if you expect choppiness ahead.

One exception: BNB surged over 4%, with open interest in BNB perpetuals jumping 10%. Activity on the Binance Smart Chain has picked up significantly this week.

The One Thing That Could Spoil This

Previous bear markets in crypto were triggered by counterparty risks. FTX. Terra/Luna. Three Arrows Capital. Each collapse sent bitcoin tumbling 70% or more.

So the question matters: Is there a ticking time bomb out there now?

I don’t see obvious candidates. But that’s always how it goes. The risks we don’t see are the ones that blow up. The U.S. government shutdown creates uncertainty. Funding issues could surface if it drags on.

Plus, wash trading allegations hit several altcoin projects recently. ASTER slumped after those accusations surfaced, though it recovered after listing on Binance. If major exchanges face regulatory action over suspicious trading, that could spook the market.

Stablecoin issuers also carry systemic risk. Plasma (XPL) faced negative sentiment around founding team token sales but recovered. Still, concentration in stablecoin reserves remains a vulnerability.

Derivatives Markets Show Mixed Signals

Bitcoin’s weekend rally to record highs drove open interest in perpetuals to the highest level since mid-August. Funding rates turned positive, meaning long positions are paying shorts.

But here’s the concern. Except for BNB, MNT, CRO and TRX, the top 30 tokens showed negative cumulative volume delta over 24 hours. That indicates net selling pressure.

XRP open interest nearly hit 3 billion tokens for the first time since July. That’s a lot of leveraged exposure. If XRP reverses, liquidations could cascade.

Ethereum open interest held flat despite bitcoin’s rally. That divergence is unusual. Typically ETH follows BTC’s lead in derivatives markets. The disconnect suggests uncertainty about Ethereum’s near-term prospects.

Traditional Markets Add Fuel

S&P 500 futures edged up 0.12% despite the government shutdown. Gold surged 1.38% to nearly $4,000 per ounce. Silver jumped 0.97%.

When both bitcoin and gold rally together, it signals concern about fiat currencies and government debt. Investors are hedging against monetary instability.

The U.S. dollar index (DXY) rose 0.72% to 98.43. Paradoxically, a stronger dollar often coincides with bitcoin rallies because global investors seek alternatives to their weakening local currencies.

Japanese stocks hitting record highs while the yen falls demonstrates this dynamic perfectly. Asset prices rise in nominal terms even as purchasing power erodes.

What Happens Next

Bitcoin faces resistance around $125,000. Options pricing suggests a 3% price swing in the week ahead. That means a range from roughly $121,000 to $129,000.

A clean break above $125,000 would confirm the bullish breakout. That could attract momentum traders and push prices toward $130,000 or higher.

But failure to hold above $125,000 might trigger profit-taking. Some analysts warn that could start a bear market, consistent with four-year halving cycles.

I’m skeptical of rigid cycle theories. Markets don’t follow calendars. They follow liquidity and sentiment. Right now, both favor bulls.

Still, watch for cracks in the foundation. Counterparty risks. Regulatory crackdowns. Leverage unwinds. Those are the threats that matter more than chart patterns.

Global monetary easing provides a strong tailwind. Whale accumulation looks healthy. Institutional inflows continue. Volatility remains manageable. Those factors support further upside.

But nothing goes up forever. Stay alert.