Bitcoin smashed through to record highs over the weekend. But the real story isn’t just about crypto prices climbing.

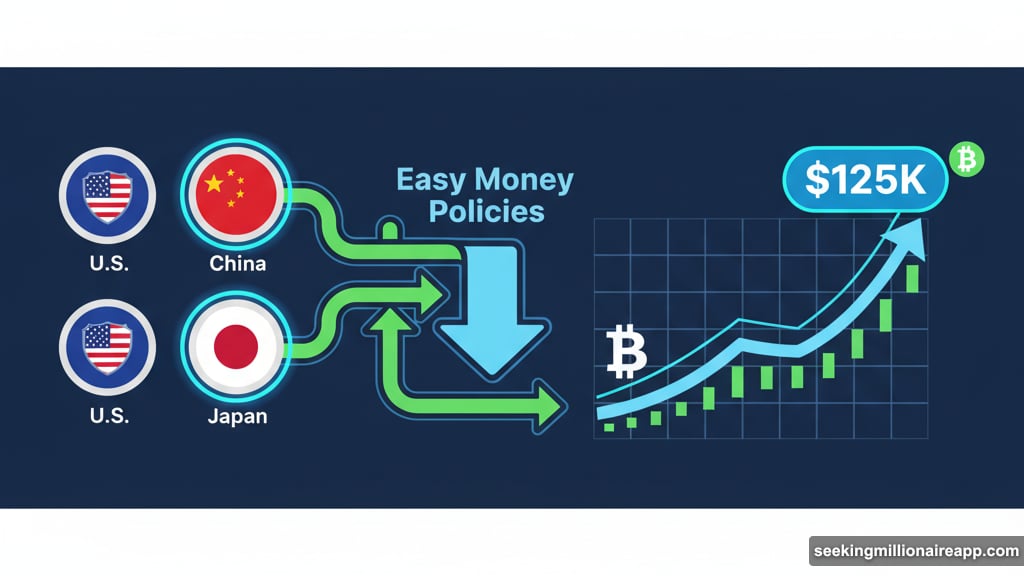

Japan’s new prime minister just pledged to revive aggressive monetary easing policies. That means all three of the world’s largest economies—the U.S., China, and Japan—are now pushing easy money. Plus, that creates a powerful tailwind for asset prices across every market.

So bitcoin’s rally looks less like a speculative blip and more like the start of something bigger.

Whales Slowed Their Selling

On-chain data backs up the bullish case. Mid-sized bitcoin holders are accumulating aggressively right now.

Meanwhile, whale distribution has moderated significantly. That’s a big shift from recent months when large holders dumped coins relentlessly. In fact, Glassnode notes that “fresh structural demand” is emerging despite continued selling from major players.

Smaller holders remain neutral. But the combination of whale restraint and mid-tier accumulation signals genuine demand beneath the surface. That’s not typical behavior before a major correction.

The data directly challenges fears that bitcoin faces a year-long bear market. Previous bear cycles were triggered by counterparty risk blowups. Is one brewing now? Hard to see where it would come from.

Four-Year Cycle Theory Takes Another Hit

Bitcoin’s behavior continues defying the so-called four-year halving cycle pattern. According to that theory, bitcoin should enter extended bear markets after each halving event.

Instead, we’re seeing sustained strength. Institutional adoption keeps accelerating. Regulatory clarity improved dramatically. And now macroeconomic tailwinds from major economies provide additional support.

The halving cycle theory worked when bitcoin was smaller and more speculative. Now the market has matured beyond simple cyclical patterns. Traditional financial dynamics matter more than mining reward schedules.

Altcoins Show Mixed Signals

While bitcoin dominance ticked up to 59%, altcoins traded in muted fashion Monday. Several tokens including PUMP, ENA, NEAR and XMR dropped over 5% in 24 hours. Meanwhile, ZEC, BNB and MNT posted modest gains.

The average relative strength index across altcoins now sits at 52.17—exiting overbought territory into neutral zone. That suggests consolidation rather than collapse. Moreover, traders are rotating from speculative tokens back into bitcoin as it approaches fresh highs.

One notable outlier: ASTER recovered after Binance listing, despite weekend wash trading allegations. Plus, Plasma (XPL) fended off negative sentiment around founding team token sales, rising from $0.85 to $0.94 before settling around $0.88.

Record Capital Inflows Continue

Digital asset investment products recorded a stunning $5.95 billion in inflows last week. That’s the largest weekly inflow ever recorded, according to CoinShares data.

The flood of institutional capital shows no signs of slowing. In fact, spot bitcoin ETFs pulled in $985.1 million just last Friday. Cumulative net flows into these products now exceed $60 billion. They collectively hold approximately 1.33 million BTC.

Even ethereum ETFs saw $233.5 million in daily net flows. Total ETH ETF holdings now stand at 6.74 million tokens. Interestingly, ether treasuries now own more circulating supply than bitcoin treasuries—a sign the market is maturing and capital rotation is becoming more deliberate.

Derivatives Signal Caution Despite Gains

Bitcoin’s weekend rally drove open interest in perpetuals to the highest level since mid-August. But funding rates remain moderate compared to previous euphoric peaks.

One concerning signal: Except for BNB, MNT, CRO, and TRX, the top 30 tokens showed negative cumulative volume delta over 24 hours. That indicates net selling pressure beneath the surface strength.

However, Volmex’s bitcoin implied volatility index (BVIV) tells a different story. The index remains in a downtrend near annualized 40%—significantly lower than the 73% observed when BTC first broke $100K last year. Lower volatility signals market maturation and growing acceptance of six-figure prices.

Japan’s Policy Shift Matters More Than You Think

Prime Minister Takaichi Sanae’s pledge to revive “Abenomics” carries major implications for global markets. The aggressive fiscal and monetary easing weakened the yen and lifted both bitcoin and equities to record highs over the weekend.

This represents a fundamental shift in global monetary policy coordination. When the world’s three largest economies simultaneously pursue easier monetary conditions, assets like bitcoin benefit enormously. The policy creates inflation concerns that drive investors toward scarce assets.

The yen slipped against the dollar even as Japan’s Nikkei index soared to record highs. That divergence shows investors betting on continued policy support rather than economic fundamentals. And bitcoin priced in yen hit all-time highs—a signal Japanese investors are seeking alternatives to their weakening currency.

Options Traders Stay Cautious

Despite bitcoin’s new highs, options pricing on Deribit suggests only modest upside expectations. Short-term options show a bias toward calls. But options from October 17 onward retain a moderate put bias.

That means traders are hedging against potential downside even while spot prices rally. Ethereum risk reversals display similar cautious positioning. The disconnect between spot strength and derivatives caution often precedes either major breakouts or sharp corrections.

CME bitcoin October futures traded positively, taking cues from bullish weekend spot action. However, the contract hasn’t yet reached its August 15 peak around $125,955. That suggests institutional futures traders remain slightly more conservative than spot market participants.

This isn’t necessarily bearish. In fact, it creates opportunity. If derivatives traders gradually shift to match spot market enthusiasm, that could fuel additional upside as positions get repriced.

Mining Stocks Surge on Multiple Fronts

Bitcoin mining stocks rallied sharply, with the CoinShares Valkyrie Bitcoin Miners ETF (WGMI) jumping 3.66% and gaining another 5.17% in pre-market trading.

Major miners posted strong gains: MARA Holdings rose 0.16% with another 3.51% pre-market. CleanSpark surged 5.28% with an additional 3.45% after hours. Core Scientific dipped 1.55% but stabilized in pre-market trading.

The rally extends beyond just bitcoin price correlation. AI and high-performance computing miners are attracting fresh attention after AMD soared 30% on an OpenAI deal. That validates the thesis that mining infrastructure can serve dual purposes—both cryptocurrency validation and AI computation.

Corporate Treasuries Keep Stacking

Strategy (MSTR) reported $3.9 billion in bitcoin gains during Q3. However, the company didn’t make any weekly bitcoin purchases for the first time since April. That pause raised questions about whether corporate accumulation is slowing.

Still, the overall trend remains intact. BitMine Immersion added $821 million in ether, bringing combined cash and crypto holdings to $13.4 billion. These treasury strategies continue validating bitcoin and crypto as legitimate corporate reserve assets.

Galaxy launched a new app offering 4%-8% yields, directly competing with Robinhood and Coinbase. The stock jumped 8% on the news. This shows how crypto companies are expanding beyond trading into full financial services—another sign of market maturation.

Volatility Collapsed From Last Year

When bitcoin first crossed $100K last year, implied volatility measured 73% annualized. Today, with BTC at $125K, that figure sits near 40%. The dramatic compression signals several important shifts.

First, the market is getting comfortable with six-figure prices. Wild swings no longer accompany new highs. Second, institutional participation dampens volatility as larger players trade with more discipline. Third, improved liquidity means individual trades move prices less dramatically.

Lower volatility attracts additional institutional capital. Many funds face strict risk parameters that prevent investing in highly volatile assets. As bitcoin’s volatility profile improves, those restrictions ease. That creates a virtuous cycle of increasing institutional adoption and further volatility reduction.

The pattern mirrors gold’s evolution from speculative commodity to reserve asset. Bitcoin appears following a similar path—just much faster.

Bitcoin’s fresh highs came with significant fundamental support this time. Japan’s monetary policy shift, continued institutional inflows, moderating whale selling, and compressed volatility all point toward sustained strength.

The four-year cycle theory looks increasingly outdated. Bitcoin now responds more to macroeconomic conditions and institutional flows than mining reward schedules. Plus, with three major economies pursuing easy money simultaneously, the macro backdrop strongly favors scarce assets.

Watch the derivatives markets closely. If options traders shift from cautious to bullish, that could spark the next major leg higher. But for now, the combination of spot strength and futures caution creates an interesting setup for patient traders.