Bitcoin blasted past $126,000 this October. Record highs. Perfect seasonality. Classic FOMO setup.

But here’s the thing. Buying spot BTC at all-time highs feels risky. Plus, options traders have smarter ways to capture upside while limiting downside exposure.

Let’s break down three bullish strategies analysts actually recommend when Bitcoin trades at record levels.

Call Spreads Cap Your Risk

Markus Thielen from 10x Research prefers call spreads over naked call purchases. Smart reasoning.

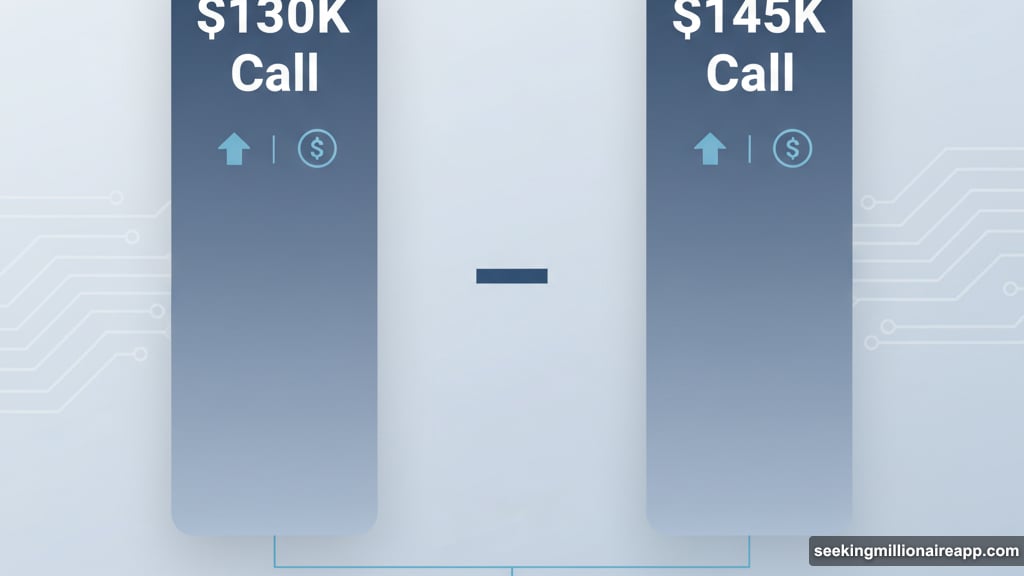

A call spread works like this. You buy a call option at one strike price. Then you immediately sell another call at a higher strike. Both expire on the same date.

For example, buy a $130,000 call and sell a $145,000 call. Your maximum profit gets capped at $15,000 per contract. But your maximum loss stays limited to whatever you paid upfront for the spread.

Why does this matter? Because Bitcoin at record highs means expensive implied volatility. Call spreads reduce that cost significantly. Plus, you still participate in further upside without overpaying for vol.

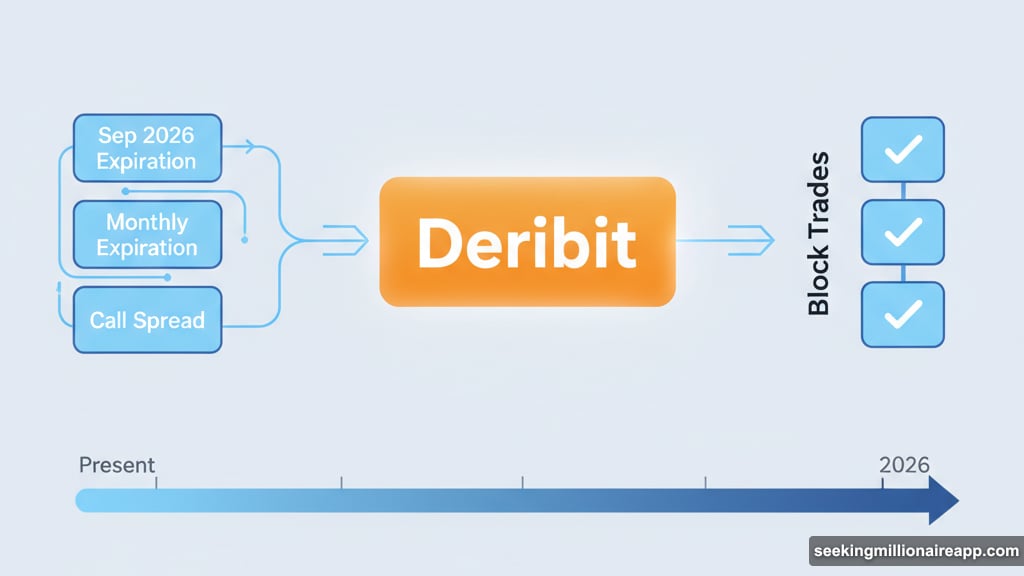

Block trades on Deribit confirm this trend. Traders are booking call spreads heavily. Some stretch out to September 2026. Others target monthly expirations for shorter-term plays.

Financing Spreads With Puts

Greg Magadini from Amberdata suggests an even more aggressive approach. Finance your call spreads by selling out-of-the-money puts.

Here’s how it works. Sell a put option below current prices. Use those proceeds to buy multiple call spreads instead of a single outright call. This strategy minimizes your upfront cost while capturing potential gains.

Sounds perfect? Not quite. Selling puts creates downside obligation.

If Bitcoin crashes below your put strike, you’re obligated to buy BTC at that higher price. That risk can exceed the initial credit you received from selling the put. So this strategy works best when you’re confident Bitcoin won’t collapse.

Currently, BTC calls trade cheaper than puts. That makes this financing strategy more attractive than usual. But remember the risk profile changes dramatically compared to a simple call spread.

OTM Calls for Pure Upside

Some traders prefer keeping things simple. Just buy out-of-the-money calls with one to two month expirations.

This approach delivers pure upside exposure. Your maximum loss equals the premium you paid. Nothing more. No obligation to buy BTC if prices fall.

The downside? OTM calls cost more than call spreads. Plus, time decay works against you. If Bitcoin consolidates or pulls back slightly, your calls lose value fast.

Still, for traders who want straightforward bullish exposure without complex multi-leg strategies, OTM calls get the job done. Just don’t overpay for vol.

October’s Bullish Seasonality

Why chase Bitcoin at record highs? Because October historically delivers.

Bitcoin tends to rally during Q4. Seasonal patterns favor bulls. This year’s run past $126,000 confirms that trend remains intact.

That said, profit-taking could trigger sudden corrections. Nobody wants to buy the absolute top. Options strategies help solve that problem by defining your risk upfront.

The Hodl Strategy Still Wins

Here’s what analysts won’t always tell you. For long-term exposure, simply buying and holding BTC beats everything.

Since 2011, Bitcoin climbed from $1 to over $120,000. That’s a return no option strategy can match over extended periods. Hodling eliminates expiration risk, time decay, and complex position management.

But if you’re specifically trying to play this October rally without massive capital outlay, options provide leverage and defined risk. That’s their advantage.

What Works Best Right Now

Call spreads make the most sense at these levels. They balance upside participation with controlled downside risk. Plus, they’re significantly cheaper than outright call purchases when vol is elevated.

Financing with puts adds complexity and risk. Only consider it if you’re comfortable owning BTC at lower levels. Otherwise, stick with simple call spreads.

And remember, just because Bitcoin hit new highs doesn’t mean the rally continues uninterrupted. Define your risk. Know your maximum loss. Don’t let FOMO drive position sizing.