Bitcoin just pushed past $88,900. The total crypto market cap hit $2.98 trillion. And traders are positioning for what comes next.

Three specific developments drove today’s gains. Plus, one altcoin surged 33% on heavy volume. Let’s break down what’s actually moving prices right now.

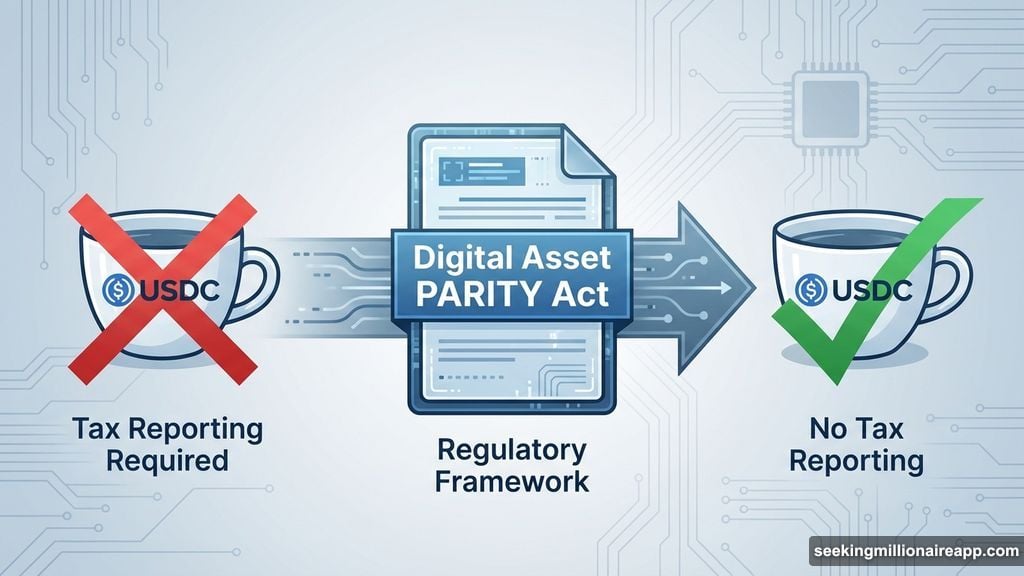

Stablecoin Tax Bill Changes the Game

Two US House lawmakers just introduced the Digital Asset PARITY Act. This bipartisan draft creates a limited tax safe harbor for stablecoin payments.

Here’s why that matters. Current tax rules treat every crypto transaction as a taxable event. Buy coffee with USDC? That’s technically a reportable transaction. This complexity killed mainstream crypto payments before they started.

The new proposal aligns crypto taxation with everyday consumer use. So stablecoins could finally work like cash for small purchases. No tax reporting for minor transactions means people might actually use crypto for payments.

Moreover, bipartisan support signals real momentum. When both parties back crypto legislation, passage becomes more likely. Markets responded positively to this rare show of political alignment on digital assets.

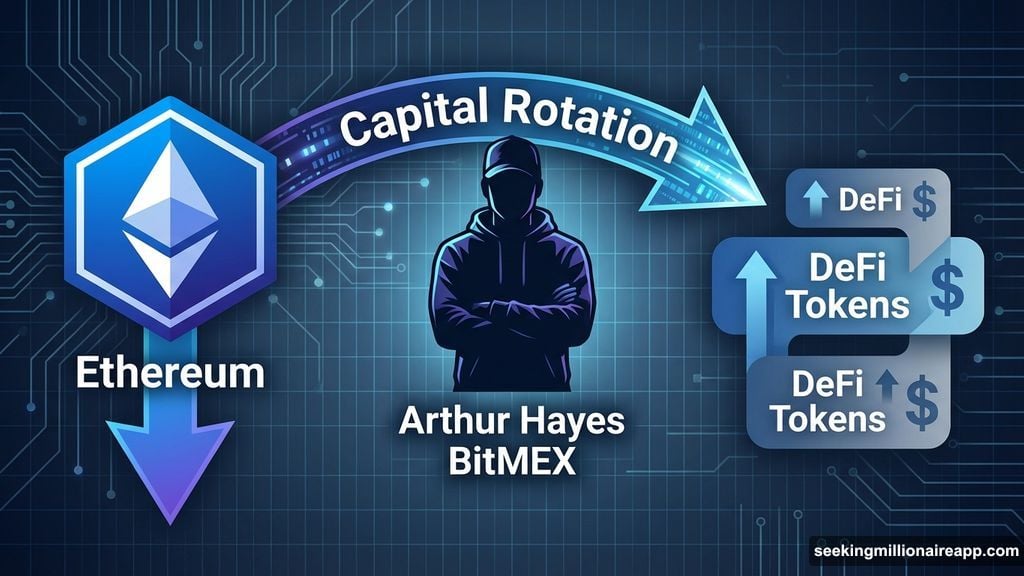

Arthur Hayes Rotates Into DeFi Tokens

On-chain data shows Arthur Hayes moving capital out of Ethereum. Instead, he’s buying specific DeFi tokens worth millions of dollars.

This matters because Hayes manages BitMEX’s former operations. His moves often signal shifts in institutional thinking. When he repositions this aggressively, other large holders take notice.

Hayes recently commented on improving global liquidity conditions. His portfolio shift backs up those words with actual capital. He’s clearly betting that DeFi protocols will outperform ETH in the near term.

The timing aligns with broader market trends. DeFi tokens have underperformed for months. But liquidity conditions are changing. Hayes appears to be front-running a potential sector rotation before it becomes obvious.

Market Cap Targets $3 Trillion Breakout

The total crypto market cap stands at $2.98 trillion right now. That’s up $23 billion in just 24 hours. And $3.00 trillion sits just above as a crucial psychological level.

Breaking above $3 trillion would restore investor confidence. This round number acts as a mental threshold. Once markets push through, fresh capital typically follows. Fear of missing out kicks in. New money enters the space.

Bitcoin itself is holding above $88,210 support. This level previously capped upside earlier this month. Flipping resistance into support suggests short-term stability has returned.

The next target sits at $90,308. If Bitcoin can break above this threshold, momentum improves significantly. That would likely pull altcoins higher and extend the current recovery attempt.

However, risks remain on the downside. A failure to sustain momentum could trigger profit-taking. Bitcoin might retreat to $86,361 support if bullish conditions fade. The crypto market cap could drop to $2.85 trillion in that scenario.

Midnight Prints New All-Time High

One altcoin is absolutely crushing it today. Midnight (NIGHT) surged 33% to hit a new all-time high at $0.0196. It’s currently trading near $0.091 as of this writing.

This rally reflects strong demand and accelerating price discovery. When tokens print new highs on heavy volume, it signals genuine interest. Traders are clearly rotating capital into NIGHT as they chase momentum.

The broader market tailwinds are helping. With Bitcoin stable above $88K, altcoins have room to run. NIGHT could extend gains toward $0.100 if momentum continues. That’s a clean psychological level that often acts as a magnet for price.

But the downside risk exists too. If buying pressure fades, profit-taking could push NIGHT back to $0.075 support. Breaking below that level would invalidate the bullish setup and increase volatility.

What Happens Next

Three trillion dollars is the number to watch. The crypto market cap needs to flip this level into support for a sustained recovery. Short-term momentum looks positive, but confirmation requires follow-through buying.

Bitcoin’s behavior at $90,308 will tell us a lot. A clean breakout above this resistance would likely trigger additional upside. Failure to break through might signal exhaustion and invite sellers back into the market.

Meanwhile, watch for capital rotation between sectors. Hayes isn’t the only one repositioning right now. DeFi tokens, layer-1 chains, and infrastructure plays are all competing for liquidity. The winners will be obvious in the next few weeks.

The stablecoin tax proposal matters more than most people realize. If it passes, crypto payments could finally work like actual money. That’s a fundamental shift that goes beyond short-term price action.

Stay alert. Markets are moving fast, and positioning for the next leg requires paying attention to both macro developments and on-chain flows.