Bitcoin’s supposed to be digital gold, right? A store of value that zigs when traditional markets zag. That playbook just got torched.

While the S&P 500, gold, silver, and AI tech stocks smash through record highs, Bitcoin has tanked hard. It’s a head-scratcher that’s got even veteran traders questioning what they thought they knew. Plus, the metrics analysts watch closely are flashing warnings most investors haven’t noticed yet.

The Gold Ratio Reveals Bitcoin’s Hidden Weakness

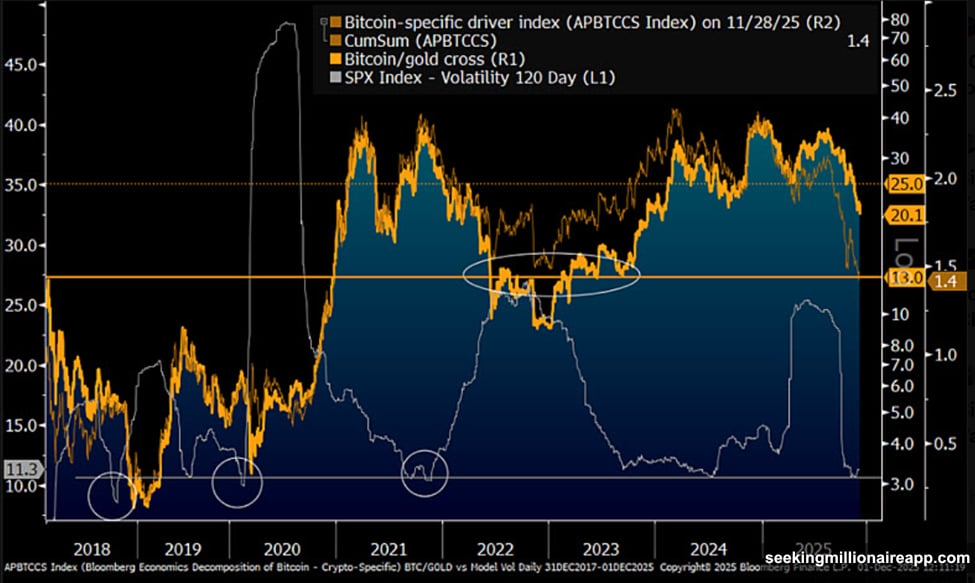

Bloomberg’s Mike McGlone just dropped a critical observation. The Bitcoin-to-gold ratio crashed to roughly 20x on December 1st. That’s a brutal 50% drop from the 40x peak right after Trump’s reelection win.

Why does this matter? This ratio has historically measured Bitcoin’s strength against the ultimate safe haven asset. When it drops this sharply, it signals that Bitcoin is underperforming relative to traditional risk hedges.

Think about what that means. Gold is hitting all-time highs. Bitcoin is bleeding. That’s not supposed to happen in a risk-on environment. Moreover, this divergence typically precedes increased market volatility.

So traders holding heavy crypto positions might be sitting on a powder keg. If the ratio keeps falling, Bitcoin could revisit much lower relative levels versus gold. That’s bad news for anyone who bought the “digital gold” narrative without understanding the nuances.

This Sell-Off Makes Zero Sense

Jeff Dorman, CIO at Arca, called this one of the strangest crypto sell-offs he’s ever witnessed. And he’s not wrong.

Look at the macro backdrop. The Federal Reserve is cutting rates. Consumer spending remains strong. Corporate earnings hit records. AI-driven tech companies are printing money. Plus, equities and credit markets are thriving.

Everything about this environment screams “risk on.” Yet Bitcoin is getting crushed. Meanwhile, all the usual FUD excuses don’t hold water this time.

MicroStrategy isn’t dumping. Tether isn’t insolvent despite endless rumors. Digital asset treasuries aren’t selling. Nvidia didn’t blow up. The Fed isn’t turning hawkish. So what gives?

The Real Problem: Missing Money

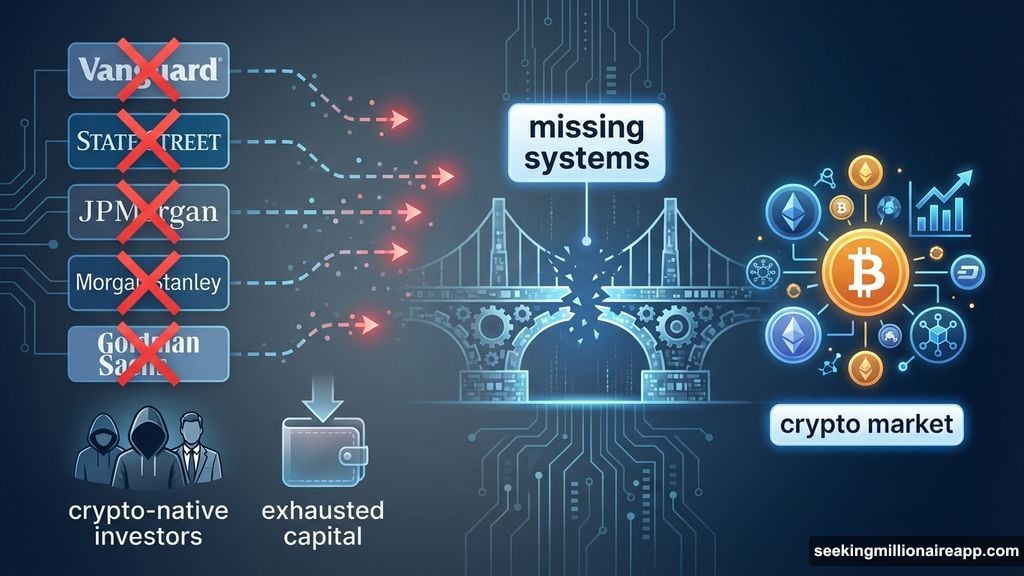

Dorman identified the structural issue nobody wants to admit. Crypto-native investors have exhausted their capital. They’ve been buying for months and simply ran out of cash.

But where’s the institutional money? Major players like Vanguard, State Street, JPMorgan, Morgan Stanley, and Goldman Sachs still aren’t buying in meaningful amounts. Sure, they’ve dipped their toes with Bitcoin ETFs. However, the systems allowing them to buy seamlessly across crypto markets don’t exist yet.

That creates a liquidity crisis. Retail and crypto funds already spent their ammunition. Traditional institutions can’t easily deploy capital even if they wanted to. Therefore, Bitcoin lacks the buying pressure needed to keep pace with surging traditional assets.

Here’s the kicker. Once these institutions build the infrastructure to buy effortlessly, we’ll likely see explosive upside. But until then? Crypto is stuck in neutral while everything else races ahead.

What This Means for Your Portfolio

The falling Bitcoin-to-gold ratio signals potential short-term pain. Historically, sharp declines in this metric have preceded increased volatility. So if you’re overweight crypto, you might want to reassess your risk exposure.

However, this divergence also creates opportunity. Bitcoin dropping while fundamentals remain strong? That’s either a warning sign or a buying opportunity, depending on your time horizon.

For long-term holders, the absence of institutional flows suggests massive pent-up demand. When Vanguard and company finally arrive, the capital influx could be staggering. But that’s a “when,” not an “if.” Nobody knows the timeline.

Meanwhile, the market is telling us something important. Bitcoin’s correlation with traditional risk assets just broke down completely. That either means crypto is discovering a new identity, or this divergence will eventually snap back violently in one direction.

The Uncomfortable Truth

Bitcoin promised to be different. A hedge against inflation. Digital gold. An uncorrelated asset that protects portfolios when stocks stumble.

Except right now, it’s doing none of those things. Instead, it’s falling while inflation hedges like gold surge. It’s bleeding while stocks and AI tech make investors rich. Plus, it’s showing weakness exactly when it should be showing strength.

Maybe this is just a temporary disconnect. Markets rarely move in perfect lockstep forever. But the Bitcoin-to-gold ratio doesn’t lie. It’s screaming that something fundamental has shifted in how investors value crypto relative to traditional safe havens.

So the question becomes: Is this a buying opportunity before institutional money arrives? Or is Bitcoin revealing that its narrative never matched reality? Your answer to that question should determine what you do next.