Bitdeer Technologies stock jumped 30% in days. Now analysts say it still has 50% upside left.

Wall Street doesn’t hand out praise easily. So when Benchmark analyst Mark Palmer bumped his price target from $24 to $38, people noticed. Plus, the stock already rallied 70% in two months. What’s driving this sudden enthusiasm?

The answer isn’t just bitcoin mining anymore. Bitdeer is pivoting hard into artificial intelligence data centers. And they’re doing it in a way that could completely change their business model.

The AI Data Center Play Nobody Saw Coming

Most bitcoin miners stick to what they know. They buy mining rigs, secure power contracts, and hope BTC prices cooperate.

Bitdeer took a different path. The company announced plans to develop AI and high-performance computing (HPC) data centers entirely in-house. That means controlling everything from power procurement to facility design to operations.

Why does this matter? Because margins in AI infrastructure dwarf traditional mining profits. Data center operators can lock in long-term contracts with tech companies desperate for computing power. Bitcoin mining, meanwhile, depends on volatile crypto prices and ruthless competition.

Palmer’s report spelled it out clearly. By bringing development in-house, Bitdeer captures more of the value chain. No middlemen. No third-party developers eating into profits. Just direct control over roughly 3 gigawatts of global power capacity across five countries.

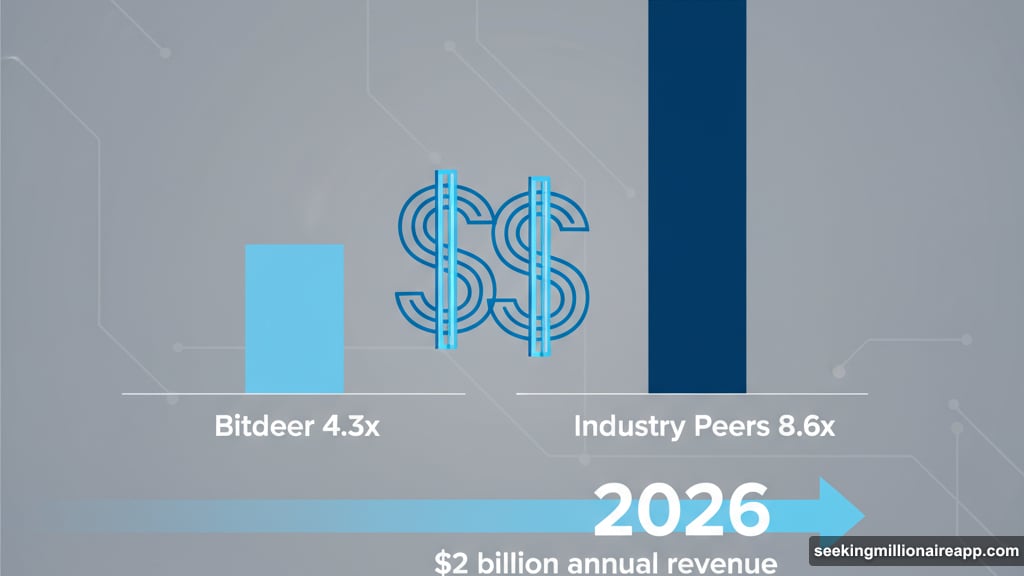

That 3 GW pipeline could generate over $2 billion in annual revenue by late 2026. For context, Bitdeer’s current market cap sits around $2.5 billion. So they’re potentially doubling their business in 18 months.

Two Sites Leading the Charge

Bitdeer isn’t just talking about AI expansion. They’re actively converting existing facilities.

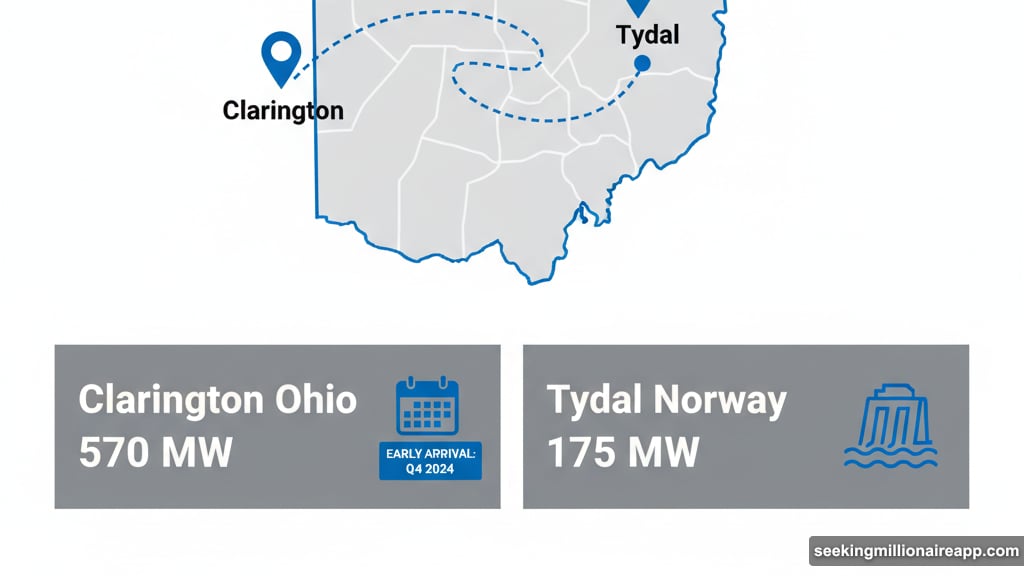

Take the Clarington, Ohio site. Originally designed for bitcoin mining, it’s being built with flexibility to switch to AI workloads. The local utility just confirmed 570 megawatts of power will arrive nearly a year early. That’s enough juice to power hundreds of thousands of high-end graphics processors.

Meanwhile, the company’s 175 MW Tydal Phase 2 facility in Norway is getting converted into a dedicated AI data center by end of 2026. Norway’s cheap hydroelectric power and cold climate make it perfect for energy-intensive computing. Plus, converting an existing site costs way less than building from scratch.

Both projects share a key advantage. Bitdeer already secured the power contracts and land rights. Most AI infrastructure companies struggle for months just to line up reliable electricity. Bitdeer solved that problem years ago while building mining operations.

The Valuation Gap Is Ridiculous

Here’s where things get interesting. Bitdeer trades at 4.3 times its projected 2026 enterprise value to revenue ratio.

Industry peers average 8.6 times. That’s almost double. So either the market thinks Bitdeer will fail at AI expansion, or the stock remains seriously underpriced.

Palmer clearly believes it’s the latter. His $38 price target implies the market will eventually value Bitdeer closer to peer multiples as AI revenue materializes. And with concrete projects already underway, that timeline might be shorter than most realize.

The stock hit $25.65 in early trading after the Benchmark report dropped. That’s still 48% below Palmer’s target. For a company with signed power contracts, operating facilities, and a clear path to AI revenue, that gap seems hard to justify.

Bitcoin Mining Isn’t Going Away

Don’t mistake this for abandoning crypto. Bitdeer’s new SEALMINER rigs continue churning out bitcoin. The company maintains significant self-mining operations alongside its AI ambitions.

But here’s the clever part. Modern data center infrastructure works for both bitcoin mining and AI computing. The same power delivery systems, cooling setups, and facility designs serve both purposes. So Bitdeer can shift capacity based on market conditions.

Bitcoin price rallying? Allocate more power to mining. AI demand surging? Convert facilities to HPC workloads. That flexibility creates a natural hedge most pure-play miners lack.

Jeffrey Thomas just joined as head of AI strategy. He brings decades of data center experience from major tech companies. His hire signals this isn’t a side project. Bitdeer is building an entirely new division focused on large-scale infrastructure development.

The Risks Nobody’s Mentioning

Let’s be honest. Executing this strategy won’t be easy.

AI data centers require different expertise than bitcoin mining. You’re dealing with enterprise clients, complex service level agreements, and demanding uptime requirements. One prolonged outage could tank relationships worth millions in annual recurring revenue.

Power costs matter more than ever. While Bitdeer secured favorable contracts, electricity prices fluctuate. A sustained spike could crush margins before AI revenue ramps up enough to offset it.

Competition is brutal. Hyperscalers like Amazon, Microsoft, and Google build their own facilities. Specialized providers like Equinix and CoreWeave compete aggressively for every major AI workload. Bitdeer enters a crowded market with deep-pocketed rivals.

And timing could work against them. If AI demand cools before late 2026, those planned facilities might sit underutilized. That’s a lot of capital deployed with uncertain payoff.

Why This Could Actually Work

Despite the risks, Bitdeer has real advantages most AI infrastructure startups lack.

First, they already own the power contracts. In today’s market, securing gigawatts of reliable electricity takes years. Bitdeer solved this problem while building mining operations. Now they’re leveraging that work for higher-margin business.

Second, they understand energy-intensive computing better than most data center operators. Bitcoin mining taught them how to operate at maximum efficiency under brutal cost pressure. Those skills translate directly to AI infrastructure.

Third, their global footprint spreads risk. Sites in the U.S., Norway, Bhutan, Canada, and Ethiopia provide geographic diversification. If one region faces regulatory issues or power constraints, others keep generating revenue.

Finally, the dual-use approach creates optionality. Pure AI data center plays bet everything on sustained computing demand. Bitdeer can shift gears if market conditions change. That flexibility carries real value.

Palmer’s price target assumes this strategy succeeds. But even partial success could justify significant upside from current levels. The company doesn’t need to dominate AI infrastructure. They just need to convert a fraction of that 3 GW pipeline into profitable data center operations.

Benchmark’s upgrade makes one thing clear. Wall Street is starting to view Bitdeer as more than a bitcoin miner. The AI pivot changes the investment thesis completely. Whether that’s enough to justify a $38 stock price depends on execution over the next 18 months.

One thing seems certain. Bitdeer won’t be a boring mining stock much longer. They’re betting big on AI infrastructure. And with power contracts in hand, they might just pull it off.