Bitcoin mining difficulty crashed 11% this week. That’s the steepest drop since China banned crypto mining back in 2021.

But here’s the twist. This time, it’s not government crackdowns causing the chaos. It’s something far more unpredictable: brutal winter weather and surging energy costs. Plus, Bitcoin prices hovering below $70,000 are squeezing profit margins to the breaking point.

Mining operations across North America are shutting down. Some temporarily. Others for good.

What Actually Happened to Mining Difficulty

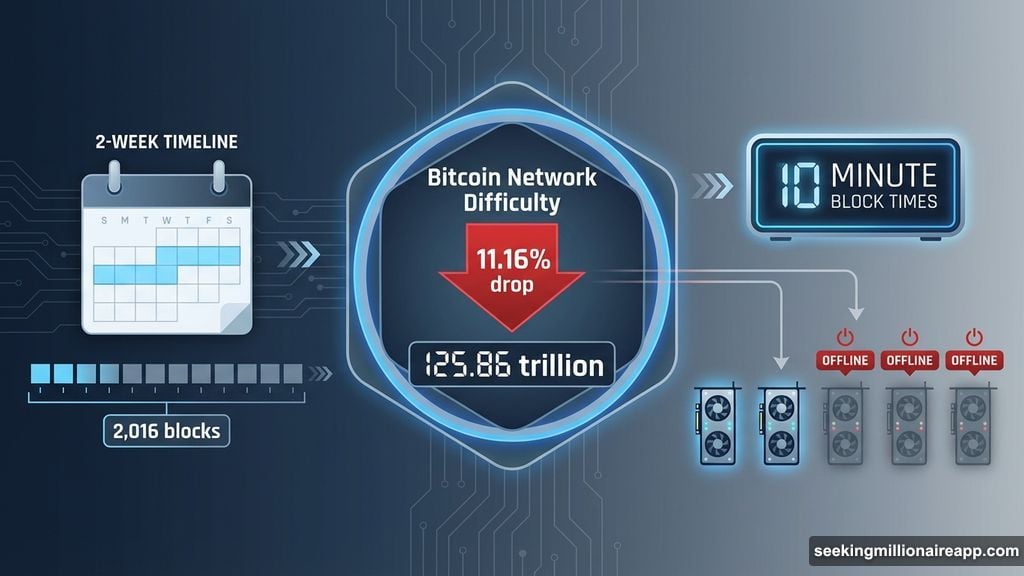

Bitcoin’s network difficulty plummeted to 125.86 trillion this week, according to Mempool developer Mononaut. That’s a massive 11.16% drop in just one adjustment period.

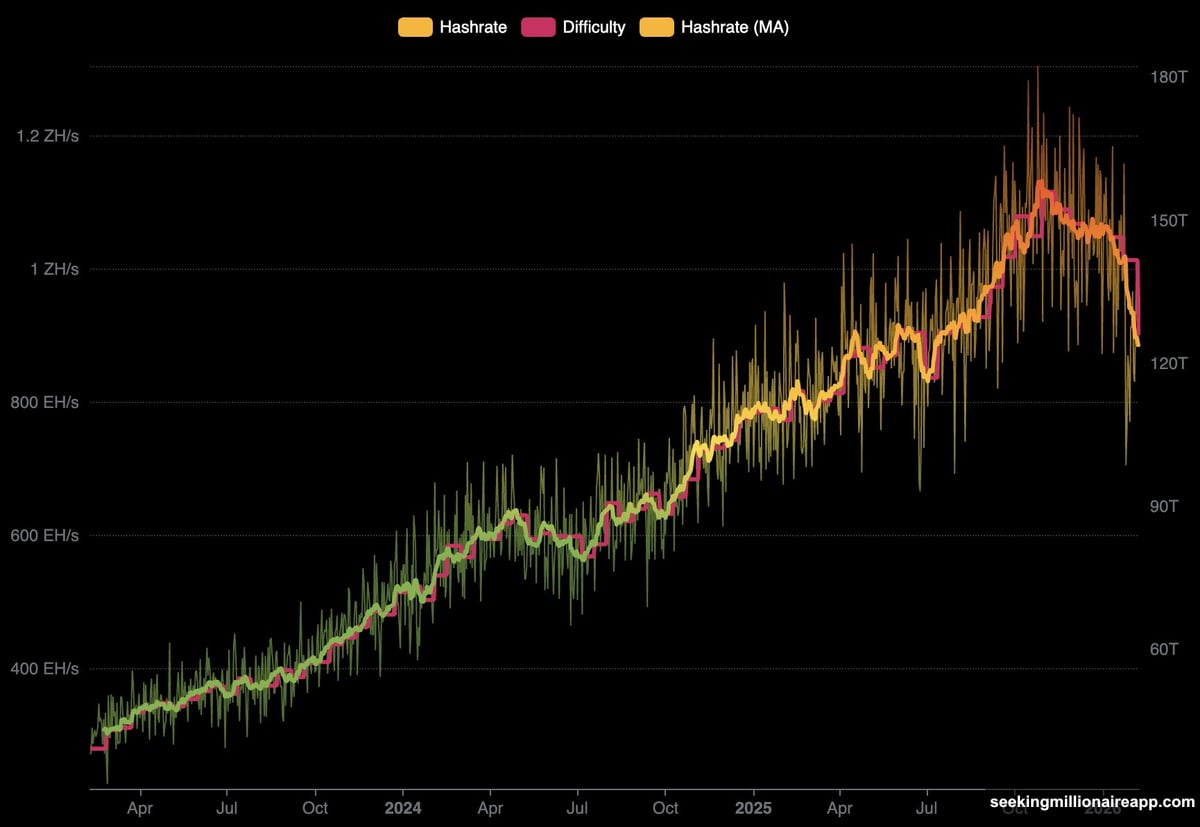

For context, mining difficulty measures how hard it is to find new Bitcoin blocks. The network adjusts this metric every 2,016 blocks (roughly two weeks) to maintain consistent 10-minute block times.

When miners go offline, blocks take longer to produce. So the protocol automatically lowers difficulty to compensate. It’s Bitcoin’s built-in stabilization mechanism.

This week’s drop signals something serious. Miners aren’t just taking short breaks. They’re pulling the plug entirely.

Winter Storms Crushed North American Mining Operations

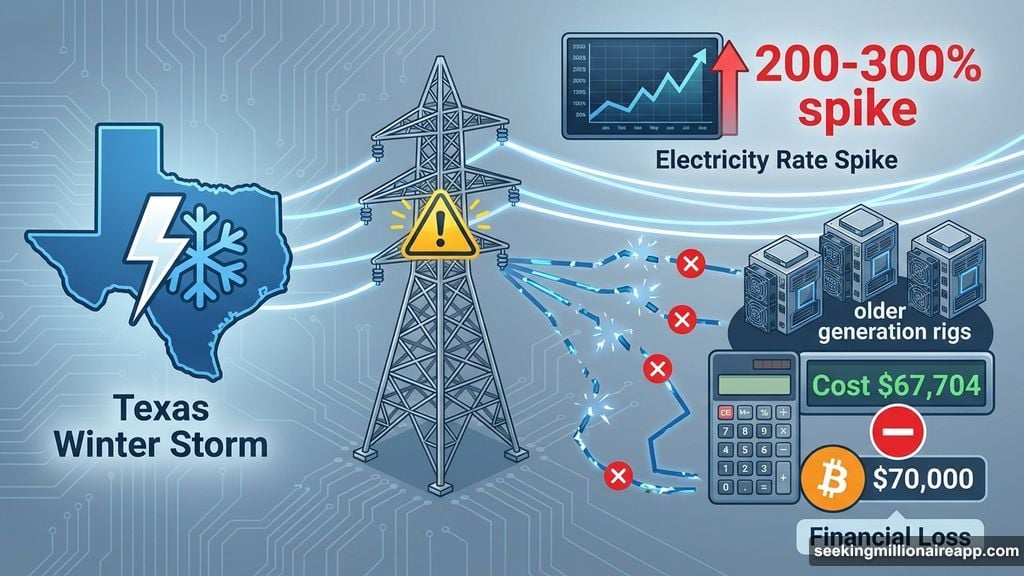

Severe winter storms slammed North America in late January. Power grids buckled under the strain. Texas, home to massive mining clusters, got hit especially hard.

Many Bitcoin miners participate in “demand response” programs in states like Texas. These arrangements let miners cut power usage during peak demand in exchange for energy credits. Sounds like a win-win.

But this wasn’t routine grid management. Storm damage and extreme cold sent electricity prices skyrocketing. Spot power rates surged beyond what most mining operations could absorb.

Here’s where it gets worse. Older mining hardware operates on razor-thin margins even in good conditions. When power costs spike 200-300%, those rigs instantly become money losers. Mining Bitcoin costs more than the Bitcoin is worth.

So operators faced a choice. Keep burning cash or shut down. Most chose survival.

Mining Profitability Turned Negative for Many Operators

Ki Young Ju, CEO of analytics firm CryptoQuant, revealed some eye-opening numbers. Marathon Digital, one of the industry’s largest players, spent approximately $67,704 to mine a single Bitcoin in Q3 2025.

Now look at Bitcoin’s price. It’s trading below $70,000. That means Marathon was barely breaking even before the storms hit. After accounting for other operational expenses, they were likely losing money on every Bitcoin mined.

Marathon isn’t alone. Most miners running previous-generation hardware face similar economics. When Bitcoin traded above $90,000, these operations stayed profitable. But prices dropped. Costs climbed. The math stopped working.

And unlike 2021’s China ban, which affected everyone equally, this crisis hits inefficient operators hardest. Modern, energy-efficient mining rigs can weather higher power costs. Older equipment simply can’t compete.

This Looks Different Than China’s 2021 Crackdown

The 2021 difficulty drop came from political intervention. China banned crypto mining overnight. Massive operations went dark within weeks. Hashrate plummeted.

But that was geopolitical shock, not economic failure. Those miners relocated to friendlier jurisdictions. Within months, many were back online.

This situation plays out differently. Weather will improve. Power prices will stabilize. But economic pressure won’t disappear as quickly.

Operators who shut down older hardware may not restart it. Why? Because even when conditions normalize, Bitcoin prices below $70,000 make those rigs unprofitable. Restarting them means accepting losses.

So this difficulty drop might not reverse quickly. Some of that lost hashrate could stay offline permanently.

What Comes Next for Bitcoin Mining

Short term, remaining miners benefit. Lower difficulty means easier block discovery. Their existing hardware becomes more profitable overnight.

But the industry faces deeper questions. Climate volatility isn’t going away. Extreme weather events hit more frequently. Energy grids face increasing stress.

Miners built massive operations in regions with cheap power and favorable regulations. Now they’re learning those advantages come with hidden costs. Weather-related shutdowns. Grid instability. Unpredictable energy prices.

Plus, Bitcoin’s price action remains uncertain. If BTC pushes above $80,000, struggling miners get relief. Below $65,000? Expect another wave of shutdowns.

The next difficulty adjustment arrives in two weeks. Watch closely. Another major drop would signal serious industry distress.

The Bigger Picture Nobody Wants to Discuss

Bitcoin mining was supposed to stabilize. Institutional players like Marathon brought professional management and capital efficiency. Industry analysts predicted steady growth.

Instead, we’re watching economic Darwinism play out in real time. Efficient operations survive. Inefficient ones die. That’s how markets work.

But here’s what bothers me. The industry’s geographic concentration creates systemic vulnerability. Too much hashrate sits in regions prone to extreme weather. One big storm can knock 10% of the network offline.

Decentralization was Bitcoin’s promise. Yet mining has become remarkably centralized in specific locations. That creates risk. This week proved it.

Miners will adapt. They always do. Some will relocate. Others will upgrade hardware. A few will exit entirely. The network survives regardless.

But the illusion of mining as a stable, predictable business just took a major hit. Weather and energy markets don’t care about your investment thesis. Neither does Bitcoin’s protocol.

The difficulty will adjust. Blocks will keep coming. That’s the beauty of Bitcoin’s design. It doesn’t need miners to be profitable. It just needs miners to exist.