The weekend might bring more than just market volatility. Reports now suggest a US military strike on Iran could happen within days, and Bitcoin traders are watching closely.

Bitcoin was holding near $66,400 on February 19, but that stability feels fragile. Beneath the surface, on-chain data tells a story of fear, stress, and investors quietly heading for the exits.

US Military Options Are Ready, Pentagon Says

Multiple American media outlets confirmed that US military officials have already briefed President Donald Trump on strike options against Iran. Those options, according to reports, could be executed as early as this weekend.

The Pentagon has moved fast. A second carrier strike group is now heading toward the Middle East. Additional aircraft have been deployed. On the other side, Iran has conducted military exercises and publicly warned it would retaliate if attacked.

These tensions follow months of stalled nuclear talks. Iran’s continued uranium enrichment and missile development programs have pushed diplomacy to a breaking point. The White House says it prefers a diplomatic resolution, but military action remains firmly on the table.

Satellite images recently surfaced showing Iran constructing concrete shields over military sites, which analysts interpret as preparation for potential strikes.

Short-Term Holders Are Already Selling at a Loss

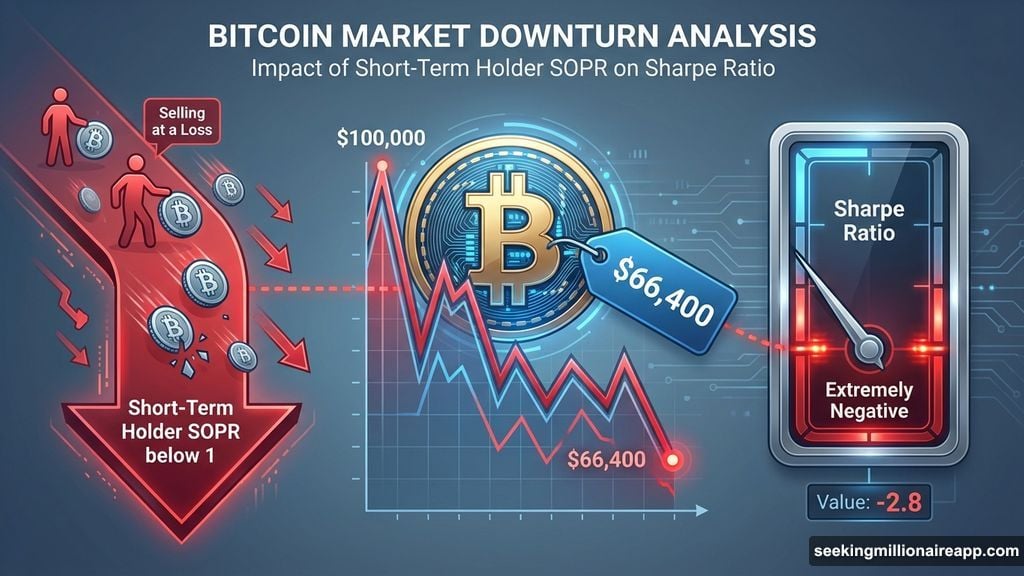

Bitcoin didn’t need a strike to start feeling the pressure. The asset has already fallen sharply from its cycle peak above $100,000. Now trading in the mid-$60,000 range, sentiment among recent buyers has soured considerably.

The Short-Term Holder SOPR (Spent Output Profit Ratio) indicator is currently sitting below 1. That number matters. It means many people who bought Bitcoin recently are now selling at a loss rather than waiting for a recovery. Fear, not patience, is driving their decisions.

On top of that, Bitcoin’s short-term Sharpe ratio has dropped to extremely negative levels. The Sharpe ratio measures how well returns hold up relative to volatility. When it craters like this, it signals that recent performance has been genuinely bad relative to the risks investors took on.

Historically, readings this low show up during periods of serious market stress.

What Happens If Strikes Actually Start

If the US launches a military strike this weekend, Bitcoin will likely react in two distinct phases.

The first phase would probably be ugly. Sudden geopolitical shocks tend to push investors toward cash and traditional safe-haven assets. Bitcoin has historically behaved like a risk asset in the early hours of a global crisis. Given that short-term holders are already stressed, a wave of panic selling would not be surprising.

But the second phase could look very different. Here’s why.

Bitcoin’s Sharpe ratio suggests the asset is already deeply oversold in the short term. Analyst @MorenoDV_ on CryptoQuant noted that each prior extreme negative reading on this metric “was followed by violent recoveries to new highs.” The weak hands have largely already sold. That means there’s less forced selling left to push prices lower.

So any sharp drop triggered by a strike could be relatively short-lived if buyers step in at discounted levels.

Geopolitical Chaos Can Eventually Help Bitcoin

There’s another angle worth considering. Sustained geopolitical instability doesn’t always hurt Bitcoin long-term. In fact, it sometimes strengthens its appeal.

When global tensions rise, some investors start looking for assets that exist outside traditional financial systems. Bitcoin, as a decentralized store of value with no government backing, fits that description. This shift doesn’t happen overnight, but it does tend to develop as crises drag on.

That dynamic played out in smaller ways during previous Middle East escalations. Whether a full US-Iran conflict would accelerate that trend is harder to predict.

Where Bitcoin Stands Right Now

Bitcoin is sitting at a genuinely critical point. Fear is elevated. Geopolitical risk is at one of its highest levels in years. Short-term holders are bleeding.

But on-chain data also suggests the worst of the correction damage may already be priced in. The SOPR readings and the extreme Sharpe ratio levels both indicate a market that has been through significant stress already. Much of the selling pressure from weak-handed investors may have already played out.

What happens next depends almost entirely on one question: does this situation escalate into actual military conflict, or do diplomacy and de-escalation win out over the weekend?

If tensions ease, Bitcoin could find solid footing and begin recovering from its extended correction. If strikes happen, expect volatility first and potentially a buying opportunity second, though timing that kind of move is never straightforward.

Either way, the next 48 to 72 hours matter a lot more than usual for Bitcoin traders.