Bitcoin just broke above $93,000 on Monday. This wasn’t a random pump. It happened right after US inflation data showed something markets desperately wanted to see: price pressures staying under control.

The Consumer Price Index came in at 2.7% year over year. That’s not falling dramatically. But it’s also not accelerating. And that middle ground matters more than most people realize. It tells the Federal Reserve they don’t need to hike rates again.

For Bitcoin, that stability flipped sentiment almost instantly. Suddenly, holding risk assets feels safer when you’re not worried about another round of monetary tightening crushing liquidity.

Why This CPI Print Actually Matters

Inflation has been running above the Fed’s 2% target for 58 straight months now. That’s the longest stretch since 1997. Back then, the Fed kept interest rates above 5% to keep prices in check.

So here’s the tension. Inflation remains elevated by historical standards. Yet the Fed isn’t rushing to hike rates further. Why? Because the current pace shows prices rising slowly, not surging.

For households, this means expenses stay high but aren’t spiraling worse. For markets, it signals the Fed can hold steady instead of tightening more. That environment supports assets that thrive on stable liquidity, including Bitcoin.

Bitcoin reacted fast. The price was hovering near $90,000 earlier Monday. Then the CPI data hit. Within hours, Bitcoin pushed past $93,000 as fears of aggressive Fed action evaporated.

The ETF Flush Already Happened

This rebound wasn’t just about macro relief. Bitcoin was already stabilizing after a brutal reset driven by spot ETF outflows.

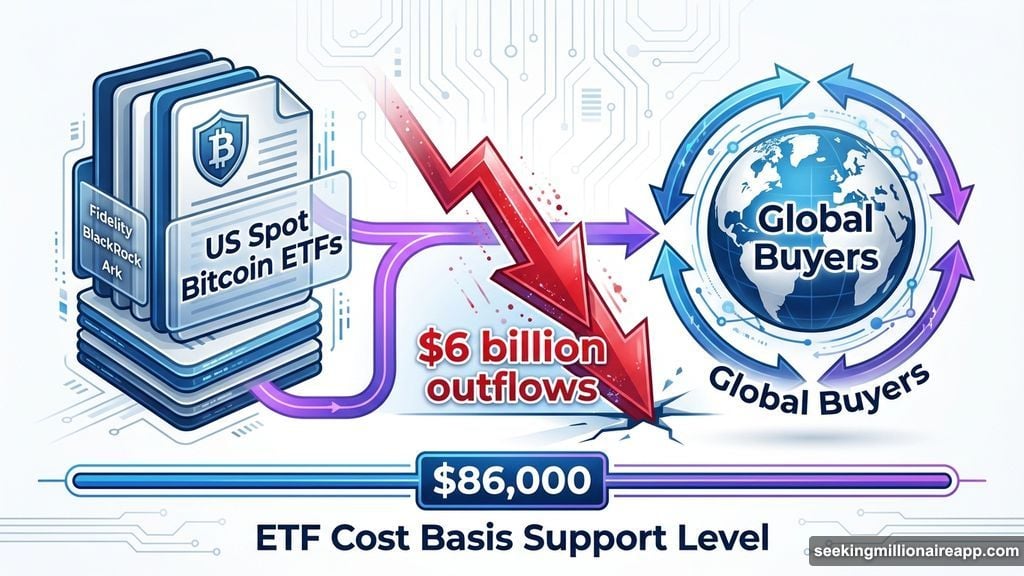

Earlier in January, more than $6 billion fled US spot Bitcoin ETFs. That selling came from investors who bought near October’s peak around $100,000. When prices dropped, they got forced out.

However, those outflows have now slowed dramatically. Bitcoin is trading close to the ETF average cost basis near $86,000. That level often acts as support once weak hands exit.

Here’s what’s interesting. US institutional buying, measured by the Coinbase Premium Index, remains muted. That shows big money stepped back after the ETF flush. Yet Bitcoin held its range despite heavy supply hitting exchanges.

This means global buyers absorbed what US ETFs released. The supply shock got digested without collapsing prices further. That’s bullish.

Support Building Between $88K and $92K

Bitcoin is now consolidating between $88,000 and $92,000. The CPI data removed a major macro risk hanging over the market. Meanwhile, on-chain and ETF data show the reset phase is already well advanced.

If ETF flows stabilize and US buyers return, Bitcoin could reclaim $95,000 in the near term. A move back toward $100,000 becomes more likely later this quarter if demand continues improving.

Exchange netflow data supports this view. Supply leaving exchanges has slowed. That typically signals investors prefer to hold rather than sell at current prices. Plus, with the ETF cost basis near $86,000, there’s less incentive to dump below that level.

The chart setup looks like consolidation before the next leg higher. Not the start of a new bear market. The difference matters.

What Changed Since October’s Peak

Bitcoin hit around $100,000 in October. Then came the correction. Prices dropped below $90,000 multiple times. ETF outflows accelerated. Late buyers panicked and sold.

But corrections don’t last forever. They flush out overleveraged positions and reset sentiment. That process appears largely complete now.

The CPI report confirms macro conditions aren’t deteriorating. Inflation isn’t spiking. The Fed isn’t tightening. Meanwhile, Bitcoin absorbed $6 billion in ETF selling without breaking down further.

That resilience suggests underlying demand remains strong. Global buyers stepped in when US institutions stepped back. Now, with macro fears easing, the path of least resistance tilts higher again.

The Risk That Nobody Wants to Talk About

Bitcoin still faces headwinds. US institutional demand hasn’t fully recovered yet. The Coinbase Premium Index shows American buyers remain cautious. If they don’t return, Bitcoin could grind sideways longer than expected.

Plus, macroeconomic surprises can still derail this setup. Another hot inflation print would revive Fed tightening fears. Geopolitical shocks could spark risk-off selling across all assets.

However, right now, the risk-reward setup favors buyers. Bitcoin held support during heavy selling. Macro conditions stabilized. ETF outflows slowed. Global demand absorbed supply.

If those trends continue, Bitcoin should consolidate briefly before pushing toward $95,000 and eventually $100,000. The bull market isn’t dead. It just took a breather.