October just started. Bitcoin already looks strong.

History backs this up. Since 2013, bitcoin averaged 79% gains every fourth quarter. So far this year, multiple factors suggest that pattern might repeat. The Federal Reserve cut rates. Institutions poured billions into crypto ETFs. Altcoins gained momentum.

Plus, the setup entering Q4 2025 looks different than previous years. Regulatory clarity improved. Corporate treasuries accumulated aggressively. Traditional finance finally embraced digital assets seriously.

Fed Rate Cuts Sparked Risk Appetite

The Federal Reserve dropped interest rates to their lowest level in nearly three years. That move changed everything for risk assets.

Lower rates make borrowing cheaper. They also push investors toward higher-return opportunities. Bitcoin fits that profile perfectly. Moreover, the central bank signaled more cuts ahead, which keeps pressure off yields and encourages speculation.

Meanwhile, inflation concerns persisted. Many investors view bitcoin as protection against currency debasement. So rate cuts create a dual tailwind: cheaper capital and stronger hedging demand.

Institutions Flooded Into Bitcoin ETFs

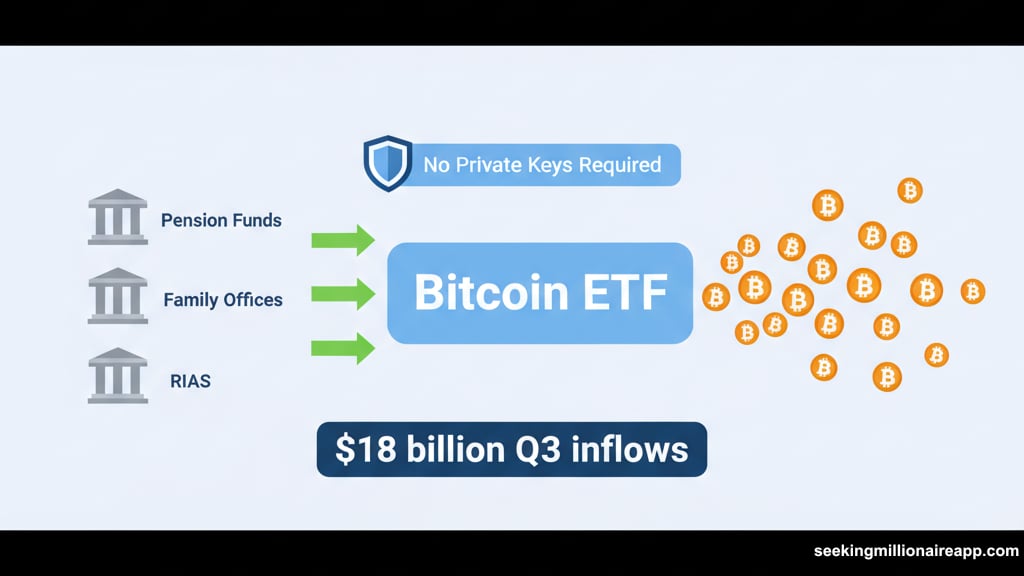

U.S. spot bitcoin and ethereum ETFs attracted over $18 billion in Q3 alone. That’s institutional money flowing directly into crypto markets.

The ETF structure matters. Traditional finance firms can now gain crypto exposure without managing private keys or dealing with exchange security. For pension funds, family offices, and registered investment advisors, that removes major barriers.

Additionally, public companies ramped up bitcoin purchases. Corporate treasuries now hold more than 5% of bitcoin’s total supply. Forty new firms added non-BTC tokens to their balance sheets last quarter alone.

This isn’t retail speculation anymore. It’s institutional adoption at scale.

Bitcoin Closed Q3 at New Highs

Bitcoin ended the third quarter at $114,000, up 8% for the period. That marked a fresh all-time high driven primarily by corporate treasury buying.

MicroStrategy led the charge. But dozens of other publicly traded companies followed their playbook. Each purchase removes supply from exchanges and creates upward pressure on price.

Furthermore, bitcoin’s correlation with traditional assets weakened. During Q3, it outperformed gold, the S&P 500, and most commodity indexes. That independent performance attracted investors seeking true portfolio diversification.

Ethereum Surged 66% on Technical Upgrades

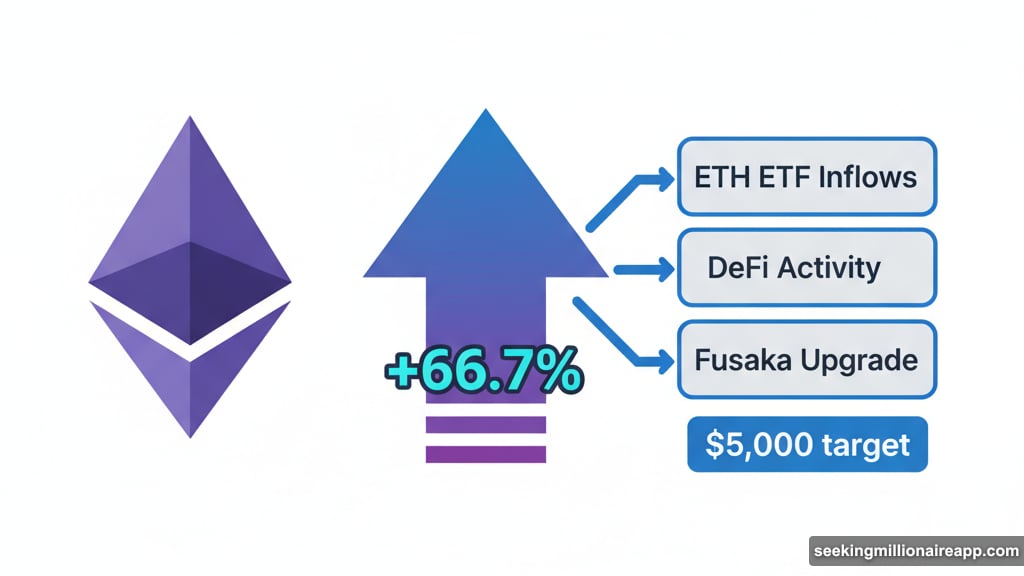

Ethereum jumped 66.7% in Q3, nearly reaching $5,000. Multiple factors drove that move.

First, spot ETH ETF inflows accelerated. Institutional buyers started treating ethereum as seriously as bitcoin. Second, DeFi activity picked up as risk appetite returned. Third, anticipation built for November’s Fusaka upgrade.

The Fusaka upgrade targets scalability and network efficiency. If successful, it positions ethereum as the preferred base layer for institutional DeFi applications. Think tokenized securities, real-world asset protocols, and corporate stablecoin settlements.

Treasury accumulation also played a role. Public companies that bought bitcoin started diversifying into ethereum. That broadened institutional exposure across the crypto market.

Solana Posted 35% Gains on Ecosystem Growth

Solana gained 35% in Q3 despite facing skepticism earlier in the year. What changed?

Ecosystem revenue hit record levels. New applications launched on Solana attracted real users and generated real fees. Plus, large corporate purchases added legitimacy to the network’s long-term prospects.

The upcoming Alpenglow upgrade promises further performance improvements. Solana already handles more transactions per second than most competing chains. Enhanced efficiency could cement its position as the high-throughput option for demanding applications.

Additionally, new exchange-traded products launched with Solana exposure. That gives institutions yet another path into the ecosystem without direct token custody.

XRP Rallied 37% After Legal Clarity

XRP gained nearly 37% year-to-date after Ripple and the SEC withdrew appeals in their lawsuit. That ended years of regulatory uncertainty.

The legal clarity unlocked institutional interest immediately. Exchanges that had delisted XRP started relisting it. Corporate buyers felt comfortable adding it to portfolios. Developers resumed building on the XRP Ledger without legal concerns.

Ripple’s RLUSD stablecoin launch also boosted sentiment. The stablecoin expanded globally and attracted DeFi protocols to the XRP Ledger. More utility for the underlying token creates more demand.

If a spot XRP ETF gets approved, institutional adoption could accelerate further. Several asset managers already filed applications.

Cardano Climbed 41% Despite Modest Activity

Cardano rose 41.1% in Q3, outperforming several larger competitors. That happened despite relatively modest on-chain activity compared to ethereum or Solana.

However, consistent growth in specific areas caught investors’ attention. Stablecoin usage increased steadily. Derivatives volume expanded. DEX activity showed reliable month-over-month gains.

The question now centers on whether a spot ADA ETF approval could spark broader institutional adoption. Cardano has strong fundamentals and an active development community. An ETF might provide the legitimacy boost needed to attract serious capital.

Broader Market Indexes Showed Strength

The CoinDesk 20 Index, tracking the 20 most liquid digital assets, gained over 30% in Q3. That outpaced bitcoin’s 8% return.

Mid-cap and small-cap indexes also posted strong returns. The CoinDesk 80 and CoinDesk 100 demonstrated growing interest across the market cap spectrum. Investors stopped focusing exclusively on bitcoin and started exploring other opportunities.

This rotation into altcoins signals maturation. Early in crypto market cycles, bitcoin leads. Later, capital flows into alternative assets seeking higher returns. That pattern appeared consistently in Q3.

Generic ETF Listing Standards Could Accelerate Growth

Regulatory developments might unlock even more institutional capital. The approval of generic listing standards for crypto ETFs would streamline the launch of new products.

Currently, each crypto ETF requires individual approval. Generic standards would allow faster launches for multi-asset funds, staking-based products, and thematic indexes. More products mean more entry points for institutional investors.

Staking ETPs represent particularly interesting opportunities. Ethereum already supports staking with attractive yields. If ETPs can pass through staking rewards to holders, they become even more compelling versus traditional fixed-income products.

Rate Cut Expectations Support Continued Gains

Markets expect the Federal Reserve to continue cutting rates through early 2026. Each cut reduces the attractiveness of bonds and savings accounts. That pushes capital toward riskier assets with higher return potential.

Bitcoin and crypto benefit disproportionately from this dynamic. Unlike stocks, cryptocurrencies don’t generate earnings that get discounted by higher rates. So rate cuts impact them primarily through liquidity flows and risk appetite.

Moreover, persistent inflation concerns strengthen bitcoin’s narrative as “digital gold.” Investors worried about purchasing power erosion allocate to scarce assets. Bitcoin’s fixed supply cap makes it appealing in that context.

Corporate Treasury Adoption Continues Building

More than 50 public companies now hold digital assets on their balance sheets. Forty of them added non-bitcoin tokens in Q3 alone. That trend shows no signs of slowing.

Corporate adoption creates steady buying pressure. Unlike retail investors who might panic sell during volatility, corporate treasuries typically hold through cycles. They view crypto as long-term strategic assets, not short-term trades.

Furthermore, seeing major corporations buy crypto reduces perceived risk for others. Each new announcement validates the asset class and encourages additional corporate buyers.

Q4 Historical Performance Backs Optimism

Since 2013, bitcoin delivered an average 79% gain during Q4. Not every year followed that pattern. But the historical tendency remains strong.

Why does Q4 typically perform well? Several factors probably contribute. Year-end bonus money flows into markets. Tax-loss harvesting in losing positions creates buying opportunities. Holiday optimism boosts risk appetite. Major conferences and events generate attention.

This year adds institutional flows and regulatory clarity to those traditional factors. That combination might produce even stronger results than historical averages suggest.

The macro backdrop, institutional adoption, altcoin momentum and favorable seasonality all point toward continued strength. No guarantees exist. But the setup entering Q4 2025 looks compelling for crypto investors willing to ride potential volatility.

Watch how institutions respond to the next Fed decision. Monitor ETF flow data weekly. Pay attention to altcoin upgrade releases and corporate treasury announcements. Those signals will confirm whether Q4 lives up to its historical reputation.