Traders are piling into Bitcoin short positions at levels not seen since August 2024. Back then, the same crowded bet against BTC backfired spectacularly.

Now funding rates across major exchanges have plunged to their deepest negative levels in over a year. Meanwhile, Bitcoin trades at $69,815, just shy of the critical $70,610 resistance level. So the market setup looks eerily familiar to seasoned observers.

History doesn’t repeat, but it often rhymes. Plus, the current configuration suggests volatility could explode in either direction soon.

Extreme Short Positioning Creates Powder Keg

Aggregated funding rate data tells a striking story. Negative funding levels have reached extremes not seen since August 2024.

That earlier episode proved costly for bears. Traders crowded into downside bets as fear gripped the market. Instead of collapsing, Bitcoin reversed violently. The subsequent short squeeze fueled an 83% rally over four months.

Deeply negative funding rates signal widespread bearish positioning. Traders are essentially paying to hold short contracts. This arrangement works fine when prices fall. But it creates a fragile structure vulnerable to sudden reversals.

Here’s why that matters now. If Bitcoin pushes above $70,000, forced liquidations could cascade. Short sellers would scramble to close positions by buying Bitcoin. That buying pressure amplifies upward momentum, potentially triggering a self-reinforcing rally.

However, extreme positioning alone doesn’t guarantee upside. It simply creates asymmetric risk. Small price moves can produce outsized consequences when positioning becomes one-sided.

Holder Sentiment Remains Fragile

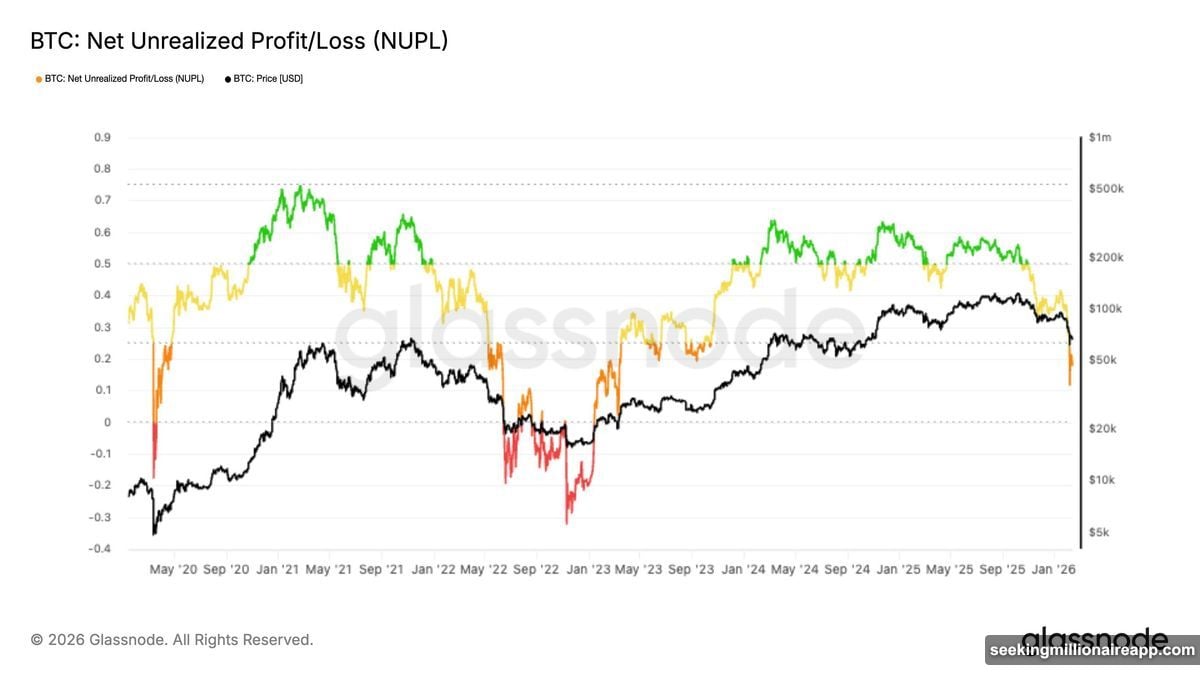

The Net Unrealized Profit and Loss indicator has returned to the Hope/Fear zone near 0.18. This reading reveals thin profit cushions among Bitcoin holders.

When NUPL enters this regime, market behavior becomes reactive. Holders lack sufficient gains to weather volatility confidently. Fear dominates decision-making. Panic selling tends to intensify before a durable bottom forms.

Historically, declines into this zone often preceded extended weakness. Capitulation events typically reset sentiment before sustained recoveries begin. Without that flush, Bitcoin may remain vulnerable to deeper pullbacks.

The combination of fragile holder sentiment and extreme short positioning creates an unstable equilibrium. Market participants are positioned defensively. Yet that defensive posture itself increases the potential for violent moves.

Technical Indicators Show Early Improvement

Short-term momentum indicators are flashing tentative bullish signals. The Chaikin Money Flow indicator is approaching the zero line from below.

A confirmed move into positive territory would signal renewed capital inflows. That would suggest accumulation rather than distribution. Meanwhile, the Moving Average Convergence Divergence indicator is nearing a bullish crossover.

Confirmed crossovers indicate momentum shifts from bearish to bullish. However, early signals require validation through sustained price strength. False breakouts remain possible in choppy conditions.

Even with improving technical cues, broader sentiment remains cautious. Shorts are unlikely to close voluntarily under weak conditions. This dynamic increases the probability that a price-driven liquidation event becomes the catalyst for recovery.

Critical Price Levels Define Near-Term Path

Bitcoin trades at $69,815 and remains capped below $70,610 resistance. The $70,000 level represents a critical psychological barrier.

A decisive close above this threshold could trigger renewed bullish momentum. Fresh capital inflows typically follow psychological breakthroughs. Moreover, short liquidations above $70,000 would provide additional fuel.

If Bitcoin overcomes selling pressure above $70,000, upside targets emerge quickly. A rally toward $73,499 could develop rapidly. Sustained strength may extend gains toward $76,685, invalidating the bearish thesis.

However, bearish pressure persists in derivatives markets. Continued dominance of short contracts could keep BTC below $70,000. A breakdown below $65,156 support may trigger long liquidations instead. That scenario would intensify downside volatility and potentially retest lower support zones.

The Setup Favors Volatility, Not Direction

Current market conditions resemble a coiled spring. Extreme short positioning creates asymmetric risk. Fragile holder sentiment adds instability. Technical indicators show tentative improvement but lack confirmation.

This combination typically produces explosive moves rather than gradual trends. The direction remains uncertain. But the magnitude of the eventual move could be substantial either way.

Traders who remember August 2024 are watching closely. That episode demonstrated how crowded positioning can unwind violently. Bears paid dearly for betting against Bitcoin at extreme funding levels.

Now the same setup has returned. Whether history repeats depends on Bitcoin’s ability to break above $70,000. That breakout would likely trigger the liquidation cascade that bulls are anticipating.

Stay alert. When extremes meet catalysts, markets move fast.