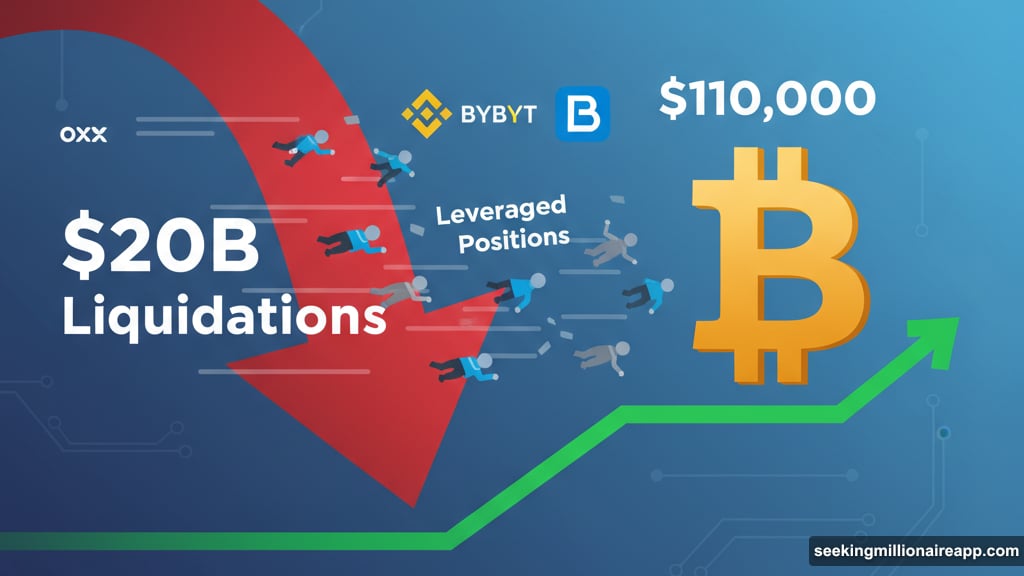

Crypto just survived its biggest leverage purge ever. Over $20 billion in positions got liquidated in a single session. Prices crashed. Traders panicked. Forums exploded with loss screenshots.

Yet here’s the strange part. Bitcoin barely flinched below $110,000 before bouncing back to $112,700. And according to fresh data from Glassnode and CryptoQuant, the smart money never stopped accumulating.

So what actually happened when leverage died? Let’s dig into the numbers that tell a very different story than the chaos suggested.

The Leverage Massacre Nobody Expected

This wasn’t a normal correction. It was a forced reset of the entire derivatives market.

Over-leveraged positions got crushed simultaneously across every major exchange. Funding rates, which measure the cost of holding perpetual futures, dropped by half overnight. Traders who were betting big with borrowed money suddenly found themselves underwater.

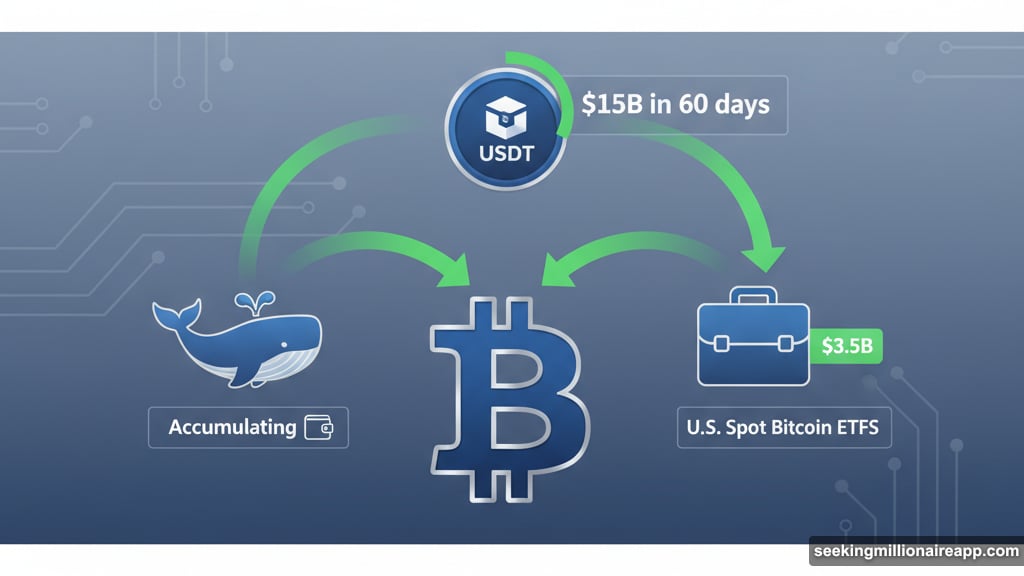

But here’s what makes this event different from past crashes. The underlying demand infrastructure stayed intact. While speculators fled, long-term holders kept buying. USDT supply grew by nearly $15 billion in just 60 days. That’s the fastest pace since January, when Bitcoin was climbing toward previous highs.

Plus, U.S. spot Bitcoin ETFs pulled in $3.5 billion during this period. Institutions didn’t panic. They saw an opportunity.

Two Views of the Same Market

Glassnode and CryptoQuant both analyzed the same data. Yet they reached slightly different conclusions about what comes next.

Glassnode sees this as a necessary cleansing. The market was over-leveraged and needed to flush out speculative excess. Their data shows options traders now paying higher premiums for downside protection. Perpetual contract volume indicators turned negative. Traders shifted from aggressive positions to defensive ones.

In other words, confidence needs time to rebuild. Recovery will be gradual, not explosive.

CryptoQuant takes a more bullish view. They point to $115,000 as the critical level to watch. That’s the on-chain realized price where most current holders bought their Bitcoin. If prices push above that threshold and hold, it could signal the start of a new rally phase.

Moreover, stablecoin liquidity keeps expanding. Whale wallets keep accumulating. The structural foundation for higher prices exists. It just needs a catalyst.

What Actually Broke vs What Held

Let’s separate the damage from the resilience.

What broke: Short-term speculation. Funding rates collapsed as leveraged positions got wiped out. Open interest on derivatives exchanges dropped to levels not seen since May. Traders who were chasing quick gains with borrowed capital learned expensive lessons.

What held: Long-term capital flows. ETF inflows continued despite volatility. Stablecoin supply kept growing, meaning fresh capital entered the system even as prices fell. Large wallet addresses, tracked as “whales” by on-chain analysts, increased their holdings during the dip.

This divergence matters. Previous market crashes saw both speculation and structural demand collapse together. This time, only leverage evaporated. The fundamental buyer base remained active.

The Geopolitical Factor Traders Ignore

Bitcoin dropped partly because of renewed Trump tariff threats. President Trump hinted at “retribution” against China, which spooked risk assets broadly. Gold climbed while stocks and crypto declined.

Yet this pattern rarely lasts. Geopolitical tensions create short-term volatility but don’t change long-term adoption trends. Central banks still devalue currencies. Governments still run massive deficits. Bitcoin still offers a hedge against monetary instability.

So while headlines drive daily price swings, they don’t alter the structural demand that underpins Bitcoin’s value proposition.

Ethereum’s Bigger Problem

While Bitcoin bounced back relatively quickly, Ethereum struggled more. ETH fell to $4,101, down 3.7% for the day, after being rejected near $4,270.

Here’s the concerning part. Open interest in Ethereum futures hit its lowest point since May. That suggests traders are less interested in speculating on ETH compared to Bitcoin. CME futures data shows institutional interest remains, but retail enthusiasm has clearly cooled.

This divergence between Bitcoin and Ethereum strength could signal shifting market dynamics. Bitcoin increasingly acts like digital gold, attracting conservative institutional capital. Ethereum faces more competition from alternative smart contract platforms and hasn’t regained its previous momentum.

The $115,000 Line in the Sand

CryptoQuant identified $115,000 as the key technical level that determines Bitcoin’s next major move.

Why that specific number? It represents the average price at which current Bitcoin holders acquired their coins. Above $115,000, most holders are in profit and less likely to sell. Below it, more holders face losses and might capitulate.

Previously, Bitcoin tested this level twice. Both times, it broke through and continued higher. Now it’s testing again from below after the liquidation event.

If Bitcoin reclaims $115,000 and holds for several days, it could mark the inflection point CryptoQuant predicts. The combination of expanding stablecoin supply, continued ETF inflows, and whale accumulation would have room to push prices higher.

But if it fails, another consolidation period becomes likely. Traders would interpret that as a sign that not enough demand exists yet to overcome profit-taking pressure.

What Gold’s Rally Means for Bitcoin

Gold just hit fresh highs, prompting BlackRock’s Evy Hambro to predict it could reach $4,200. Bank of America goes even further, forecasting $5,000 gold and $65 silver by 2026.

Their reasoning? Governments are drowning in debt. Central banks keep creating money. Investors increasingly seek hard assets that can’t be printed into irrelevance.

This narrative directly benefits Bitcoin too. If institutional investors are rotating into gold because they don’t trust fiat currencies, some of that capital will flow toward Bitcoin as “digital gold.” The same macro conditions driving gold higher also support Bitcoin’s long-term case.

Yet gold’s strength during this recent volatility also reveals something. When risk appetite declines, traditional investors still prefer gold over Bitcoin. That preference creates headwinds during geopolitical uncertainty but doesn’t change Bitcoin’s appeal to younger, tech-savvy investors.

The Calm After the Purge

Markets rarely recover instantly after massive liquidations. Traders need time to rebuild positions. Confidence takes days or weeks to return. Speculative appetite doesn’t reappear overnight.

So while the structural demand indicators look solid, short-term price action will likely remain choppy. Bitcoin could trade sideways between $110,000 and $115,000 for a while as the market digests what happened.

That’s not bearish. It’s normal after extreme leverage resets. The question is whether this consolidation creates a base for the next move higher or signals a longer correction ahead.

Based on stablecoin growth and ETF flows, the former seems more likely. But market timing is always uncertain. The data shows capital is ready. Traders just need a reason to put it to work.

Why This Crash Felt Different

I’ve watched Bitcoin crash dozens of times over the years. This one had a unique quality.

Previous crashes saw panic selling across all holder types. Exchanges went down. Stablecoin reserves drained. ETF outflows accelerated. Everything broke at once.

This time? Exchanges handled the volume. Stablecoin supply grew. ETFs kept accumulating. Only leverage broke. That’s a healthier kind of crash, paradoxically.

It means the market matured enough to differentiate between speculative froth and genuine demand. Institutions didn’t panic. Whales bought the dip. Retail traders using excessive leverage paid the price.

That’s closer to how traditional markets behave during volatility. And it suggests Bitcoin is transitioning from a purely speculative asset to something with more staying power.

Watch the $115,000 level. If Bitcoin breaks and holds above it, the structural demand that survived this liquidation wave will have room to push prices higher. If not, expect more consolidation as the market searches for equilibrium.

Either way, the fact that $20 billion in leverage died without killing the market shows how much has changed. Bitcoin doesn’t need speculation anymore. Real demand is enough.