Bitcoin just broke its all-time high. The largest cryptocurrency surged past $125,000 Sunday morning, capping an 11% weekly rally that caught many traders off guard.

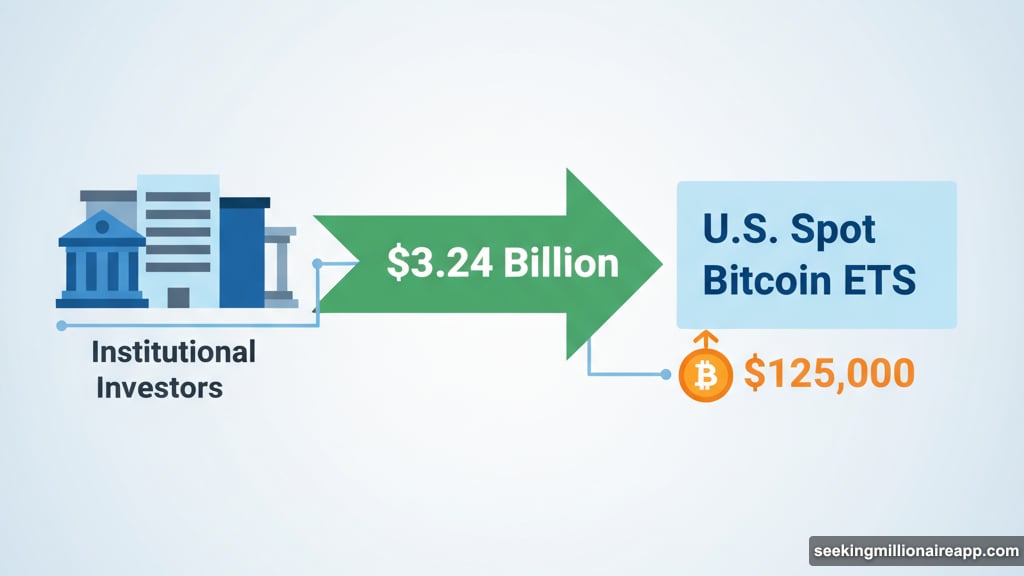

What sparked this monster move? Follow the money. U.S.-listed spot Bitcoin ETFs pulled in a staggering $3.24 billion last week. That’s the second-largest weekly haul ever recorded, according to SoSoValue data.

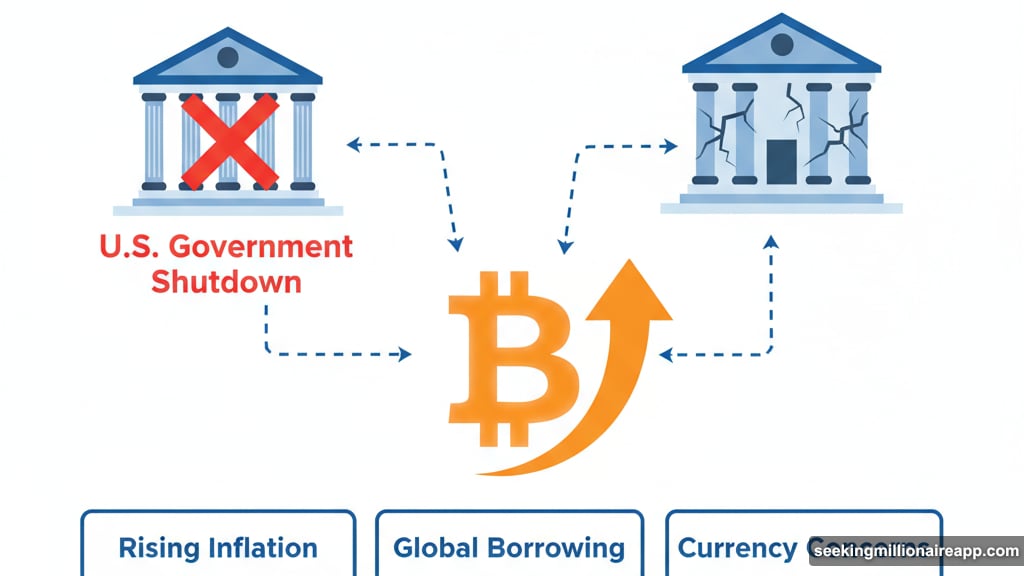

Plus, the timing couldn’t be more interesting. This rally happened during a U.S. government shutdown that’s shaking investor confidence in traditional financial systems.

Why Money’s Rushing Into Bitcoin Right Now

The ETF inflows tell a clear story. Institutional investors are piling into Bitcoin exposure at record pace.

These aren’t retail speculators chasing quick gains. Instead, the money flowing through ETFs represents serious institutional capital looking for a safe harbor. When traditional systems show cracks, Bitcoin suddenly looks more attractive.

Jeff Dorman, Chief Investment Officer at Arca, saw this coming. He wrote just before the shutdown: “The only time I buy BTC is when society loses faith in governments and local banks. $BTC likely a good buy here ahead of yet another U.S. government shutdown.”

That prediction played out perfectly. Bitcoin surged as the shutdown dragged on.

The Bigger Economic Picture Driving Gains

Government shutdowns grab headlines. But deeper economic forces are pushing Bitcoin higher.

Noelle Acheson, who writes the Crypto Is Macro Now newsletter, breaks down the underlying drivers. First, U.S. inflation shows more risk of rising than falling. Second, global borrowing keeps climbing, which intensifies currency concerns worldwide.

Then there’s the gold connection. What works for gold tends to work for Bitcoin. Yet institutional portfolios still hold far less Bitcoin than the fundamentals suggest they should.

“Plus, the incoming rush of market support – lower rates, yield curve control and lots and lots of ‘money printing’ – will boost global liquidity,” Acheson explained. That liquidity naturally flows into risk assets, including crypto.

So multiple macro trends are converging to support Bitcoin’s climb. The government shutdown just accelerated what was already building.

Other Cryptos Join the Party

Bitcoin’s surge lifted the entire crypto market. XRP gained 1.75% to trade above $3, with traders now eyeing a move to $4. Ethereum climbed 1.58% to $4,530. Solana jumped 2.21% to $229.91.

Even meme favorite Dogecoin rallied 3.14%, pushing back above $0.26. Traders are targeting $0.30 as the next resistance level.

This broad-based rally suggests real conviction behind the move. When Bitcoin breaks records, altcoins typically follow if the momentum is genuine rather than a quick pump.

What This Means for October and Beyond

October has historically been Bitcoin’s best-performing month. Traders call it “Uptober” for good reason.

This year’s October is living up to the nickname. Bitcoin entered the month around $111,000 and already tagged $125,000. That’s a 12.6% gain in just five days.

But can it continue? The ETF flows suggest institutional demand remains strong. Meanwhile, macroeconomic conditions favor hard assets over fiat currencies. Both factors point to more upside potential.

Options markets show traders positioning for even higher prices. Key resistance levels to watch include $135,000 and $140,000. Those represent major psychological barriers where selling pressure might emerge.

The Haven Narrative Gets Stronger

Bitcoin’s rally during a government crisis reinforces its emerging role as a non-sovereign store of value. When political systems stumble, Bitcoin benefits.

This wasn’t supposed to be Bitcoin’s narrative originally. Early proponents pitched it as peer-to-peer electronic cash. But the market decided otherwise.

Now Bitcoin increasingly functions as digital gold. A hedge against government dysfunction and currency debasement. The ongoing shutdown demonstrates this use case in real-time.

That’s significant. It means Bitcoin’s value proposition extends beyond technology or payments. It’s become a political and economic hedge. And in unstable times, hedges become essential.

The $3.2 billion of institutional money flowing into ETFs last week shows this narrative resonating with serious investors. They’re not buying Bitcoin for transactions. They’re buying it as insurance against systemic risk.

Whether the rally continues depends on several factors. But the fundamental drivers remain intact. Government debt keeps climbing. Political dysfunction persists. Inflation threatens to resurge. In that environment, Bitcoin’s value proposition only gets stronger.

Post Title:

Meta Description: