Bitcoin bounced back slightly over the past 24 hours. But don’t get too excited yet.

The crypto king now faces a brutal test at $95,000. Break through, and the five-week downtrend finally ends. Fail, and BTC could tumble back to $86,822. Meanwhile, weak institutional support and declining network activity suggest this recovery might be a false start.

Let’s examine what the data actually reveals.

Institutions Aren’t Buying the Recovery

Spot Bitcoin ETFs show remarkably weak demand right now. Monday brought just $8.5 million in inflows, according to Farside data. Then those same ETFs bled $61.6 million the very next day.

That’s a problem. Bitcoin’s price improved during this period, yet institutional money fled anyway. So price action and investor confidence are completely disconnected.

ETF flows typically signal institutional sentiment. When large players pull back despite rising prices, it reveals deep skepticism about sustainability. Plus, without strong institutional backing, Bitcoin lacks the buying power needed to push through major resistance levels.

The numbers paint a concerning picture. Large investors see something in the market they don’t like. They’re taking money off the table even as prices climb. That’s rarely a bullish signal.

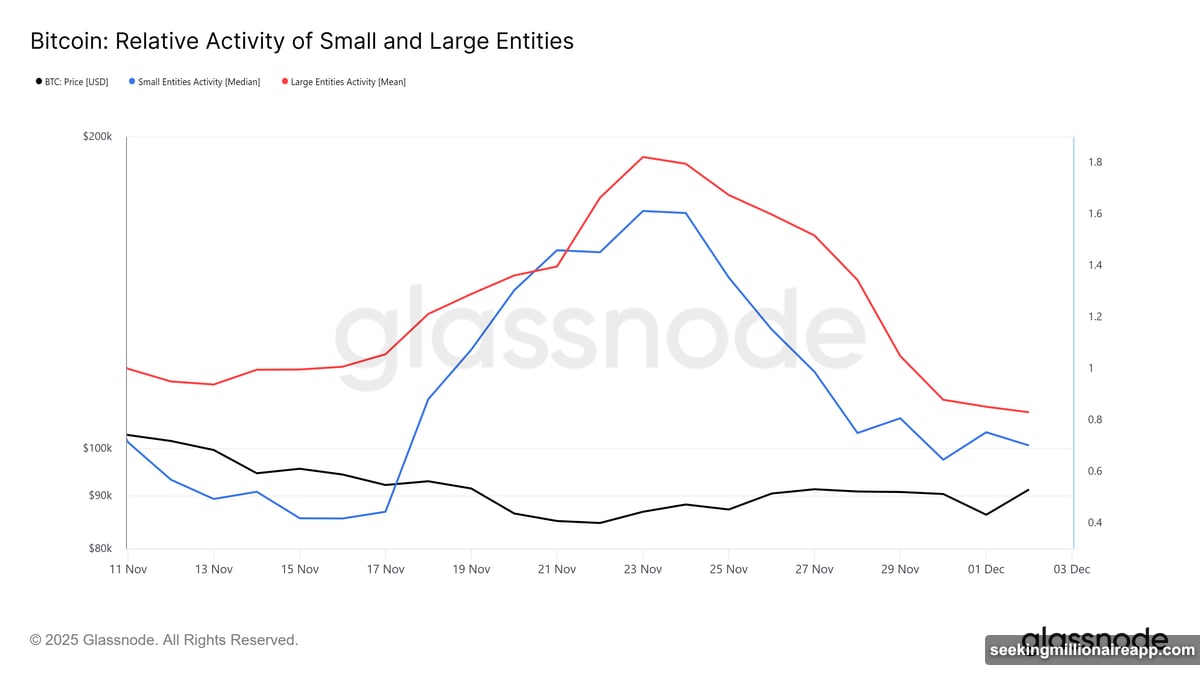

Network Activity Is Dying Across the Board

On-chain data confirms the weakness. Both small holders and whales are reducing their activity simultaneously, based on Glassnode metrics. When participation drops across all holder categories, it signals genuine demand erosion.

This decline directly impacts Bitcoin’s price momentum. Fewer transactions mean less organic buying pressure. Lower whale activity removes the large orders that can push prices higher. Reduced retail engagement eliminates the volume needed to sustain rallies.

Think of it like a store with no customers. The doors are open, but nobody’s shopping. Bitcoin needs active participants to maintain upward pressure. Right now, engagement is falling off a cliff.

Moreover, this weakness spans the entire holder spectrum. It’s not just retail getting cold feet. Large entities are pulling back too. That makes recovery much harder since Bitcoin can’t rely on either cohort for support.

$95,000 Decides Everything

Bitcoin currently trades at $92,939 after breaking through $91,521 resistance. Good start. But the real battle happens at $95,000.

This level determines whether Bitcoin’s bounce becomes a genuine trend reversal or just another failed rally attempt. Break above $95,000 and hold it as support, and BTC can target $98,000 next. That would invalidate the five-week downtrend and restore bullish momentum.

However, rejection at $95,000 tells a darker story. Failure here would likely push Bitcoin back below $91,521. From there, $89,800 becomes vulnerable. Ultimately, BTC could slide to $86,822, erasing all recent gains and cementing the downtrend for another week.

The technical picture is clear. Either Bitcoin powers through this resistance with conviction, or it crumbles back down. There’s not much middle ground at this critical juncture.

Why This Recovery Feels So Fragile

Here’s what bothers me most. Bitcoin’s price is climbing, but the fundamentals aren’t supporting it. Institutions are skeptical. Network activity is declining. ETF flows show more selling than buying.

That’s not how healthy recoveries work. Real bull runs have strong institutional backing and rising on-chain activity. They show growing confidence and expanding participation. This recovery shows the opposite.

So while Bitcoin’s short-term price action looks decent, the foundation underneath is shaky. Without stronger demand signals, this bounce might just be a temporary relief rally before the next leg down. Watch $95,000 closely. It’s the level that separates hope from reality.