Bitcoin nearly cracked $124,000 Thursday morning. Then silver hit $50 per ounce for the first time ever. Suddenly, everything reversed.

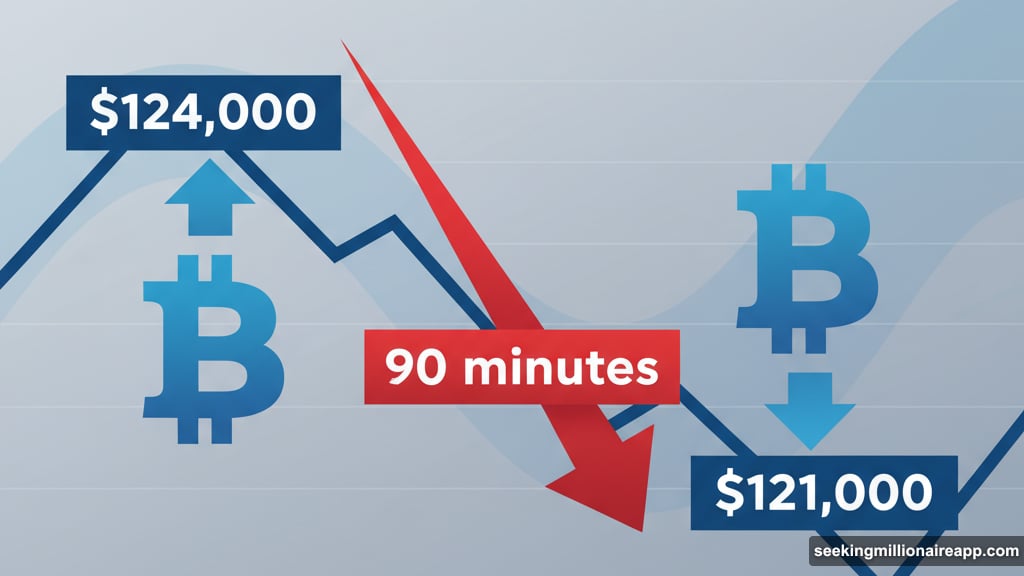

The selloff hit fast. Within ninety minutes, BTC dropped from $124,000 to below $121,000. Plus, precious metals traders who pushed silver to that historic milestone decided to cash out immediately. So much for celebration rallies.

Silver’s Record Becomes a Trap

Silver’s surge to $50 looked unstoppable. The metal climbed 50% from its April lows, finally reaching that psychological barrier traders watch obsessively.

But that milestone triggered instant profit-taking. The price crashed 4% within minutes. By press time, silver traded at $48.55, well below its peak.

“Near term, momentum looks choppy as technicals flag an increasingly overbought market,” wrote Daniela Sabin Hathorn, senior market analyst at Capital.com. However, she noted appetite for ranges above $50 should persist if macro conditions stay favorable.

Gold followed silver’s lead. The yellow metal pulled back more than 1% after challenging $4,100 per ounce. Now it trades around $4,035. Still impressive, but clearly traders wanted to lock in gains after weeks of relentless climbing.

Government Shutdown Clouds the Picture

The ongoing U.S. government shutdown might finally be weighing on markets. Key economic data releases stopped. Federal services slowed down. Businesses depending on government operations face disruptions.

That uncertainty affects both traditional and digital asset markets. When traders can’t access reliable data, they often reduce risk exposure. So the timing of today’s pullback makes sense.

Markets hate uncertainty more than bad news. At least bad news provides clarity. The shutdown creates fog.

Altcoins Bleed Harder Than Bitcoin

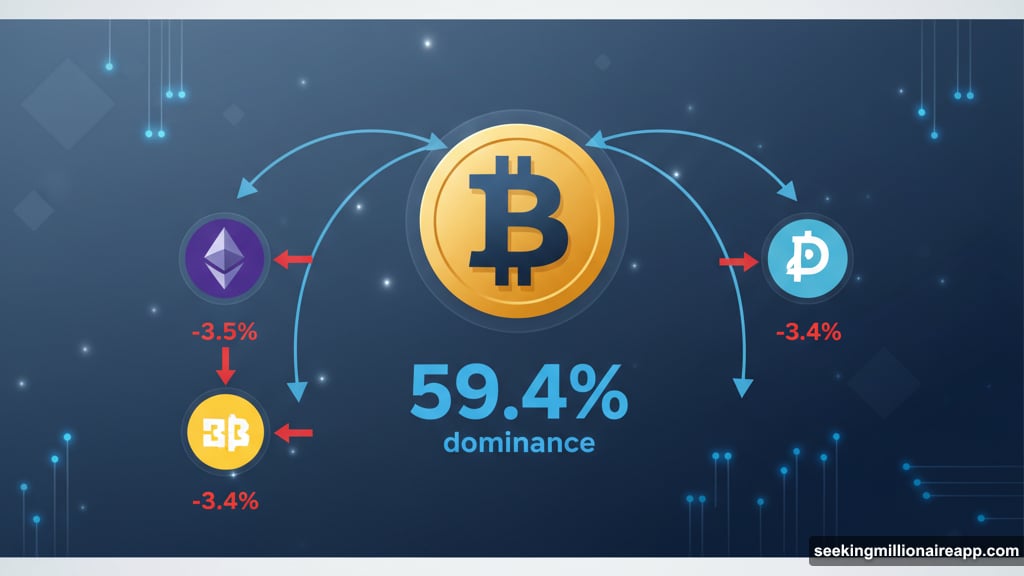

Smaller cryptocurrencies suffered worse during the selloff. Ether dropped 3.5% to $4,300. BNB and DOGE fell 3-4% each. Meanwhile, bitcoin’s decline stayed relatively modest.

This rotation back to bitcoin shows up clearly in dominance metrics. Bitcoin’s market share of total crypto value climbed above 59.4% for the first time since August. That’s nearly eight weeks of declining dominance reversed in one session.

Traders retreat to bitcoin during uncertainty. It’s the oldest, most liquid, most trusted crypto asset. So when markets turn choppy, capital flows from altcoins back to BTC. This pattern repeats constantly.

Leverage Wipes Out $600 Million

Derivatives markets took serious damage. Over $600 million in leveraged trading positions got liquidated across all digital assets in 24 hours, according to CoinGlass data.

Leveraged traders bet on continued rallies. When prices reversed quickly, exchanges automatically closed their positions to prevent further losses. That forced selling accelerated the decline.

These liquidation cascades happen regularly in crypto. Markets spike. Traders pile on leverage. Then a reversal triggers automatic selling. Prices fall faster than they would from natural selling pressure alone.

What This Means for Bitcoin’s Record Chase

Bitcoin still trades above $121,000. That’s impressive by any measure. But the failure to hold above $124,000 suggests resistance at higher levels remains strong.

The correlation with precious metals matters. Gold and silver rallied for weeks alongside bitcoin. Many investors view all three as inflation hedges. So when silver hits $50 and immediately reverses, it signals traders think these assets got ahead of themselves.

Does this derail bitcoin’s path to new records? Not necessarily. But it probably means the climb takes longer than bulls hoped. Quick rejections from new highs rarely lead to immediate breakthroughs.

Markets need time to consolidate after big moves. Bitcoin jumped from around $100,000 to $124,000 in weeks. A pause at these levels makes sense technically. Plus, the government shutdown adds extra uncertainty that discourages aggressive buying.

For now, $121,000 matters more than $124,000. If bitcoin holds current levels while altcoins bleed, that’s actually bullish. It means the market still wants BTC exposure despite the pullback. That bitcoin dominance metric tells the story clearly.

New records will come eventually. Just maybe not today.

Post Title:

Meta Description: