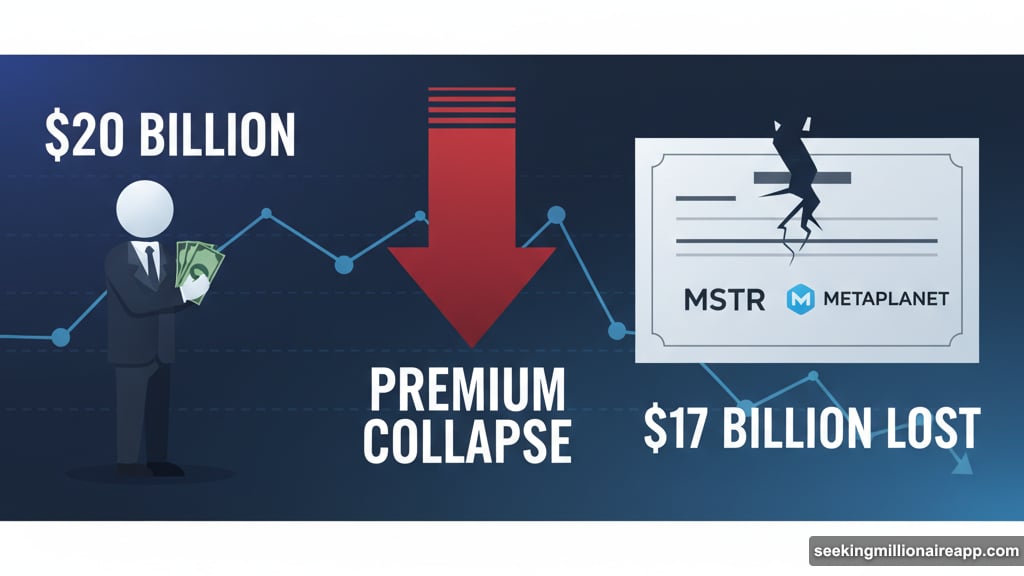

Retail investors lost $17 billion betting on Bitcoin through treasury stocks. The numbers are brutal and getting worse.

Companies like MicroStrategy and Metaplanet promised easy Bitcoin exposure. Instead, they delivered massive losses. Their share premiums collapsed, leaving everyday investors holding worthless paper while executives cashed out.

The era of financial engineering in crypto just ended. Now these firms must prove they can actually make money instead of just riding hype cycles.

The $17 Billion Wealth Transfer

Bitcoin treasury companies sold a dream. Buy our stock, get Bitcoin exposure without the hassle of wallets and exchanges. Sounds perfect, right?

Wrong. A recent 10X Research report reveals retail investors overpaid by roughly $20 billion through inflated equity premiums. They’ve lost about $17 billion of that as share prices crashed.

These Digital Asset Treasury Companies (DATCOs) issued stock at huge premiums above their actual Bitcoin holdings. When Bitcoin rallied, the strategy worked brilliantly. Stock prices rose faster than Bitcoin itself.

But momentum doesn’t last forever. Once Bitcoin’s surge slowed, those premiums evaporated. Investors who bought during the frenzy now sit on devastating losses.

Here’s the math that hurts. Global companies raised over $86 billion in 2025 just to buy cryptocurrencies. That’s more than total US IPO volume this year. Yet Bitcoin-linked stocks have badly underperformed the broader market.

Premium Valuations Turned Into Discount Disasters

MicroStrategy’s MSTR stock dropped over 20% since August. Tokyo-based Metaplanet collapsed more than 60% in the same period. These aren’t small corrections. They’re portfolio killers.

Even worse? Their market-to-net-asset-value (mNAV) ratios crashed. This metric once measured investor confidence. Now it screams warning.

MicroStrategy trades around 1.4x its Bitcoin holdings today. That’s still a premium but far below past levels. Metaplanet fell under 1.0x for the first time since adopting its Bitcoin treasury model in 2024.

Think about that. Metaplanet stock now trades below the value of Bitcoin it actually owns. You’re literally better off buying Bitcoin directly than owning their shares.

Across the market, nearly 20% of all listed Bitcoin treasury firms trade below their net asset value. The premium game is over.

Why Share Premiums Collapsed So Fast

The business model relied on perpetual optimism. Companies issued shares at inflated prices, used that money to buy more Bitcoin, then watched their stock valuations soar even higher. It created a self-reinforcing cycle.

Until it didn’t. Bitcoin hit $126,000 this month but quickly retreated after Trump’s tariff threats against China. That pullback exposed the fundamental weakness in these treasury stocks.

Investors realized they’d been paying massive premiums for nothing special. These companies don’t generate earnings from operations. They just hold Bitcoin and occasionally buy more. Why pay 50% or 100% above Bitcoin’s value for that?

As 10X Research bluntly stated: “Those once-celebrated NAV premiums have collapsed, leaving investors holding the empty cup while executives walked away with the gold.”

That’s not hyperbole. Company insiders often sold shares during the premium boom. Retail investors bought them. Now retail holds the losses while insiders already cashed out.

The Counter-Argument Doesn’t Hold Up

Brian Brookshire from H100 Group AB argues mNAV ratios are cyclical. He claims MicroStrategy’s current valuation isn’t unusual because volatility is normal.

“Most BTCTCs trading near 1x mNAV have only arrived there within the past couple weeks. By definition, not a norm,” he said.

Sure, ratios fluctuate. But this ignores the bigger picture. Investors lost $17 billion. That’s not cyclical noise. That’s real wealth destruction.

Plus, the trend is clear. More firms trade below net asset value than ever before. Premiums that seemed permanent have vanished. Calling this “normal volatility” misses the point entirely.

Financial Alchemy Doesn’t Work Long-Term

The Bitcoin treasury model worked during bull runs. Companies leveraged market euphoria to raise capital at insane valuations. They bought more Bitcoin, which pumped their stock prices higher, which let them raise more capital.

It was financial alchemy. Creating value from nothing but market sentiment and clever timing. Except alchemy isn’t real.

10X Research calls this “the end of financial alchemy” for Bitcoin treasuries. The illusion of limitless upside through inflated share issuance has shattered. Reality reasserted itself.

Now these DATCOs face a harsh new world. They must generate actual alpha—real returns above Bitcoin’s performance. They need earnings discipline instead of marketing hype.

“With volatility falling and the easy gains gone, these firms face a hard pivot from marketing-driven momentum to real market discipline,” 10X Research concluded.

That pivot will be painful. Most of these companies have no real business beyond holding Bitcoin. They don’t mine it. They don’t build products. They just buy and hold while issuing shares at premiums.

What Happens Next

Retail investors learned an expensive lesson. Don’t pay premiums for indirect Bitcoin exposure when you can buy Bitcoin directly.

Treasury stocks made sense when crypto exchanges were sketchy and custody was hard. In 2025, buying Bitcoin through Coinbase or other platforms is dead simple. Why pay 40% extra for MicroStrategy to hold it for you?

Some treasury firms might pivot to actual business models. Perhaps they’ll develop Bitcoin-related products or services that justify premium valuations. But most will likely fade as their premiums stay near or below 1.0x.

The $17 billion loss isn’t coming back. Those who bought MSTR at $400 or Metaplanet at peak valuations are stuck. Selling now locks in massive losses. Holding hopes for another Bitcoin boom that might restore premiums.

Neither option is good. That’s the brutal reality of financial engineering that depends entirely on market sentiment. When sentiment shifts, the engineering fails.

Bitcoin itself hit new highs recently. But Bitcoin treasury stocks crashed anyway. That tells you everything about how badly this investment thesis broke down.