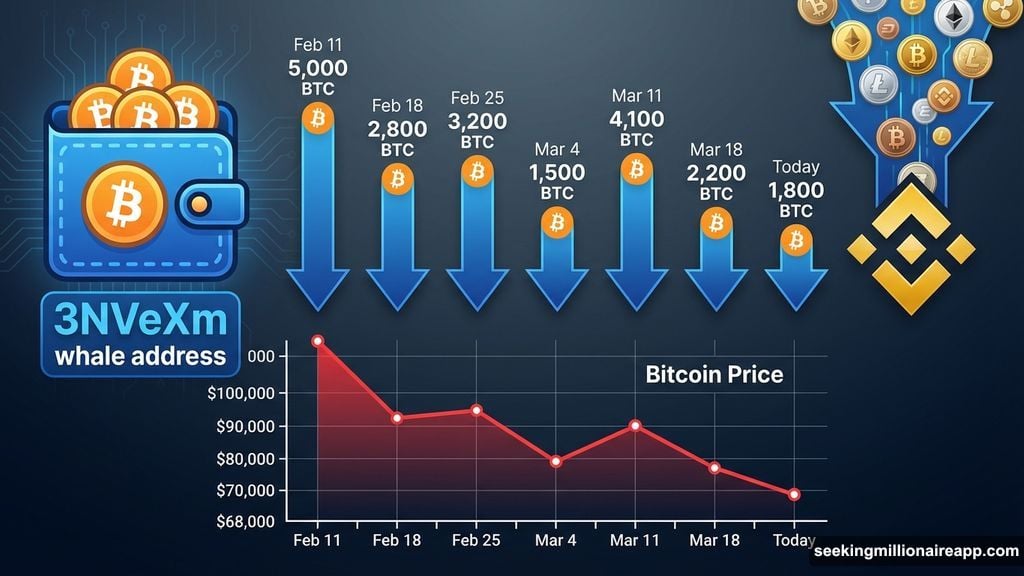

A single wallet moved thousands of Bitcoin to exchanges this month. Prices fell after every deposit.

This pattern repeated seven times in three weeks. The most recent transfer happened today. Meanwhile, Bitcoin plunged 30% this month, reaching levels not seen since last summer.

Is this whale driving the crash? Or just timing exits perfectly? The timing is suspicious either way.

One Wallet, Seven Transfers, Perfect Timing

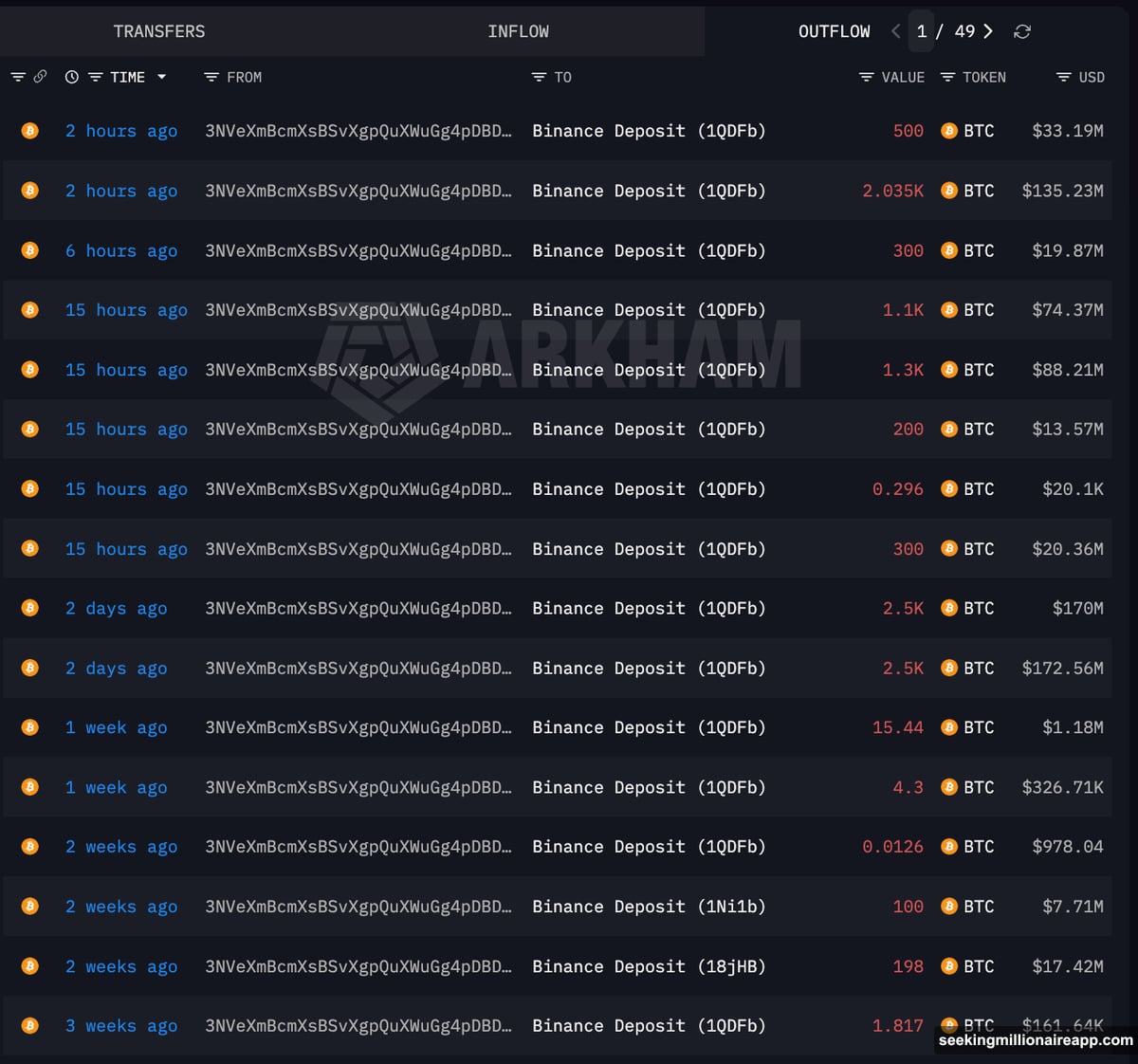

Blockchain analysts tracked a whale address that started moving Bitcoin to Binance three weeks ago. Small amounts at first. Then the activity accelerated.

On February 11, the whale transferred 5,000 BTC in a single transaction. That’s worth roughly $340 million at current prices. Today, another 2,800 coins left the wallet.

Lookonchain noticed something unsettling. Every deposit preceded a price drop. Yesterday, they warned followers when another transfer hit the exchange. Bitcoin dropped 3% within hours.

The wallet still holds 166.5 BTC, valued at $11 million. But that’s pocket change compared to what already moved. Plus, large exchange inflows typically signal selling. Traders move coins to platforms when they plan to liquidate positions.

In fragile markets, even the perception of whale selling triggers panic. Other investors react to on-chain signals and adjust their positions. So one whale’s moves can cascade into broader selling pressure.

Capitulation Signals Flash Red Across the Market

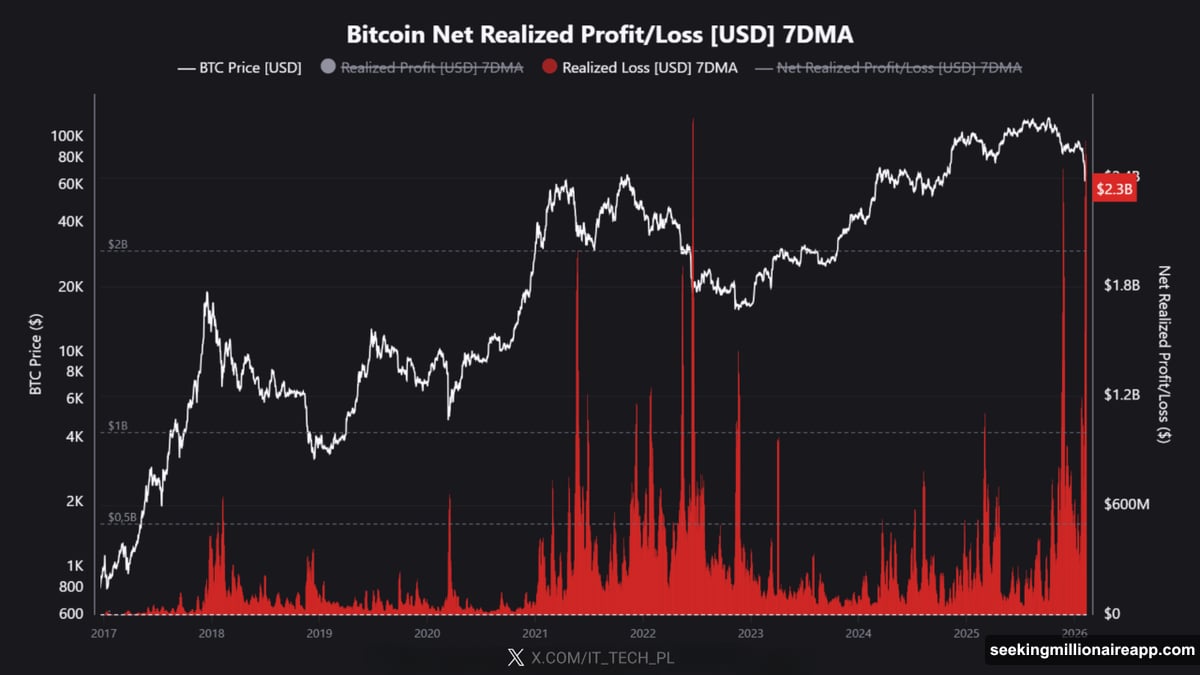

The whale transfers coincide with extreme market stress. Bitcoin’s realized losses hit $2.3 billion this month. That ranks among the top five loss events in Bitcoin’s history.

Only a handful of moments ever recorded this level of capitulation. Most occurred during major bear markets. The 2022 crash. The 2018 meltdown. Now 2026 joins that grim list.

Short-term holders are driving much of the selling. These investors bought BTC between $80,000 and $110,000. Now they’re locking in brutal losses as Bitcoin trades around $68,000.

That suggests overleveraged retail participants are exiting positions. Weaker hands capitulate first. Long-term holders aren’t selling in similar volumes. They typically hold through drawdowns.

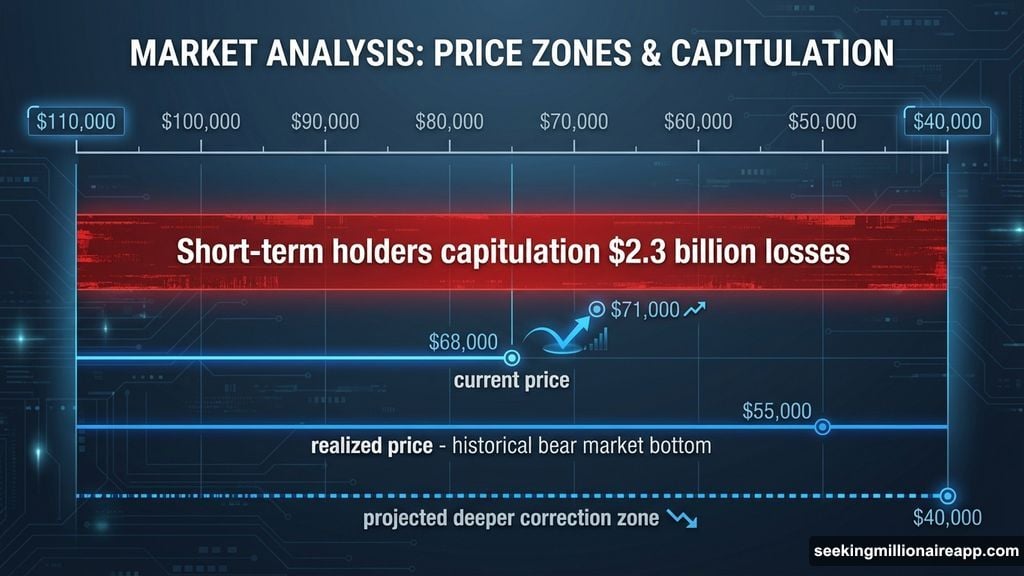

Bitcoin did bounce from $60,000 to $71,000 after the recent capitulation spike. Historically, extreme loss events trigger short-term rebounds. But relief rallies happen even in prolonged bear markets.

Where Bitcoin Goes From Here

CryptoQuant analysts point to $55,000 as Bitcoin’s realized price. That level historically marks bear market bottoms. In previous cycles, BTC traded 24% to 30% below its realized price before stabilizing.

Bitcoin currently sits above that zone. However, approaching the realized price typically triggers sideways consolidation before recovery. Some analysts expect a deeper correction toward $40,000 before a definitive bottom forms.

The whale’s behavior raises uncomfortable questions. Did 3NVeXm’s deposits cause the price drops? Or did the whale simply read market conditions and exit before crashes?

Either way, the pattern is undeniable. Seven transfers. Seven price drops. That’s not random coincidence. But proving causation is harder than spotting correlation.

Markets remain fragile. Another large transfer from this wallet could spark more selling. Traders are watching the address closely now. The next move will reveal whether this whale plans to dump remaining holdings or hold through the storm.

For investors who bought near $100,000, this month delivered devastating losses. The question now is whether capitulation has run its course or if deeper pain awaits. History suggests extreme selling creates buying opportunities. But timing the bottom is notoriously difficult.