Those massive “whale accumulation” signals flooding crypto Twitter? Turns out they’re mostly fake.

Recent data seemed to show Bitcoin whales aggressively buying during December’s volatility. But CryptoQuant researchers dug deeper and found something else entirely. Plus, when you strip away the noise, large holders were actually dumping coins throughout the month.

This changes how we interpret recent market action. What looked like confidence might actually signal exhaustion among Bitcoin’s most patient investors.

Exchange Housekeeping Fooled the Trackers

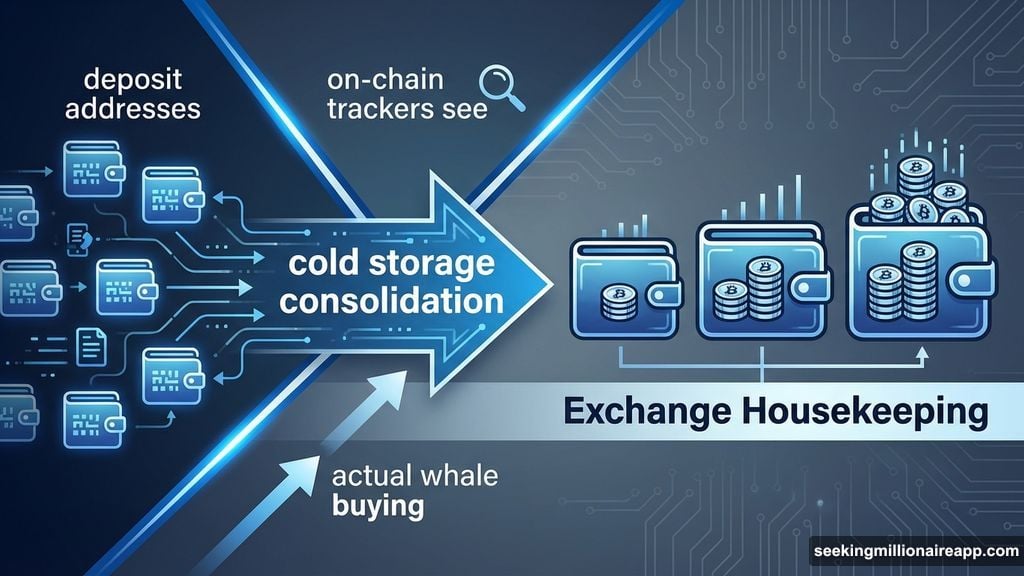

Julio Moreno, CryptoQuant’s research head, revealed the issue on January 2. Those huge wallet balance increases weren’t whales buying. Instead, exchanges were reorganizing their cold storage.

Here’s how it works. Exchanges hold customer Bitcoin across hundreds of smaller deposit addresses. Periodically, they consolidate these funds into fewer, larger wallets. This improves security and simplifies management.

But on-chain trackers can’t distinguish between an exchange consolidating funds and a whale making massive purchases. Both create the same signature: coins moving into wallets with increasingly large balances.

So the data painted a false picture. Market observers saw accumulation signals when exchanges were simply tidying up their backend infrastructure. No new buying pressure materialized.

Whales Actually Dumped 300K Bitcoin in December

Once you filter out exchange transfers, the real story emerges. Large holders sold aggressively throughout December.

Wallets holding over 1,000 Bitcoin—the whale category—dropped their collective holdings from 3.2 million coins to 2.9 million. That’s a 300,000 Bitcoin reduction in just one month. Later, balances recovered slightly to 3.1 million, but the selling trend remained clear.

Mid-tier “dolphin” investors also participated in the selloff. Wallets holding 100 to 1,000 Bitcoin saw their combined balance decline to 4.7 million coins.

This distribution happened during Bitcoin’s December correction. Prices fell from $94,297 to $84,581 as these large holders liquidated positions. The timing wasn’t coincidental.

Capital Flows Turned Negative for First Time in Two Years

Glassnode data confirms the bearish shift. Monthly capital netflows into Bitcoin networks went negative in late December. This marks the first time that’s happened since late 2023.

For two years straight, Bitcoin saw consistent positive inflows. New capital entered the network monthly as investors accumulated. That streak just ended.

Moreover, long-term holders started locking in losses at unprecedented rates. These are investors who typically weather any storm, holding through volatility that shakes out weaker hands. They’re now selling at losses that exceed records set earlier in 2024.

Glassnode attributes this to “time-based investor fatigue.” Even patient holders eventually tire of sideways price action and volatility. When that happens, they capitulate.

Why This Matters More Than People Think

The confluence of these signals paints a concerning picture. Large holders are selling. Capital flows turned negative. Long-term investors are taking losses.

These developments contradict the bullish narrative dominating crypto discourse. Many analysts expected institutional demand and ETF inflows to drive prices higher. Instead, sophisticated investors are reducing exposure.

Plus, the misinterpretation of exchange consolidation as accumulation shows how easily markets can misread on-chain data. Traders made decisions based on false signals. That creates systematic risk nobody accounts for.

The current setup mirrors classic late-cycle behavior. Prices trade in compressed ranges. Volatility remains high but directionless. Patient capital starts exiting positions.

What Comes Next Depends on New Buyers

Bitcoin needs fresh capital to reverse this trend. Without new buyers absorbing whale distribution, prices face continued pressure.

Some possibilities exist. Retail interest could return if prices break to new highs. Institutional allocations might increase as traditional finance embraces crypto more fully. Macro conditions could shift in Bitcoin’s favor.

But right now, the data shows supply overwhelming demand. Large holders are distributing coins. The most patient investors are capitulating. Capital flows are negative.

That doesn’t guarantee lower prices. Markets can remain irrational longer than anyone expects. But the fundamental picture has clearly deteriorated.

Smart money watches what whales do, not what they say. And right now, they’re selling.