Bitcoin’s 6% bounce looks fragile. On-chain data reveals whales are moving coins to exchanges at the fastest pace in ten months.

That’s rarely a bullish signal. Moreover, trading volume just hit a two-year low. So thin liquidity means even modest selling pressure could trigger sharp drops.

Let’s examine why this early 2026 rally might not last.

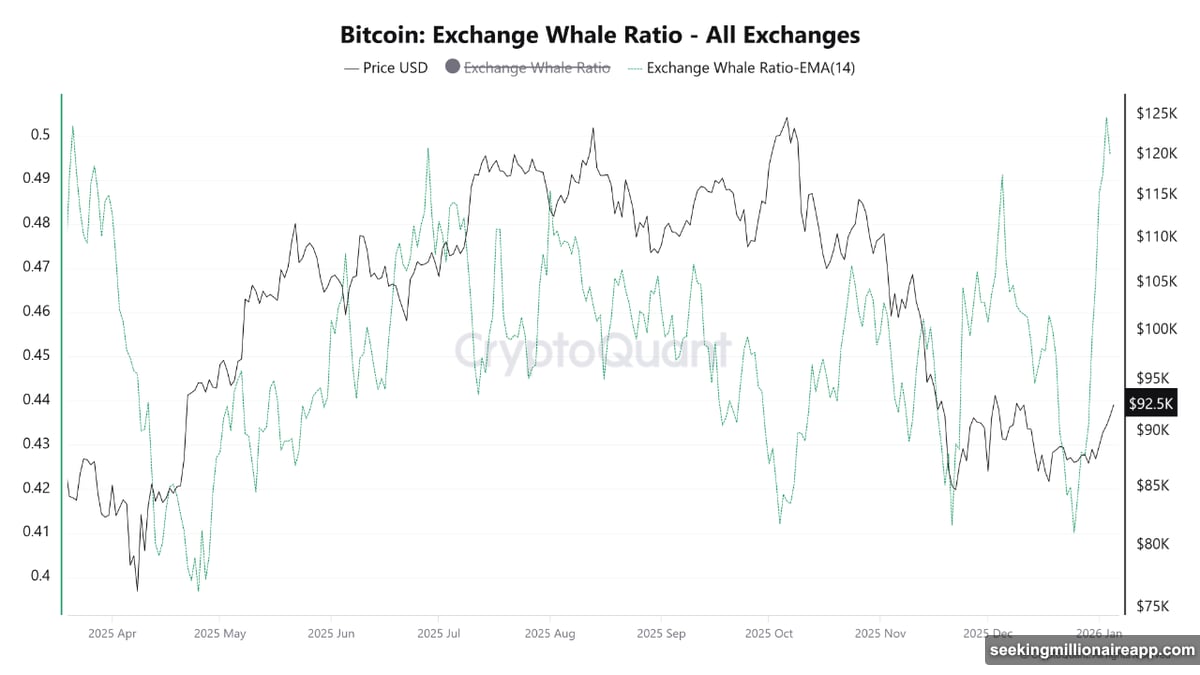

Whale Activity Reaches 10-Month High

The All Exchanges Whale Ratio spiked to its highest level since March 2025. This metric tracks the ratio of top 10 inflows to total exchange inflows.

High readings mean big holders are using exchanges heavily. And that usually happens before they sell.

Here’s the problem. Bitcoin exchange reserves continue falling thanks to ETF demand and institutional buying. But this sudden whale activity could reverse that trend fast.

CryptoQuant analyst CryptoOnchain warns these whales might be positioning to take profits. They’re likely using the current recovery as exit liquidity. In other words, retail buyers pump prices while whales dump on them.

Plus, this pattern emerged right as Bitcoin attempts to recover from recent corrections. That timing raises red flags about the sustainability of this bounce.

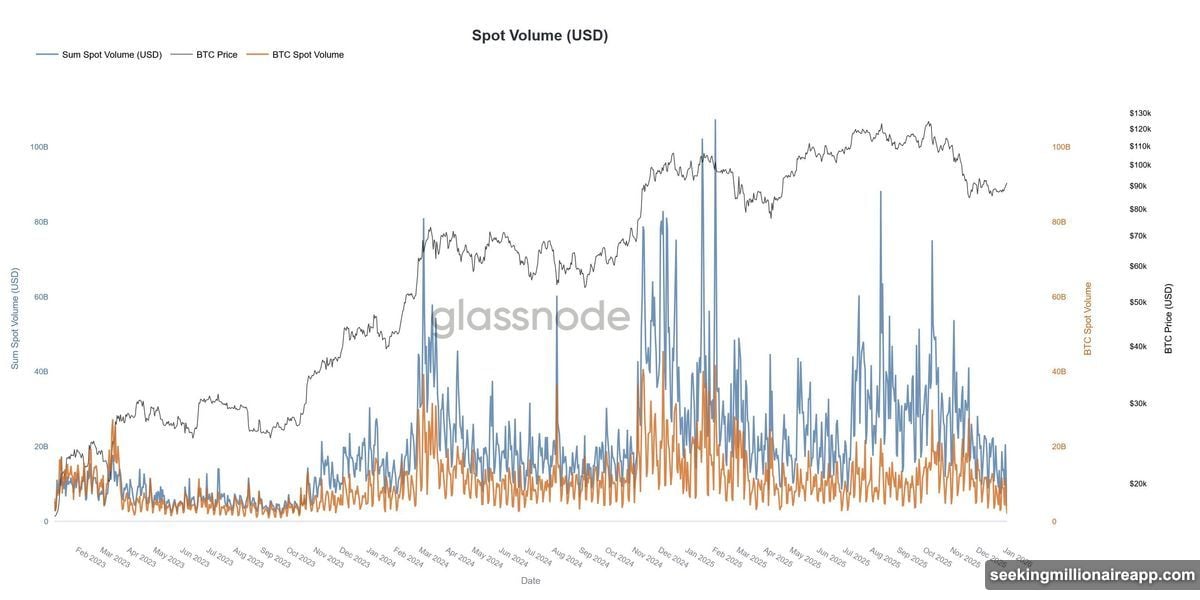

Trading Volume Collapses to 2023 Levels

Spot trading volume for Bitcoin and altcoins just fell to its lowest point since November 2023. Glassnode data shows demand weakening sharply despite recent price gains.

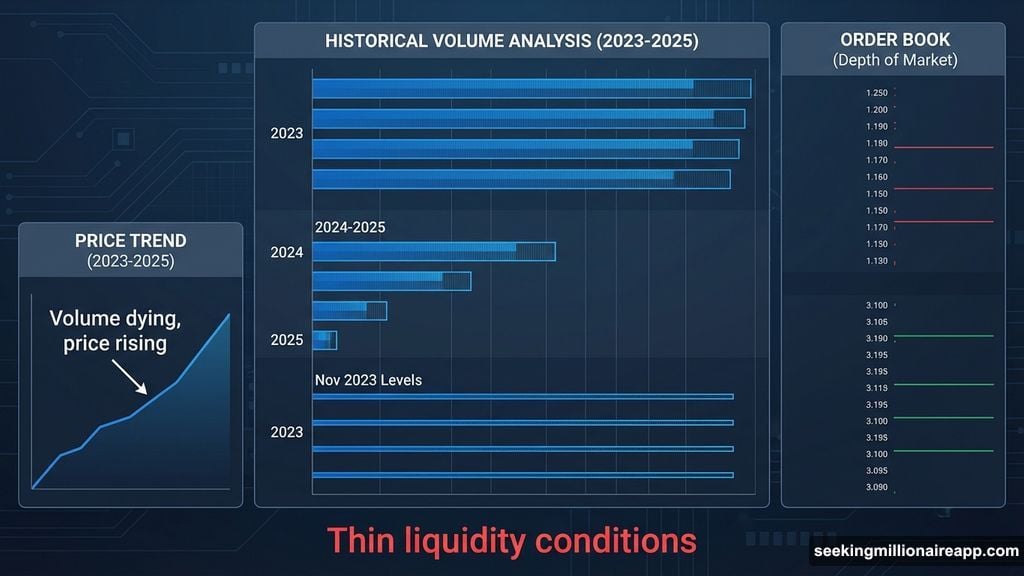

This creates a dangerous situation. Prices are rising. But volume is dying. That disconnect signals increasingly thin liquidity conditions.

In low-volume environments, markets become fragile. Small buy orders can push prices higher easily. But the reverse is also true. Moderate selling pressure triggers outsized downside moves.

So if whales start dumping as the data suggests, combined with weak volume, Bitcoin’s recovery could evaporate quickly. The 10% rebound in total altcoin market cap looks equally vulnerable.

Analyst Willy Woo describes the market as a “ghost town.” Transaction fees collapsed. Mempool activity dropped to record lows. Both indicators reflect reduced on-chain activity and weaker capital flows.

CME Gaps Point to Correction Targets

Technical analysts are eyeing two key price levels below current prices. Bitcoin could correct toward $90,000 or $88,500 in the short term.

These levels align with newly formed CME gaps. Futures markets often fill these gaps eventually. So traders watch them as potential support zones during corrections.

Woo expects a possible short-term pump as liquidity hits a local bottom. But his longer-term outlook remains bearish due to lack of real activity.

The market needs genuine demand to sustain rallies. Right now, the data shows mostly price manipulation and thin order books. That’s not a foundation for lasting recovery.

Why This Matters for Your Portfolio

Three forces are converging to threaten Bitcoin’s bounce. Whale exchange inflows are rising. Trading volume is collapsing. And on-chain activity is dead.

Each factor alone would be concerning. Together, they create conditions for sharp downside volatility.

If you’re holding long positions, consider the risks carefully. The data suggests whales are preparing to sell into strength. And there aren’t enough buyers to absorb that supply without big price drops.

Meanwhile, the broader crypto market shows similar weakness. Altcoins recovered 10% recently. But that gain sits on top of record-low volume. It won’t take much selling to erase those gains.

Watch those CME gap levels closely. If Bitcoin starts dropping toward $90,000, it could accelerate fast in this low-liquidity environment.

The recovery looked promising a few days ago. Now the data tells a different story. Smart traders adjust their positions based on what’s actually happening, not what they hope will happen.