Bitcoin just flashed a signal that’s been right every single time it appeared.

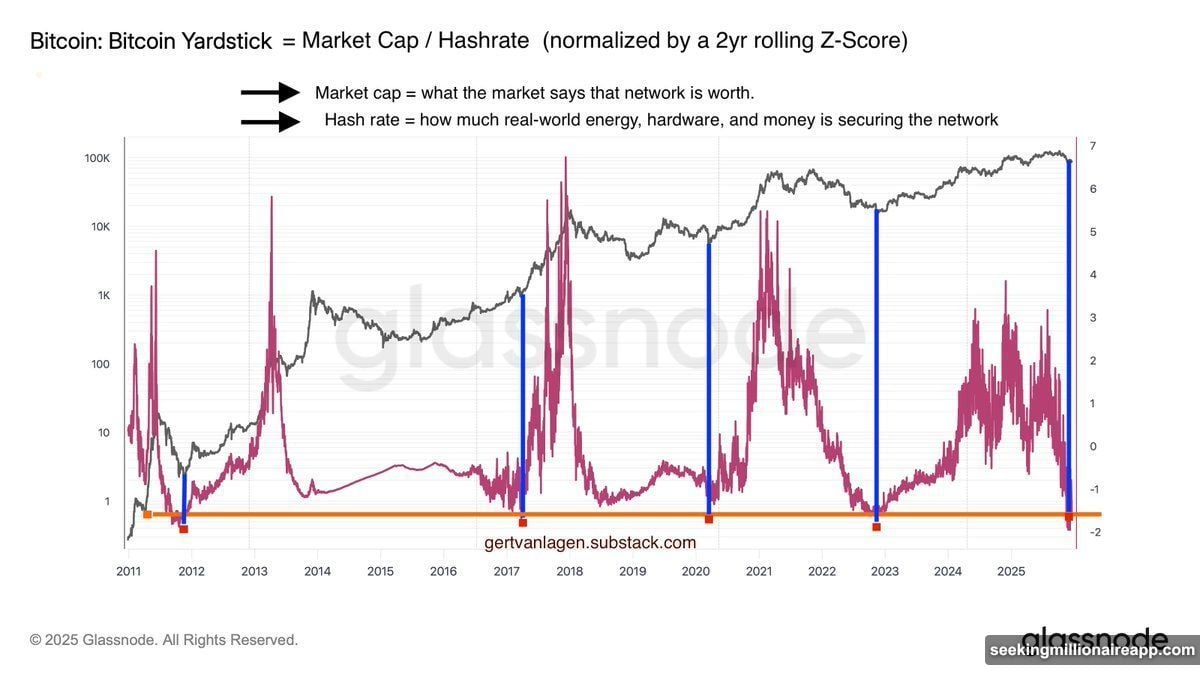

The BTC Yardstick, a valuation metric tracking Bitcoin against mining costs, dropped to -1.6 standard deviations below its long-term average. That’s the deepest undervaluation since the 2022 bear market bottom. Plus, this exact reading marked every major cycle low in Bitcoin’s history.

Meanwhile, whales quietly accumulated 269,822 BTC over the past month. That’s the biggest buying spree in 13 years. So while retail investors feel exhausted, smart money is loading up.

What the Yardstick Actually Measures

The BTC Yardstick compares Bitcoin’s market price to the cost of securing its network. That includes mining hardware, electricity, and operational expenses.

When the metric hits -1.6σ or lower, it means Bitcoin trades far below its production cost. Miners are losing money at these prices. But historically, that’s when smart buyers step in.

“BTC Yardstick at -1.6σ = Bitcoin is insanely undervalued,” wrote analyst Gert van Lagen. He noted this reading appeared at crucial moments: the 2011 bear market bottom, the 2017 pre-rally base, the 2020 COVID crash low, and the 2022 bear market floor.

Every single occurrence coincided with strong accumulation. And every time, the bottom was in.

Whales Bought More Than Ever

The undervaluation signal arrived alongside record-breaking whale activity. Large holders accumulated 269,822 BTC in just 30 days, worth approximately $23.3 billion at current prices.

According to Glassnode data, that’s the largest monthly accumulation since 2011. It beats even the buying sprees during previous bull market beginnings.

Most purchases came from wallets holding between 100 and 1,000 BTC. That range typically includes high-net-worth individuals and smaller institutions. So both groups are positioning for a potential rebound.

“Largest accumulation in 13 years. The 4-year cycle is dead; the Supercycle is here,” wrote crypto analyst Kyle Chasse.

The timing is striking. Retail sentiment remains exhausted after Bitcoin’s recent correction. But whales are acting like they see a massive opportunity.

Recent Losses Look Small in Context

Bitcoin dropped roughly 7% year-to-date after two years of explosive gains. But Bloomberg ETF analyst Eric Balchunas says that perspective matters.

“Bitcoin was up 468% in the two years prior to this year. That’s 138% annually, 8x U.S. stocks,” he wrote. “All that happened this year is you gave back a tiny bit.”

Spot Bitcoin ETFs launched in early 2024, driving the asset to then-record highs near $69,000 in March. Bitcoin returned 155.42% in 2023 and 121.05% in 2024. So the current dip looks like a natural correction after exceptional gains.

Yet many investors feel drained. They’re tired of waiting for the next move. But that exhaustion might be the signal.

Frustration Often Marks Market Bottoms

Market rallies rarely start when everyone feels optimistic. Instead, they begin when investors give up hope.

“We are not scared anymore, we are tired. Tired of waiting. Tired of believing,” wrote analyst Ash Crypto. “But listen, market rallies don’t start when hope is high. It’s when people are tired, frustrated, and ready to give up.”

That sentiment matches previous major bottoms. In 2020, most investors were terrified during the COVID crash. In 2022, many declared crypto dead during the bear market. Both times marked incredible buying opportunities.

Now the same pattern is emerging. Retail investors feel exhausted while whales accumulate aggressively. Plus, the Yardstick shows deep undervaluation. And declining leverage suggests overleveraged traders already got flushed out.

Why This Time Feels Different

Three factors rarely align at once: deep undervaluation, record whale accumulation, and retail exhaustion. But they’re all happening now.

The Yardstick has been accurate at every major cycle bottom since 2011. That’s a 100% historical accuracy rate. So when it signals extreme undervaluation, smart investors pay attention.

Meanwhile, whales just completed their largest monthly accumulation in over a decade. That’s not speculation or hype. It’s concrete on-chain data showing institutional-scale buying.

And retail sentiment has shifted from fear to exhaustion. That’s often the final stage before major rallies begin. Fear keeps people out of markets. But exhaustion makes them stop watching entirely. That’s when prices quietly bottom.

What Comes Next

Timing market bottoms remains impossible. Nobody knows if Bitcoin will drop further before recovering. But the indicators are flashing bright green.

Historic undervaluation rarely lasts long. Production costs create a natural floor as miners shut down unprofitable operations. That reduces selling pressure and sets up supply squeezes.

Plus, whale accumulation of this magnitude doesn’t happen randomly. These buyers have access to better data and deeper analysis than retail investors. When they’re buying aggressively, they usually see something others miss.

The combination suggests Bitcoin may be nearing another cyclical turning point. Whether that happens in weeks or months remains uncertain. But the setup looks remarkably similar to previous major bottoms.

For long-term investors, this window might be the opportunity of the current cycle. Whales are betting big. The Yardstick screams undervalued. And exhausted retail investors are looking away. That’s usually when the next move begins.